Rises to 11th Place in Market Capitalization, Surpassing Naver

Benefits from SK Hynix and Expectations for Shareholder Returns

As SK Hynix continues its unstoppable rally, smiles are spreading among shareholders of SK Square. Having attracted market attention as the largest shareholder of SK Hynix, SK Square is now eyeing a spot among the top 10 companies by market capitalization on the KOSPI.

According to the Korea Exchange on November 12, SK Square closed at 310,500 won the previous day, up 7%, setting a new all-time high. During the session, it surged as much as 12% to reach 327,000 won. Its market capitalization on this day was approximately 41.28 trillion won, surpassing Naver and climbing to 11th place in the KOSPI market capitalization ranking. It is now on the verge of overtaking Kia, which holds 10th place with about 45 trillion won.

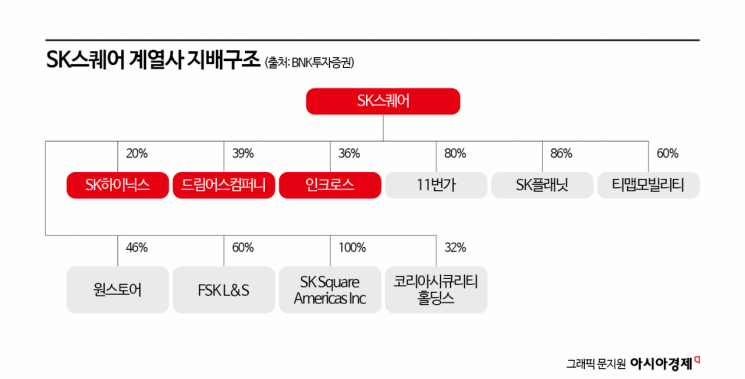

SK Square, which owns about 20% of SK Hynix shares as its largest shareholder, serves as an intermediate holding company in the governance structure that flows from SK Inc. to SK Square to SK Hynix. The net asset value (NAV), which sums up the corporate value of SK Square's subsidiaries, is about 75 trillion won. This consists of 73 trillion won from listed subsidiaries such as SK Hynix, Incross, and Dreamus Company, and 2 trillion won from unlisted subsidiaries such as One Store, Content WAVE, and T Map Mobility. Of this, SK Hynix accounts for more than 90%.

Kim Jangwon, a researcher at BNK Investment & Securities, commented on SK Square, saying, "Its status as the largest shareholder of SK Hynix explains the current stock price level," and added, "As the semiconductor industry is expected to remain strong based on the growth of the artificial intelligence (AI) sector, SK Square is also likely to continue its upward momentum." Although SK Square's corporate value is highly dependent on fluctuations in SK Hynix's stock price, its recent investment returns have actually outperformed. While SK Hynix has risen about 10% this month, SK Square has jumped more than 19%. Compared to the beginning of the year, SK Square has soared 292%, outpacing SK Hynix's 256% increase.

Ahn Jaemin, a researcher at NH Investment & Securities, explained, "Under the Capital Markets Act, collective investment managers subject to a 10% investment limit per stock expanded their holdings in SK Square as an alternative when SK Hynix's weighting exceeded 10%." This explains why SK Square's share price has outperformed SK Hynix this year. However, starting this month, collective investment managers are allowed to purchase additional shares corresponding to the portion exceeding 10% of SK Hynix's KOSPI market capitalization weighting, raising the possibility that some demand may shift away from SK Square.

The securities industry is also paying attention to SK Square's efforts to streamline its business portfolio. Content WAVE, which is in the process of merging with CJ ENM's Tving, has been excluded from subsidiaries due to loss of control, and recently, BeMyFriends was selected as the final preferred bidder for the sale of Dreamus Company. In order to restructure its business around AI semiconductors, SK Square is divesting non-core affiliates, with the proceeds expected to be used for shareholder returns.

Researcher Ahn stated, "SK Square repurchased and retired 200 billion won worth of treasury shares last year and has repurchased 100 billion won worth this year. Considering that SK Hynix's dividend payouts are expected to increase significantly after 2026, further shareholder returns are anticipated." He raised his target price from 165,000 won to 350,000 won.

However, the rapid surge in SK Hynix's stock price in the short term is increasing concerns about a potential peak, which is seen as a variable for SK Square's share price trend. As of November 6, the net short-selling balance for SK Hynix stood at 1.026 trillion won, ranking second among all listed companies after LG Energy Solution.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.