KOSDAQ Rises Only 35% While KOSPI Surges Over 70%

"Policy Momentum and Biotech Rally Expected to Drive Growth"

While the KOSPI has reached an all-time high this year, the KOSDAQ has shown relatively lackluster performance. This is because liquidity has concentrated on large-cap stocks, with the semiconductor, defense, and shipbuilding sectors all experiencing boom cycles.

However, the KOSDAQ is also expected to catch up with the KOSPI. There is optimism that government policies and strong performances from biotech stocks will help improve investor sentiment.

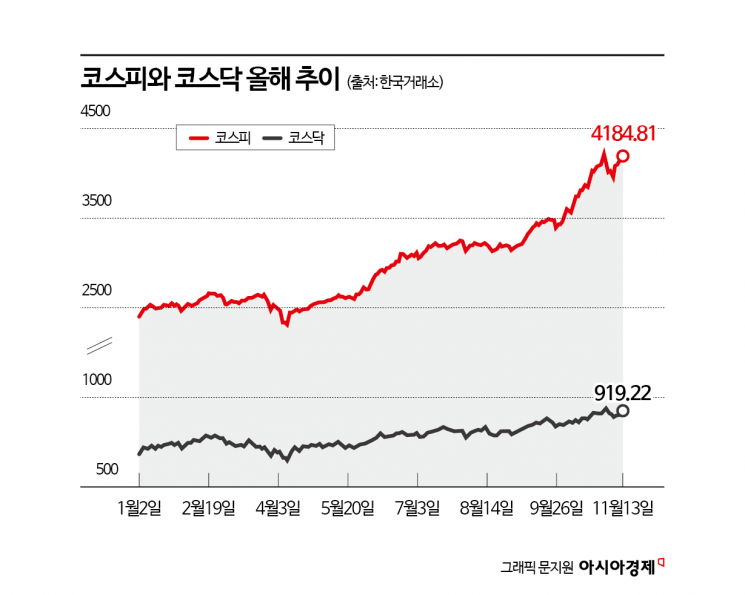

According to the Korea Exchange on November 14, the KOSDAQ has risen 35.41% so far this year. In contrast, the KOSPI has surged 73.81%, significantly outperforming the KOSDAQ. The difference is also clear in the indices themselves: the KOSPI started the year at 2,400 and broke through the 4,200 mark, setting a new all-time high, while the KOSDAQ only rose about 250 points from 678 to a yearly high of 932. This is still far below its recent peak of 1,060 in 2021.

The stark difference between the two markets is due to this year’s market being driven by large-cap stocks. The global expansion of artificial intelligence (AI) investment has led to a sharp rally in semiconductor-related stocks. This year, Samsung Electronics and SK Hynix have climbed 93.22% and 251.93%, respectively.

A similar trend has been observed in the defense and shipbuilding sectors. Rising geopolitical tensions and the spread of armed conflicts worldwide have increased defense spending, bringing attention to Korean defense companies. The shipbuilding sector has also entered a super-cycle, leading to a steep rise in stock prices.

Nevertheless, the KOSDAQ is expected to catch up with the KOSPI going forward. The first driver is policy momentum. The government plans to establish a National Growth Fund, investing 150 trillion won over the next five years in advanced strategic industry companies. In addition, it plans to announce a roadmap this year to become one of the world’s top four venture powerhouses.

Byun Junho, a researcher at IBK Investment & Securities, said, “The reason we expect policy optimism to diversify from the end of November is that the outline of the third amendment to the Commercial Act has already been revealed and is largely reflected in the stock market, so policies related to the KOSDAQ market could come to the forefront.”

The recent positive momentum in biotech stocks is also a favorable factor. Recently, ABL Bio signed a technology transfer and joint research and development (R&D) agreement for its ‘Grabody’ platform with global pharmaceutical company Eli Lilly for new drug development. The company is set to receive an upfront payment of 40 million dollars (about 58.5 billion won). In addition, it is eligible to receive up to 2.562 billion dollars (about 3.7487 trillion won) in development, approval, and commercialization milestone payments, as well as tiered royalties based on net product sales.

Given the significant influence of biotech on the KOSDAQ market, this contract is expected to have a positive impact. Based on the KOSDAQ 150, biotech stocks account for as much as 40% of the index. Wi Hyeju, a researcher at Korea Investment & Securities, commented, “On November 12, the KOSDAQ pharmaceutical index closed up 5.6%. Boosted by the strong rally in the US healthcare sector, the announcement of ABL Bio’s technology transfer to Eli Lilly heightened expectations for biotech performance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.