Aimed Bio, Semifive, and Livsmed Set to Go Public

Improved Investment Environment and Institutional Reforms Fuel Virtuous Cycle of Exit and Reinvestment

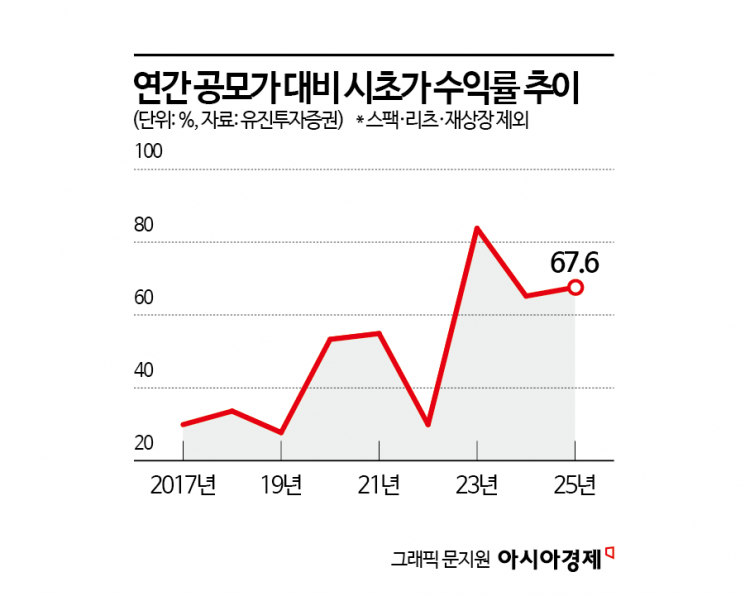

The domestic venture investment market is expected to enter a full-fledged recovery phase in the second half of the year, coinciding with the resumption of initial public offerings (IPOs). As the market capitalization of listed companies expands in the latter half, there are growing expectations that a virtuous cycle of venture investment-where exits (investment recovery) are followed by reinvestment-will become more active.

According to the investment banking (IB) industry on November 10, the domestic IPO market, which saw only one deal last month with Myungin Pharmaceutical, is set to resume in earnest this month. Excluding special purpose acquisition company (SPAC) listings, there are 12 general company public offerings scheduled for this month, and another 7 planned for next month. By the end of the year, about 20 venture companies are expected to become listed firms.

Attention on the Expansion of Listed Company Scale... IPO Candidates Targeting 500 Billion to Over 1 Trillion Won Awaiting

Kim Sooyeon, a researcher at Hanwha Investment & Securities, analyzed, "Once IPOs start to increase, the unlisted market, which is the front end of listings, will also recover more quickly," adding, "A virtuous cycle is expected, where exit funds from large-scale IPOs are reinvested into venture capital (VC)."

The expansion in the size of listed companies is also noteworthy. AIMEDBIO, an antibody-drug conjugate (ADC) new drug development company, and SEMIFIVE, a semiconductor design house, are proceeding with the related procedures, each targeting a market capitalization of over 500 billion won for their listings this year. The surgical robot company LIVSMED is aiming for a market capitalization of over 1 trillion won. While IPO sizes in the first half of the year were typically in the 100 billion to 200 billion won range, the second half is seeing a clear step up.

Not only has investment sentiment improved in the artificial intelligence (AI) sector, which has led the market so far, but also in the bio sector. This was largely due to the continued achievements of unlisted companies in technology transfer (license-out) deals. As technology transfer agreements with global pharmaceutical firms increased, the value of bio ventures has been reassessed.

Regulatory improvements by the government and the stock exchange are also contributing to a better exit environment for VCs. The Korea Exchange has announced guidelines for AI technology-special listing. It has eased the requirements for technology evaluation exemptions for technology growth companies and established evaluation standards reflecting the characteristics of the AI sector. The Korea Financial Investment Association also plans to raise the allocation ratio of KOSDAQ public offerings for KOSDAQ venture funds from the current 25% to 30% next year. The strategy is to expand IPO participation opportunities for venture funds, increase investment returns, and thereby promote venture reinvestment.

The Global Venture Investment Market Is Also Recovering... "A Signal of Entering a Full-Fledged Recovery Phase"

The vibrancy of the IPO market is also spreading to the venture investment ecosystem. According to the venture investment analysis platform Innovation Forest, 84 domestic startups attracted a total of 386.2 billion won in new investments last month. There was a balanced investment across all stages, from seed to pre-IPO. For two consecutive months since September, healthcare and bio have ranked first in both investment amount and number of companies, maintaining strong investment momentum.

Notably, IMBiologics raised 42.2 billion won, DMAPBio secured 25.6 billion won, and Medifab attracted 23.8 billion won. At the pre-IPO stage, in addition to IMBiologics, mobility service company Autohands and resource circulation company Superbin also received large-scale investments. In addition, the manufacturing and hardware sector ranked second with 63.2 billion won, and commerce ranked third with 55.6 billion won.

The recovery of the global venture investment market is also a positive signal for the Korean market. Researcher Kim noted, "In the United States, VC investment reached $324 billion (about 472 trillion won) from the beginning of this year through October, a 49% surge compared to the same period last year. This will be the third most active year in the past decade," adding, "After bottoming out in 2023, a definite recovery trend is underway."

She continued, "There is pressure to invest in AI startups, but the increase in exits through large-scale IPOs has also had an impact. The recovery in the United States increases the likelihood of a rebound in Korea. Korea is expected to follow a similar trajectory."

A representative of a domestic mid-sized VC commented, "As previously blocked exit routes are opening up, the atmosphere among VCs is changing. If successful exit cases continue to increase, LP (limited partner) commitments will also rise." He added, "VCs have inevitably maintained a conservative investment stance, but as liquidity returns to the market, this will provide an opportunity to significantly increase the proportion of early-stage investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)