Economic Cleansing Mechanism Fails to Function, Deepening Growth Slowdown

Smooth Entry and Exit of Companies Essential; Financial Support Must Be Selective

An analysis has found that the “economic cleansing mechanism,” in which insolvent companies exit and innovative companies enter the market, has not been functioning properly, leading to a deepening of the structural slowdown in South Korea’s economic growth. For smooth entry and exit of companies, the government should selectively provide financial support to companies facing temporary liquidity crises-such as those experiencing cash-flow insolvency despite being profitable-and to innovative startups. It is also advised that, in order to foster new industries to follow the country’s mainstays such as semiconductors and automobiles, regulatory easing should be implemented to encourage investment in these sectors.

According to the “BOK Issue Note: Why Has Our Growth Been Structurally Lower Since the Economic Crisis?-Focusing on Corporate Investment Channels” (authored by Lee Jongwoong, Bu Yooshin, and Baek Changin), published by the Bank of Korea on November 12, 2025, South Korea’s economic growth trend has not recovered to pre-crisis levels and has structurally slowed since the 1990s economic crises. Analysis of macroeconomic data suggests that negative demand shocks caused by crises led to a trend decline in growth through the hysteresis effect in investment. Hysteresis refers to the phenomenon where temporary shocks have a long-term negative impact on economic variables such as unemployment and investment.

The report further used firm-level microdata to empirically analyze the causes of this investment hysteresis and to seek solutions. Lee Jongwoong, Deputy Head of the Research Coordination Team at the Bank of Korea’s Research Bureau, stated, “An analysis of more than 2,200 externally audited companies found that, except for a few large corporations, most companies experienced stagnation or decline in investment after the financial crisis.” He added, “This sluggish investment was found to be closely related to worsening profitability rather than financial constraints.”

Given that post-crisis sluggish corporate investment is attributed more to deteriorating profitability than to financial constraints, financial support alone may not be sufficient to alleviate the hysteresis effect. Lee explained, “Fundamentally, the cleansing mechanism-where marginal companies naturally exit the market-needs to function properly, while also ensuring smooth entry for new companies to enhance the dynamism of the economy.”

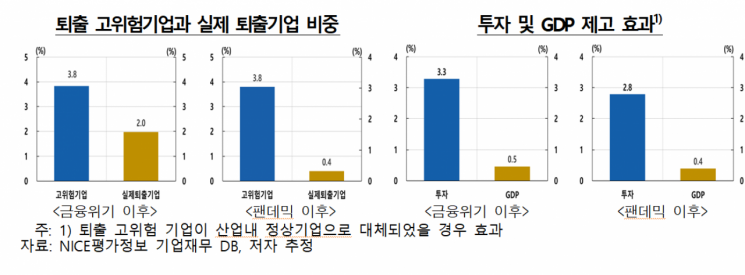

Based on the characteristics of exiting companies, the identification of high-risk companies for exit showed that, between 2014 and 2019, they accounted for 3.8% of the total sample. In contrast, the actual proportion of companies that exited was only 2.0%, roughly half the number of high-risk companies. This indicates that the cleansing effect has been insufficient. If high-risk companies had actually exited and been replaced by healthy firms within the industry, domestic investment during that period would have improved by an estimated 3.3%, and gross domestic product (GDP) by 0.5%.

Looking at the period after COVID-19 (2022 to 2024), the proportion of high-risk companies for exit remained similar at 3.8%. However, the actual exit rate dropped further to just 0.4%. Lee estimated, “If these companies had been successfully replaced, investment could have increased by 2.8% and GDP by 0.4%.”

Lee emphasized, “The post-crisis slowdown in our economic growth stems from sluggish investment due to deteriorating corporate profitability, but the trend slowdown has worsened as the cleansing mechanism that could address this has not functioned smoothly.” He added, “To reverse the slowdown in growth trends and achieve a rebound, even if financial support is provided, it must be done in a way that supports the smooth entry and exit of companies, thereby backing the economy’s innovation and dynamism.” He stressed the need to selectively and supplementarily operate financial support for companies experiencing short-term liquidity difficulties and for innovative startups, in order to ensure the effectiveness of such support.

Lee also stated, “While our core industries maintain their technological edge, it is important to expand the future growth engine of our economy by creating new demand for products and services through regulatory easing that promotes investment in new industries.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)