As the Stock Market Rises, 'Debt-Fueled Investments' Also Surge

Investment Using Borrowed Funds from Securities Firms Hits 26.4 Trillion Won, "All-Time High"

Government Warns, "Invest Only Within Your Means"

On November 3, 2025, when the KOSPI index rose significantly, dealers were working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. Photo by Kang Jin-hyung

On November 3, 2025, when the KOSPI index rose significantly, dealers were working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. Photo by Kang Jin-hyung

As the Korean stock market reached new all-time highs, the scale of so-called "debt-fueled stock investments" by individuals also hit record levels. While the government stated that this phenomenon does not yet pose a burden to the financial system, it cautioned against excessive borrowing for investments that exceed one’s capacity to repay.

As the Stock Market Hits Record Highs, 'Debt-Fueled Investments' Surge

According to the Korea Financial Investment Association on November 18, as of November 14, the balance of margin loans (credit transactions) in the domestic stock market reached a new all-time high of 26.4033 trillion won. After surpassing 26 trillion won for the first time on November 6, the balance continued to rise. Margin loans are a representative form of debt-fueled investment, where investors borrow money from securities firms to purchase stocks. An increase in the margin loan balance indicates that more investors are borrowing to make aggressive investments.

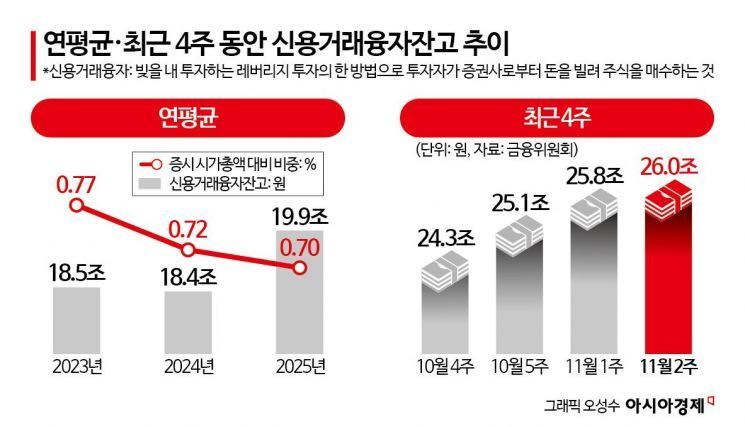

The margin loan balance averaged 18.5 trillion won in 2023 and 18.4 trillion won in 2024, but it expanded to around 20 trillion won earlier this year and surged to 26 trillion won this month. This is attributed to a record-breaking rally in the stock market, with the KOSPI index surpassing the 4,200 mark earlier this month, drawing more investors into the market.

As of October 31, the number of active domestic stock trading accounts reached 95.33 million, an increase of 8.76 million since the end of last year. Active stock trading accounts are defined as entrusted trading or securities savings accounts with deposits of at least 100,000 won and at least one transaction in the past six months. The unprecedented bullish trend in the stock market has led to a significant rise in new investors. There is also analysis that, as the prices of virtual assets such as Bitcoin have corrected recently, more young people are entering the stock market.

Investors are not only borrowing from securities firms but also from banks to fund their stock investments. As of November 7, the outstanding balance of household credit loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 105.9137 trillion won. This is an increase of 1.1807 trillion won compared to the end of October (104.733 trillion won), surpassing the entire increase for the month of October (925.1 billion won) in just one week. The increase recorded by November 7 alone marks the largest since July 2021 (1.8637 trillion won), roughly four years and four months ago. Overdraft account balances surged by 1.0659 trillion won, while general credit loans increased by 114.8 billion won. This indicates a growing number of individuals opening overdraft accounts at banks to invest in stocks.

Government Warns, "Invest Only Within Your Means"

The government assessed that the surge in debt-fueled investments has not yet reached a level that threatens the economy or financial system. An official from the Financial Services Commission stated, "Although credit loans have increased recently, there is usually a seasonal tendency for credit loans to rise in October and November." The official added, "Typically, credit loans decrease until March due to bonuses and then see larger increases in August (vacation season), October, and November due to seasonal factors."

Some experts believe that, since credit transactions are increasing in line with the expansion of market capitalization due to rising stock prices, there are no significant problems at present. In fact, the ratio of margin loan balances to the stock market capitalization decreased from 0.77% in 2024 to 0.70% this year. Lee Eogweon, Chairman of the Financial Services Commission, also stated at a press briefing on November 12, "Credit loans are not driving overall household debt growth or threatening financial soundness."

However, the government cautioned against investments that exceed an investor’s ability to repay and warned of potential volatility in credit loans. In particular, regarding the sharp increase in margin loans, it emphasized that risks are being managed through various regulations, including total volume limits by securities firms, restrictions on deposit and collateral ratios, and differentiated limits for individual clients.

An official from the Financial Services Commission said, "For so-called debt-fueled investments, it is the consistent and firm position of the commission that investors must exercise strict risk management within their own capacity to absorb losses," adding, "Currently, we have shifted to daily monitoring systems for margin loans at each securities firm, closely tracking daily trends to manage risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)