Four Major Non-Life Insurers Post 230 Billion Won Deficit in Auto Insurance for Q3

Premium Cuts and Rise in Insurance Fraud Push Loss Ratio Above Break-Even Point

"Freezing or Raising Premiums Unavoidable"

The third-quarter auto insurance results for major domestic non-life insurance companies have all turned into losses. As a result, the trend of lowering auto insurance premiums, which has continued for the past four years as part of efforts for mutually beneficial finance, is expected to be difficult to maintain next year.

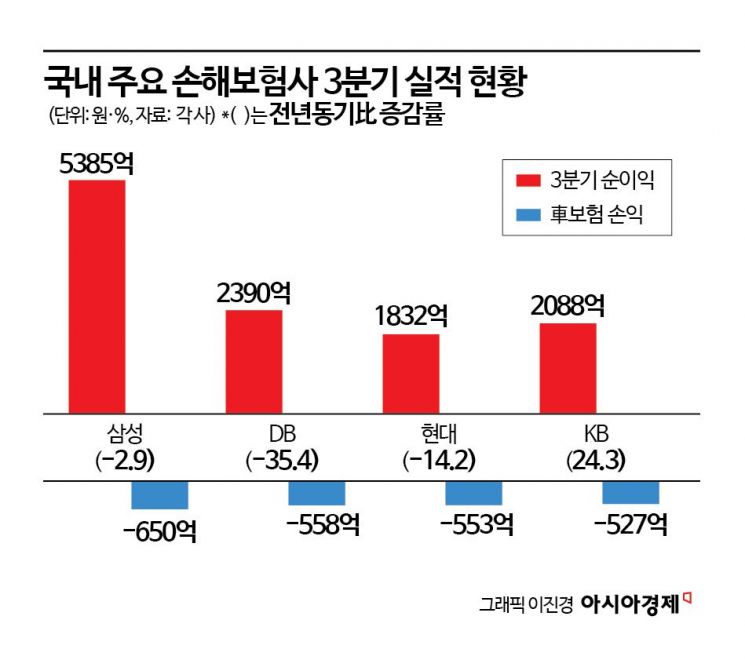

According to the financial sector on November 17, Samsung Fire & Marine Insurance, which holds the largest market share in auto insurance, posted a consolidated net profit of 538.5 billion won in the third quarter of this year, down 2.9% from the same period last year. The third-quarter auto insurance profit and loss shifted from a profit of 14 billion won last year to a loss of 65 billion won this year. On a cumulative basis for the third quarter, the auto insurance segment is also recording a loss of 35 billion won.

DB Insurance reported a standalone net profit of 239 billion won in the third quarter of this year, a sharp decline of 35.4% compared to the same period last year. Its third-quarter auto insurance profit and loss turned from a profit of 16 billion won last year to a loss of 55.8 billion won this year. Although the cumulative auto insurance profit and loss for the third quarter stands at a profit of 22 billion won, considering the recent rise in loss ratios, it is highly likely to turn into a loss.

Hyundai Marine & Fire Insurance posted a standalone net profit of 183.2 billion won in the third quarter, down 14.2% from the third quarter of last year. Its third-quarter auto insurance profit and loss turned from a profit of 13 billion won last year to a loss of 55.3 billion won this year. On a cumulative basis for the third quarter, it is also recording a loss of 39 billion won.

KB Insurance's third-quarter consolidated net profit attributable to controlling shareholders was 208.8 billion won, up 24.3% from the same period last year. It was the only one among the four major non-life insurers to see an increase in performance. However, its third-quarter auto insurance profit and loss widened from a loss of 2.4 billion won last year to a loss of 52.7 billion won this year. The cumulative loss for the third quarter is also 44.2 billion won.

The reason why all four major non-life insurers, which account for about 85% of the auto insurance market, posted losses in their third-quarter auto insurance results is due to a recent sharp rise in loss ratios. In the third quarter of this year, the average auto insurance loss ratio for the four major non-life insurers was 90.96%, up 8.2 percentage points from the first half (82.76%). The cumulative loss ratio for the third quarter was 85.4%, up 4.3 percentage points from the same period last year (81.1%). The industry generally considers a loss ratio of 82% as the break-even point for major companies' auto insurance.

The main reasons for the rise in loss ratios are the four-year-long reduction in auto insurance premiums up to this year, increases in repair costs, a rise in auto insurance fraud, and excessive treatment of minor injury patients. This year, extreme weather events such as heavy rains and heatwaves have further accelerated the spike in loss ratios.

Non-life insurers believe that raising auto insurance premiums is inevitable. Kwon Youngjib, Head of Auto Insurance Strategy at Samsung Fire & Marine Insurance, said at the third-quarter earnings briefing held on November 13, "We have continued to lower rates over the past four years," and added, "Considering the combined ratio (loss ratio plus expense ratio), we are reviewing a plan to increase premiums next year."

However, it remains uncertain whether the financial authorities will allow an increase in auto insurance premiums. Auto insurance premiums are determined by each non-life insurer calculating its own rates based on loss ratios, which are then verified by external institutions such as the Insurance Development Institute or actuarial firms. Although insurers are formally free to set their own rates, it is a common view in the industry that the authorities inevitably exert influence. Typically, non-life insurers complete rate verification by the end of the year and consult with the authorities at the beginning of the year. An insurance industry official said, "With losses in auto insurance this year expected to reach nearly hundreds of billions of won, it will be difficult to lower premiums next year," adding, "Freezing or raising premiums is the most likely scenario."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.