Youngest Internet Bank,

Accelerating Growth

Government Household Loan Regulations

Slow Down KakaoBank and K Bank in Q3

Non-Interest Income Growth Remains Positive

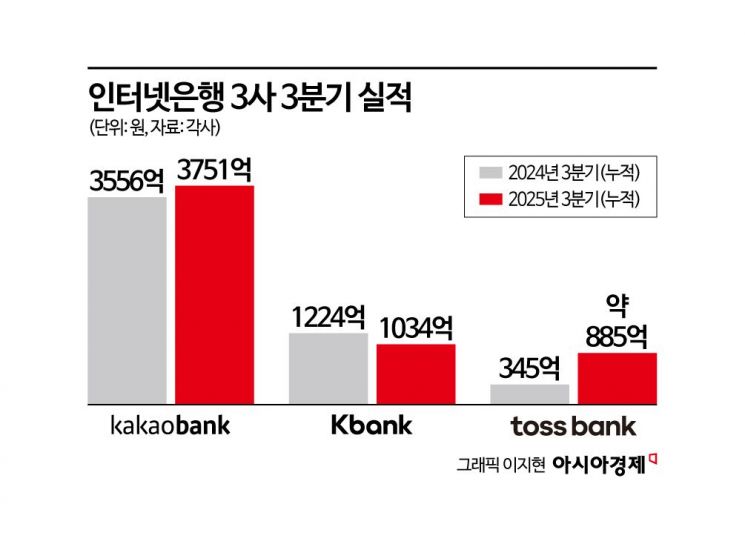

Internet-only banks experienced mixed results in the third quarter. The youngest, Toss Bank, posted record-breaking earnings. KakaoBank achieved its highest cumulative results to date, but its net profit for the third quarter declined slightly. K-Bank saw both its cumulative and quarterly net profits decrease year-on-year, impacted by government regulations on household lending.

Toss Bank Delivers a Surprise Performance

According to Hana Financial Group's quarterly report released on November 21, Toss Bank's cumulative net profit for the third quarter is expected to reach 88.458 billion won. This figure represents a 156% increase compared to the previous year's 34.5 billion won and far exceeds last year's annual net profit of 45.7 billion won. Hana Financial Group holds a 9.5% stake in Toss Bank, so its quarterly report discloses Toss Bank's approximate financial status.

As of the third quarter, Toss Bank's assets stood at approximately 33.2773 trillion won, with revenue around 1.279 trillion won. Considering that cumulative net profit through the second quarter was 40.4 billion won, third-quarter net profit is estimated to be about 48 billion won. This is nearly 30 billion won higher than K-Bank's third-quarter net profit of 19.2 billion won.

Launched in 2021, Toss Bank is the youngest among internet-only banks. After posting its first annual profit last year, the bank has continued its growth trajectory. In particular, Toss Bank has shown strong results not only in net interest income but also in non-interest segments, leveraging its platform competitiveness. Products such as the private label credit card (PLCC) and joint loans with Gwangju Bank have also contributed to improving fee-based income. Toss Bank's monthly active users (MAU) number around 10 million.

With this surprise performance, there is growing optimism about CEO Eunmi Lee's reappointment. Her term is set to expire in March next year. Having taken office last year, Lee drew attention as the first female president of an internet-only bank. Toss Bank plans to convene its executive candidate recommendation committee next month and begin the process of selecting the next president.

KakaoBank and K-Bank See Third Quarter Slowdown

KakaoBank and K-Bank, which have grown through aggressive mortgage lending, both saw their third-quarter results slow as interest income declined, impacted by recent financial authorities' regulations on household loans.

KakaoBank posted cumulative net profit of 375.1 billion won for the third quarter, with quarterly net profit at 111.4 billion won. While cumulative net profit reached an all-time high, quarterly net profit decreased by 10.3% year-on-year. This was due to reduced interest income resulting from household loan regulations. KakaoBank also suspended its mortgage lending operations for nearly a month after the real estate policy announcement on October 15, only recently resuming them.

K-Bank's cumulative net profit for the third quarter was 103.4 billion won, down 15.5% year-on-year, while its third-quarter net profit was 19.2 billion won, a sharp 48.1% decrease from the previous year. K-Bank explained that this was due to increased general administrative expenses, which resulted from ongoing IT investments and higher marketing costs aimed at business expansion. K-Bank is preparing for its third attempt at an initial public offering (IPO).

Although this was not enough to offset the decline in household loan income, both KakaoBank and K-Bank saw positive growth in non-interest income. KakaoBank's non-interest income for the third quarter reached 835.2 billion won, up 26.7% year-on-year. The proportion of non-interest income rose by 6 percentage points to 36%. K-Bank's non-interest profit grew 90.8% year-on-year to 22.9 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.