Individual Deposits Down, Corporate Deposits Up...

Rising Bank Funding Costs Triggered

Quantitative Assessment of Customer Rate Impact Needed for Effective Response

There have been concerns that the issuance of Korean won stablecoins could lead to higher lending rates for customers due to increased funding costs for banks. Analysts argue that when specifying the market impact and countermeasures for stablecoin issuance, it is also necessary to consider these effects.

Jang Boseong, a research fellow at the Korea Capital Market Institute, pointed out at a Korean won stablecoin forum held on November 10 at the Korea Federation of SMEs in Yeouido, Seoul, that "the issuance of Korean won stablecoins could result in a decrease in individual deposits and an increase in corporate (institutional) deposits at banks, and it is important to assess the impact of this from an interest rate perspective." He explained that an increase in corporate deposits could lower the liquidity coverage ratio (LCR), a key indicator of financial soundness, thereby raising funding costs and potentially affecting customer interest rates.

"Korean Won Stablecoin Could Raise Lending Rates"

The Bank of Korea recently published a white paper on Korean won stablecoins (Key Issues and Countermeasures for Korean Won Stablecoins), in which it analyzed the impact of increased institutional deposits at banks from a monetary supply perspective. The paper concluded that while the current monetary supply, based on existing indicators, may decrease slightly with stablecoin issuance, the real monetary supply-including stablecoins-would increase. This is because, if stablecoins are used as a universal means of payment, they are effectively treated as currency. The International Monetary Fund (IMF) is currently discussing whether to include stablecoins in the monetary supply in the future. The white paper also noted that, since stablecoin issuers promise to redeem at face value and hold high-liquidity safe assets as reserves, stablecoins are similar to money market funds (MMFs) and are therefore likely to be included in broad money (M2).

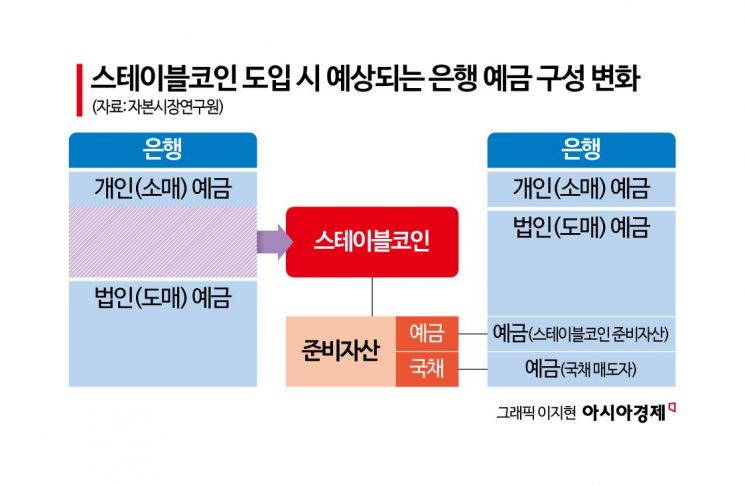

The Bank of Korea explained that the current monetary supply, based on existing indicators, could decrease slightly, and mentioned the decline in LCR due to the increase in corporate deposits, as pointed out by Research Fellow Jang. When individuals withdraw retail deposits and deposit them with a stablecoin issuer, these become the issuer’s reserve assets and are reallocated into deposits, government bonds, and other assets. At this point, the deposits flow back into banks as wholesale deposits, partially replacing individual deposits with corporate deposits. This process causes the LCR at banks to decline. During a liquidity crisis, the risk of large-scale withdrawals by institutions is higher, so a sort of penalty is applied to the LCR calculation. The LCR refers to the ratio of high-quality liquid assets that financial institutions must hold to cover net cash outflows over a 30-day period in preparation for a liquidity crisis.

If the LCR declines, banks will try to reduce lending and secure additional high-quality liquid assets such as government bonds, which are less likely to be withdrawn. As a result, the monetary supply within the existing monetary and financial system could contract to some extent, according to the Bank of Korea. However, when considering the new currency (Korean won stablecoin) on the blockchain, the total liquidity in the Korean economy would actually increase. A simple simulation using the business reports of 19 domestic banks as of the second quarter of this year suggests that if the proportion of wholesale deposits is 10%, the ratio of 'increase in monetary supply ÷ stablecoin issuance' is estimated to be about 93%. This means that if 100 trillion won worth of Korean won stablecoins are issued, the monetary supply would increase by 93.3 trillion won.

When evaluated from an interest rate perspective, this situation could lead to higher lending rates at banks. As individual deposits are replaced by corporate deposits, banks compensate for the drop in LCR by issuing bank bonds with maturities longer than one month to ensure they hold the required high-quality liquid assets at the relevant time. When banks raise funds by issuing financial products such as bank bonds, the funding cost rises compared to low-cost individual deposits. As banks’ costs increase, there is greater upward pressure on customer interest rates, including retail loan rates used by the public.

Research Fellow Jang stated, "A decrease in individual deposits and an increase in corporate deposits create a need for additional liquidity and raise funding costs," adding, "While the Bank of Korea white paper evaluated the issue from a monetary supply perspective, a more quantitative assessment of the impact on funding costs and customer interest rates would be more useful in formulating concrete countermeasures."

Bank of Korea: 'Gradual Bank-Centric Introduction' Is a Realistic Approach... 'Deliberate Omission in White Paper' Not True

The Bank of Korea emphasizes that, given the current calls for the rapid introduction of Korean won stablecoins, a 'bank-centric initial rollout' is the best approach. The most realistic option is for IT companies and other non-bank entities to form consortia with banks that already meet regulatory requirements. While this approach may have drawbacks, such as conflicting interests between banks and non-banks, it is necessary to minimize risks in the highly uncertain early stages of stablecoin introduction. On the same day, Noh Jinyoung, head of the Policy and System Team in the Monetary Policy Department at the Bank of Korea, stated, "Ultimately, the central bank needs to monitor the issuance and system of stablecoins, detect potential risks in advance, and control risks by coordinating the issuance volume with policy authorities to prevent instability in the monetary and financial system."

Meanwhile, the Bank of Korea has denied recent allegations that its white paper deliberately omitted content from the 2025 U.S. President's Working Group on Financial Markets (PWG) report. The Bank explained that it merely introduced one of many overseas cases similar to its own position (the need for a bank-centric rollout), and that the 2025 report, published after the launch of the Trump administration, only described the status of non-bank operations and did not advocate for allowing non-bank issuance, which is why it was not separately cited in the white paper. According to the Bank of Korea, the 2025 report explains that many U.S. state governments have been granting licenses for non-bank stablecoin issuance under the money transmitter framework.

In its stablecoin white paper, the Bank of Korea stated that a bank-centric strategy for introducing stablecoins is desirable, and added that "some policy institutions and academics have argued that stablecoin issuance should be permitted only by insured depository institutions with high regulatory standards and safeguards." The white paper also included a footnote referencing the 2021 PWG report, which recommended limiting stablecoin issuers to insured depository institutions for the purposes of supervision, prudential regulation, and application of financial safety nets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.