Average Broad Money (M2) Balance in September Reaches 4,430.5 Trillion Won

Up 0.7% from Previous Month, Led by Growth in Demand Deposits

In September, the amount of money circulating in the market increased by more than 30 trillion won, marking the sixth consecutive month of growth in the money supply. This was driven by an increase in demand deposits and other liquid funds, as more investment capital was held on standby amid a bullish stock market.

The real-time KOSPI and KRW/USD exchange rate are displayed on the electronic board in the dealing room of the Hana Bank headquarters in Jung-gu, Seoul. Photo by Yonhap News Agency

The real-time KOSPI and KRW/USD exchange rate are displayed on the electronic board in the dealing room of the Hana Bank headquarters in Jung-gu, Seoul. Photo by Yonhap News Agency

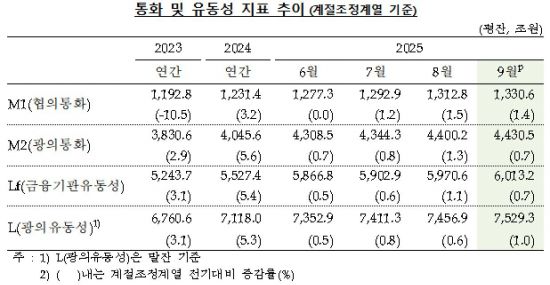

According to the Bank of Korea on November 12, the seasonally adjusted average balance of broad money (M2) for September 2025 was 4,430.5 trillion won, up by 30.3 trillion won (0.7%) from the previous month. M2 has now risen for six consecutive months since April.

M2 is a broad measure of the money supply that includes narrow money (M1)-comprising cash, demand deposits, and passbook savings accounts-along with money market funds (MMFs), time deposits and installment savings with maturities of less than two years, beneficiary certificates, and repurchase agreements (RPs).

By financial product, demand deposits increased by 9.5 trillion won, and passbook savings accounts rose by 6.8 trillion won compared to the previous month, leading the overall growth. A Bank of Korea official stated, "This was influenced by quarter-end financial ratio management and an inflow of investment standby funds." Beneficiary certificates also continued their upward trend, increasing by 5.7 trillion won as the stock market remained strong.

By economic sector, companies increased their holdings of demand deposits, passbook savings accounts, and beneficiary certificates by a total of 10.3 trillion won. Households and nonprofit organizations saw an increase of 8.9 trillion won, mainly in beneficiary certificates and cash currency. Other financial institutions raised their passbook time deposits by 1.8 trillion won, while other sectors increased their beneficiary certificates and time deposits by 6.9 trillion won.

The average balance of M1 stood at 1,330.6 trillion won, up 1.4% from the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.