Cosmetics and Entertainment Stocks Plunge: Cosmax Down 18% This Month

Brokerages Raise HYBE Target Price Despite Poor Earnings... BTS Effect Anticipated

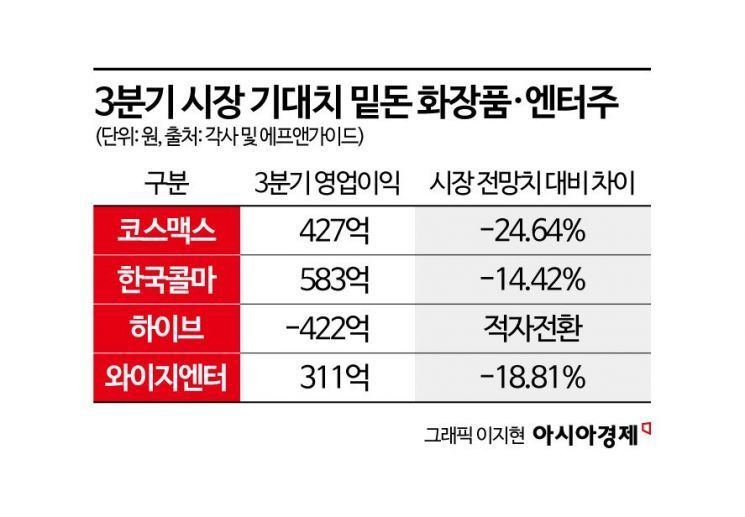

Stock prices of companies related to K-culture, such as cosmetics and entertainment, have plunged. This is due to third-quarter earnings falling short of market expectations.

According to the Korea Exchange on November 12, Cosmax closed at 155,800 won on the previous day, down 33,700 won (17.78%) from the previous trading session. The decline for this month has reached 23.86%. Korea Kolmar has also dropped by 17.40% this month. Entertainment stocks have shown a similar trend. During the same period, Hybe and YG Entertainment fell by 16.28% and 30.49%, respectively.

The sharp decline in K-culture stocks is attributed to poor third-quarter results. This is because earnings fell far below the previously high expectations. Cosmax posted sales of 585.6 billion won and operating profit of 42.7 billion won in the third quarter. These figures were 1.25% and 24.64% lower than market expectations, respectively, according to FnGuide.

Shinhan Investment & Securities analyzed that the decline in the operating profit margin (OPM) of Cosmax's Korean subsidiary was a key factor. Park Hyunjin, a researcher at Shinhan Investment & Securities, said, "The reason for the poor performance of the Korean subsidiary is that the increase in the number of new indie brand clients led to a higher cost ratio," and added, "Compared to the first half, there was an increase in orders for items with lower margins, such as color cosmetics and mask packs."

Korea Kolmar also recorded sales of 683 billion won and operating profit of 58.3 billion won, falling short of expectations by 2.75% and 14.42%, respectively. The poor performance of its U.S. subsidiary had a negative impact.

The same applies to entertainment stocks. YG Entertainment's sales stood at 173.1 billion won, 12.76% below expectations, and operating profit was 31.1 billion won, down 8.06%. Merchandise (MD) sales from BLACKPINK's world tour fell short of expectations.

Hybe posted an earnings shock. Its sales reached 727.2 billion won, 5.32% above expectations, but it recorded an operating loss of 42.2 billion won. Due to one-off factors, the company swung to a loss compared to the same period last year.

Lee Gihun, a researcher at Hana Securities, commented, "One-off expenses amounted to about 87 billion won, which caused the OPM to drop by about 12%," and added, "The restructuring of the North American business and debut costs for new global groups each accounted for about half of these expenses."

However, as these one-off factors have already been reflected, further improvement in performance is expected going forward. In particular, NH Investment & Securities, Samsung Securities, Eugene Investment & Securities, and iM Securities have raised their target prices. This is because next year, profits from the group BTS will be fully reflected, and the performance of the fan platform 'Weverse' is also anticipated. According to FnGuide, Hybe's sales and operating profit forecasts for next year are 2.6553 trillion won and 197 billion won, respectively. Sales are expected to increase by 17.72% year-on-year, and operating profit is expected to turn to a surplus.

Lee Hyunji, a researcher at Eugene Investment & Securities, emphasized, "Rather, by resolving all cost burdens this year, next year, when the BTS tour begins, the company will be able to enjoy full profit growth," and added, "Weverse also successfully turned profitable on a cumulative basis through the third quarter of this year, and with the full return of BTS next year, the scale of profitability is expected to expand, making a meaningful contribution to performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)