US Plant Expansion Confirmed... Up to 2 Trillion KRW

Full-Scale New Drug Development Centered on ADCs and Obesity Treatments

Celltrion has unveiled its 'growth blueprint,' focusing on the expansion of its U.S. manufacturing plant, new domestic investments, and the development of ADCs (antibody-drug conjugates) and obesity treatments. Having grown primarily through its biosimilar business, Celltrion is now seeking new growth strategies by diversifying its drug portfolio and expanding its global footprint.

KRW 4 Trillion Invested in Songdo, Yesan, and More... KRW 1.4 Trillion for U.S. Expansion

Seo Jungjin, Chairman of Celltrion Group, announced during an online press conference on November 19 that the company plans to complete the acquisition of its Branchburg, New Jersey plant in the United States within the year and immediately begin the first and second phases of expansion. With a total investment of KRW 1.4 trillion-KRW 700 billion for the acquisition and an additional KRW 700 billion for expansion-Celltrion aims to boost production capacity to up to 66,000 liters over the next five years. The strategy is to produce U.S. supply at the local plant, while global export volumes will be manufactured at domestic facilities, thereby accelerating market expansion. Seo stated, "The CMO (contract development and manufacturing organization) business in the U.S. will also automatically commence, and our CMO contract with Eli Lilly has already received U.S. government approval. By securing a U.S. plant, we have escaped price reduction pressures and tariff risks."

Seo Jungjin, Chairman of Celltrion, is speaking at the Korea-US tariff negotiation follow-up public-private joint meeting held at the Yongsan Presidential Office on the 16th. Photo by Yonhap News

Seo Jungjin, Chairman of Celltrion, is speaking at the Korea-US tariff negotiation follow-up public-private joint meeting held at the Yongsan Presidential Office on the 16th. Photo by Yonhap News

Domestic investment plans are also being significantly expanded. In addition to the ongoing drug product (DP) plant in Songdo, Celltrion will invest a total of KRW 4 trillion in new production facilities, including the Songdo DS plant, the Yesan drug product plant in South Chungcheong Province, and the Ochang PFS plant in North Chungcheong Province. By investing in both domestic and overseas production facilities, Celltrion plans to substantially increase its annual supply capacity and strengthen its ability to respond to global market demand for key products. The simultaneous expansion of U.S. and domestic plants is expected to ensure seamless supply even when blockbuster biosimilars are launched after 2030.

Celltrion has also outlined a mid- to long-term goal of securing a portfolio of 41 biosimilars by 2038. By 2030, the company plans to commercialize a total of 18 products by launching seven new products, including biosimilars of Keytruda, Cosentyx, Ocrevus, and Darzalex. The company aims to expand its existing portfolio, which has focused on autoimmune and oncology areas, to include atopic dermatitis, asthma, and hemophilia, thereby establishing itself as a comprehensive global biopharmaceutical company rather than just a biosimilar manufacturer.

Full-Scale New Drug Development Centered on ADCs and Obesity Treatments

The core of Celltrion's new drug development is its ADC and multi-antibody platforms, along with an open innovation-based licensing-in strategy. By 2025, Celltrion expects to have four ADC and multi-antibody candidates in clinical trials, and by 2027, the company anticipates a total new drug pipeline of 20 candidates, including more than 10 in clinical stages. Obesity treatment is another next-generation growth driver for Celltrion. Beyond the globally dominant GLP-1-based dual and triple agonists, the company is developing a 'quadruple agonist' obesity treatment, CT-G32. The goal is to reduce individual efficacy variation and muscle loss side effects seen in existing drugs, while increasing weight loss rates to up to 25%. Animal efficacy studies are currently underway, and preclinical trials are planned for 2026.

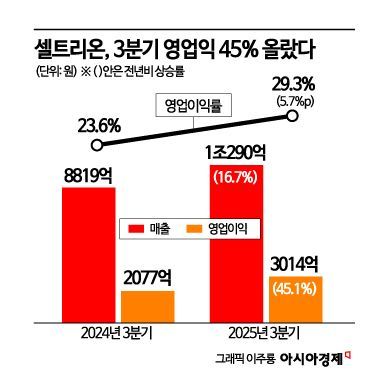

Performance is expected to rebound significantly from the fourth quarter. With most one-off merger-related costs resolved and high-margin new products growing rapidly, sales are projected to increase by at least 30% compared to the third quarter. The cost of goods sold ratio is expected to fall below 35%, and the operating margin is forecast to return to the 40% range. Newly launched biosimilars such as denosumab and omalizumab are seeing rapid prescription growth in the U.S. and Europe, and additional new products like aflibercept will be introduced to the European market by year-end. Celltrion plans to further enhance its structure of securing a stable cash flow base through the biosimilar business and reinvesting it into new drug development.

Seo stated, "From the fourth quarter onward, we expect to achieve operating profit levels comparable to those before the spin-off of Samsung Biologics. Our next goal is to maintain leadership in biosimilars while also becoming a global top-tier company in new drugs, obesity treatments, and ADCs."

Seo Jungjin: "Currently Negotiating One M&A Deal... Decision May Be Made Within the Year"

During the Q&A session, Seo provided detailed insights into key issues that have drawn market attention, such as plant investments, capital policy, and M&A strategy. He specifically addressed M&A, noting that Celltrion Holdings announced plans in July to restructure its business, including mergers and acquisitions with high-value domestic and international companies.

Seo said, "We are in substantive M&A discussions with one company and are competing with several global players. The outline of who will acquire whom may become clear within the year." However, he clarified that, "Due to ongoing competition, it is difficult to disclose the target company." He added that Celltrion Holdings will continue its strategy of acquiring and investing in innovative technology companies both domestically and internationally.

The fund for open innovation will also be expanded. Seo commented, "We have promised the government to increase our current KRW 500 billion collaboration fund to KRW 1 trillion by 2027. By jointly investing in startups and digital/AI bio companies, we will discover new drug candidates and create a structure where areas not directly pursued by Celltrion are supplemented through partnerships. This is a good model for nurturing future entrepreneurs and sharing ideas that our employees may not have."

Regarding the utilization rate of the Songdo plant, Seo explained, "We are already relying on CMO (contract manufacturing organization) partners because the Songdo plant alone is insufficient, so the U.S. plant is essentially for internalizing outsourced volumes. By 2030, we will need to build at least a 180,000-liter DS (drug substance) plant in Songdo, and if we aggressively expand the CMO business, we are considering scaling up to 360,000 liters."

On domestic facility investment, Seo stated that, including the expansion of the Songdo DS and liquid drug product plants, the Yesan drug product plant, and the Ochang auto-injector and injectable drug plant, "We expect to invest about KRW 4 trillion in domestic production facility expansion alone over the next three to five years." He added, "Since there are not many global CMO sites for DS plants, priority investment is necessary. Within the next six months, we will decide and announce whether to expand DS capacity to 180,000 liters or to more than 300,000 liters."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.