Five Major Life Insurers Launched the System at the End of Last Month

605 Applications Received in Eight Days

Serving as a Bridge to Fill the Gap Before National Pension Payments Begin

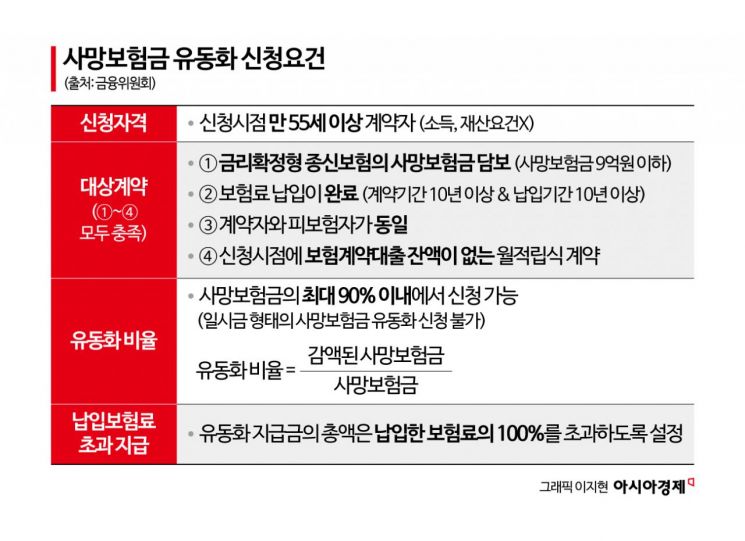

The death benefit securitization system, which was first implemented by major life insurance companies at the end of last month, is rapidly establishing itself in the market. With the entry into a super-aged society, it is expected that more people will use the option to receive their death benefits in advance to utilize them as retirement funds.

According to the Korea Life Insurance Association on November 18, a total of 605 applications for death benefit securitization were received from five life insurance companies-Samsung Life Insurance, Hanwha Life Insurance, Shinhan Life Insurance, Kyobo Life Insurance, and KB Life Insurance-over eight business days from October 30 to November 10. During this period, a total of approximately 2.89 billion won (an average of 4.77 million won per case) in annuity payments was made, based on the first-year payout amount.

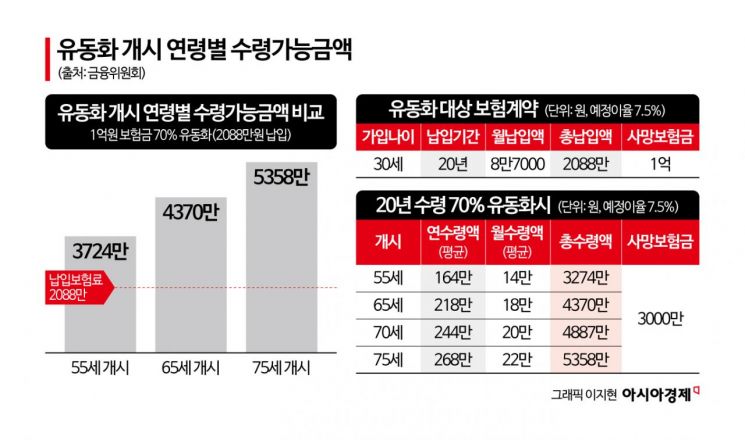

The average age of applicants was 65.6 years. The average securitization ratio and payment period, both chosen directly by consumers, were 89.2% and 7.9 years, respectively. Many policyholders increased the securitization ratio and shortened the payment period to maximize the effectiveness of the system.

In South Korea, the estimated appropriate monthly living expenses needed for each elderly person to maintain a decent standard of living in retirement is about 1.92 million won. It is expected that, by supplementing the National Pension with personal pensions and retirement pensions, and utilizing the death benefit securitization system or home pension products when necessary, retirees can address potential shortfalls.

The average monthly payment per applicant for the death benefit securitization system is about 398,000 won. Considering that the average monthly payout from the National Pension is about 680,000 won, the death benefit securitization system is expected to serve as a bridge to fill income gaps between retirement and the start of National Pension payments.

Mr. A, in his 60s, recently applied to securitize a whole life insurance policy he purchased in the early 2000s. The death benefit amount for Mr. A's policy was about 30 million won. Mr. A chose a relatively high securitization ratio of 90% and a short payment period of five years to secure retirement funds. As a result, Mr. A will receive a total of 13.14 million won over five years, including a first-year payment of 2.446 million won. This equates to an average monthly payment of 219,000 won.

Ms. B, also in her 60s, applied to securitize a whole life insurance policy she purchased in the late 1990s. The death benefit amount for Ms. B's policy was 70 million won. Ms. B also chose a 90% securitization ratio and a relatively short payment period of seven years to increase her annual payout. Her first-year payment will be 4.46 million won, and she will receive a total of 34.36 million won over seven years. Her average monthly payment will be 409,000 won.

The Korea Life Insurance Association plans to listen to major consumer complaints raised in the early phase of the system's implementation and review ways to improve the system. Since the death benefit securitization system uses the surrender value as its financial source, the association will ensure thorough consumer guidance so that customers are fully aware of the system when utilizing it. The association also plans to pursue rational improvements to the system by reflecting consumer feedback and complaints gathered during its operation. A representative from the association stated, "We will continue to monitor the market to prevent any cases of misselling related to the death benefit securitization system when new whole life insurance policies are sold. Through ongoing communication with financial authorities, we will support the establishment of the death benefit securitization system as a consumer-oriented financial product and help create a flexible insurance benefit utilization system that meets the needs of an aging society."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.