High-Alcohol Beer (7% and Above) Sees 14% Sales Growth in One Year

Cost-Effective Single Glass Gains Popularity, Driven by Rising Demand Among Women in Their Twenties

While the domestic beer market is contracting, high-alcohol beer is showing a distinct growth trend. As demand has become dispersed due to the rise of non-alcoholic beverages and highballs, beers with higher alcohol content that provide sufficient satisfaction with just one glass are establishing themselves as cost-effective alcoholic beverages.

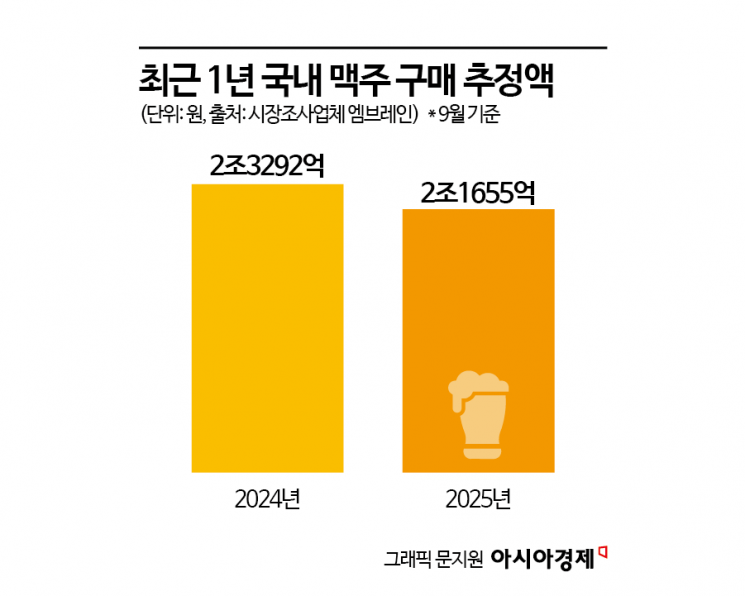

According to a purchasing trend analysis released on the 14th by market research firm Embrain Deep Data, the estimated total purchase amount for the entire beer market over the past year as of September this year was 2.1655 trillion won, a 7.0% decrease compared to the same period last year (2.3292 trillion won). This appears to be due to consumer demand being spread across non-alcoholic beverages and highballs, as well as the burden of price increases for major beer products.

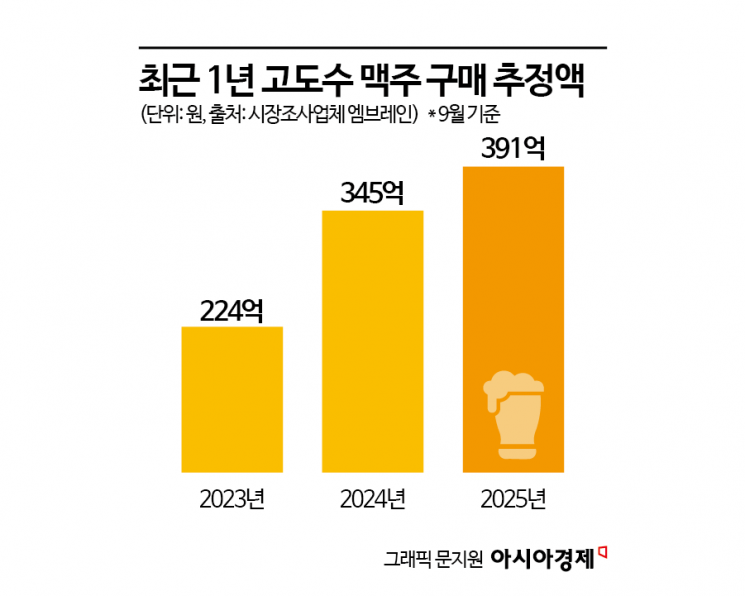

Amid the overall stagnation in the beer market, high-alcohol beer is rapidly increasing its presence. The estimated purchase amount for high-alcohol beer sold during the same period was 39.1 billion won, representing a 13.5% growth rate compared to the previous year (34.5 billion won). In a situation where overall alcoholic beverage consumption has contracted due to the economic downturn, high-alcohol beer is becoming a cost-effective choice because it is less expensive than premium liquors and provides quicker satisfaction than regular beer due to its higher alcohol content.

High-alcohol beer generally refers to beer with an alcohol content of 7% or higher. There is no clear legal classification standard for high-alcohol beer in Korea, but according to market practice, the 6-7% range is classified as a strong style, which is stronger than session IPA, while the 8-12% range is treated as a high-alcohol premium segment such as Imperial, Double IPA, or Imperial Stout.

This change is particularly noticeable among people in their 20s. According to age-based purchasing data, men in their 50s and 60s led the growth of the high-alcohol beer market, with estimated purchase growth rates of 40.1% and 43.2%, respectively, compared to the same period last year. However, demand from women in their 20s also increased by 35.5%, showing a clear upward trend compared to men in their 20s, who saw a 21.9% decrease. Although the overall scale is not large, it is noteworthy that a culture of enjoying higher alcohol content is spreading among younger generations.

The growth of the high-alcohol beer market has occurred alongside increased demand for low-alcohol and non-alcoholic beverages driven by the "Healthy Pleasure" trend, indicating a diversification of consumer preferences. The increase in consumption among women in their 20s can also be attributed to the fact that, compared to regular beer, high-alcohol beer has a higher alcohol content but is not as strong as soju, and is less burdensome in terms of price than whiskey.

The industry expects this growth trend to continue, based on consumers' preference for strong flavors and premium products. An industry insider said, "Sales of barrel-aged products and similar items are increasing at offline bars and pubs," and added, "We believe that some of the demand for highballs and whiskey has shifted to high-alcohol beer." However, the insider also pointed out, "Most of these products are priced two to three times higher than regular lager beers, so they are sensitive to economic downturns, which could be a weakness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)