The Workforce Steadily Grew for a Decade After the Savings Bank Crisis

Real Estate PF Defaults Halted the Growth in Late 2022

Industry Becomes a Stepping Stone... Securing Specialized Talent Is Critical

The labor shortage in the savings bank sector is being prolonged due to the aftermath of non-performing loans (NPLs) in real estate project financing (PF). After the large-scale business suspensions in 2011-2012 (the savings bank crisis), the industry had steadily increased its workforce as profitability and soundness recovered, but the recent surge in real estate PF defaults has dampened this progress. Industry voices are calling for a swift resolution to the labor shortage by leveraging favorable conditions such as major mergers and acquisitions (M&A) and restructuring, which have begun following government policy support this year.

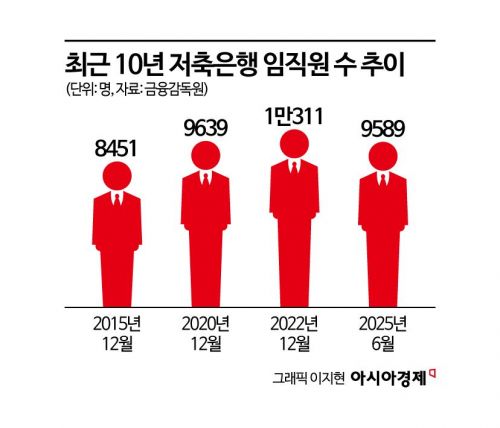

According to an analysis conducted on November 10 using the Financial Supervisory Service's DIVA (Dynamic Visualization Analysis System), the number of employees at savings banks peaked at 10,311 at the end of 2022 before entering a downward trend. The workforce had increased from 8,451 at the end of 2015 to 9,639 at the end of 2020, and then to 10,311 at the end of 2022, but as of the end of June this year, it had decreased to 9,589. This represents a decline of about 7% compared to the peak at the end of 2022.

Profitability and Soundness Worsen... Workforce Down by 7%

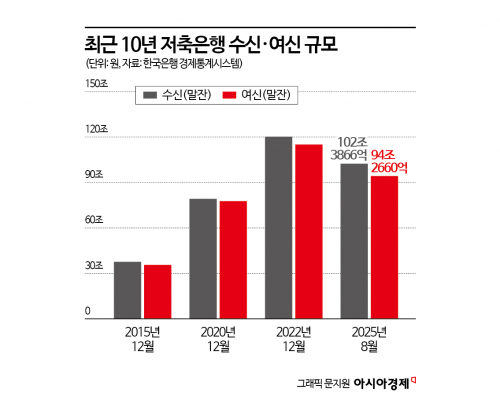

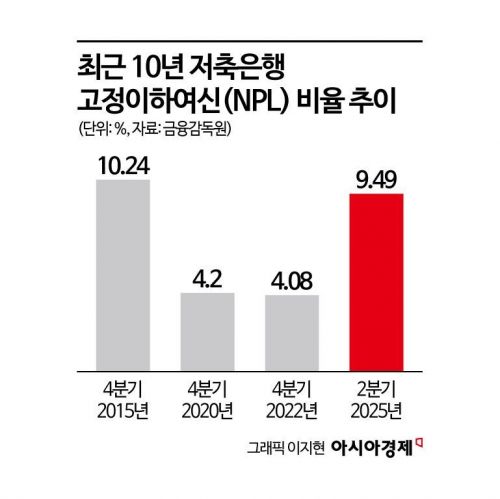

The decrease in personnel is rooted in the deterioration of profitability and soundness caused by real estate PF defaults. The balance of savings deposits in the sector surged from 37.6467 trillion won at the end of 2015 to 120.2384 trillion won at the end of 2022, but fell to 102.3866 trillion won as of August this year. Similarly, the loan balance increased from 35.5838 trillion won to 115.0283 trillion won during the same period, but then declined to 94.266 trillion won. The NPL ratio improved from 10.24% at the end of 2015 to 4.08% at the end of 2022, but worsened again to 9.49% in the second quarter of this year. Ultimately, the recovery that had continued for more than a decade after the 2011 crisis was reversed by the real estate PF defaults in 2022, leading to the current labor shortage.

This labor shortage is particularly serious because it is not a temporary financial incident like in the past, but a structural problem caused by macroeconomic recession and weakening fundamentals in the industry. Looking at the number of employees in savings banks over the past 27 years since 1999, there were three sharp declines: in 2003, 2011, and 2022.

In 2003, the industry’s credibility collapsed due to incidents such as the Busan Savings Bank corruption case (involving about 7 trillion won) and the bankruptcy of Gimcheon Savings Bank. In 2011, a combination of major shareholder corruption, early withdrawals by VIP clients, and other moral hazards and financial accidents culminated in the so-called "savings bank crisis." However, since 2022, the labor shortage has been viewed as a structural phenomenon resulting from a slump in the real estate market and weakened competitiveness, rather than from moral hazard, making recovery difficult according to industry consensus. Currently, among job seekers and junior employees, there is a widespread perception that "savings banks are just a stepping stone to gain experience before moving to securities firms," perpetuating a vicious cycle within the sector.

Regulatory Easing and M&A as a 'Window of Opportunity'... "Securing Top Talent Is Critical"

The industry believes that now is a golden time to resolve the labor shortage, as the government has eased regulations and restructuring is intensifying around large firms. Recent M&A news includes the Kyobo Life Insurance and SBI Savings Bank deal (about 900 billion won), KBI Group’s push to acquire Raon Savings Bank and SangSangin Savings Bank (with SangSangin valued at about 110 billion won), and EQT Partners’ plan to sell Aequon Savings Bank (including Aequon Capital, worth over 1 trillion won).

On the policy front, the government has also stepped in to support the industry. On November 5, the Financial Services Commission raised the risk weight for policy finance products such as Sunshine Loans from 100% to 150%, thereby easing lending regulations. On October 22, the government included incentives for savings banks in its policy to expand the supply of local finance by policy finance institutions by about 25 trillion won (to a total of 120 trillion won per year). Other measures being pursued include relaxing lending limits for non-metropolitan areas, preferential treatment for non-metropolitan borrowers when applying individual credit limits, and converting the Korea Federation of Savings Banks’ NPL-specialized subsidiary "SB NPL Loan" into an asset management company. In terms of loan operations and handling real estate PF NPLs, the government has essentially met all of the industry's demands.

As a result, there are calls for the industry to focus all efforts on securing specialized talent in areas such as M&A, corporate paper (CP) and other investment banking, loan operations, and unsecured lending. Since the government’s policy momentum is concentrated this year, there is a strong possibility that upward momentum will weaken in the future. In particular, it is analyzed that small and medium-sized firms in the provinces need bold HR strategies, such as offering exceptional incentives, to prevent talent from being poached by large metropolitan firms or securities companies.

An industry official stated, "Since 2022, the labor shortage has been characterized by a much faster rate of employee departures than new hires," adding, "It is necessary to offer somewhat exceptional incentives, at least for top talent in corporate finance and loan operations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)