Operating Profit Reaches 24.4 Billion Won in Q3, Up 165% Year-on-Year

Stock Price Rises 10% Even on "Black Wednesday"

Performance Improvement Expected to Continue Into Next Year

While the domestic stock market experienced a sharp decline, Daeduck Electronics, a printed circuit board (PCB) manufacturer, reached an all-time high. The company surpassed market expectations in the third quarter of this year, and its corporate value has exceeded 2 trillion won.

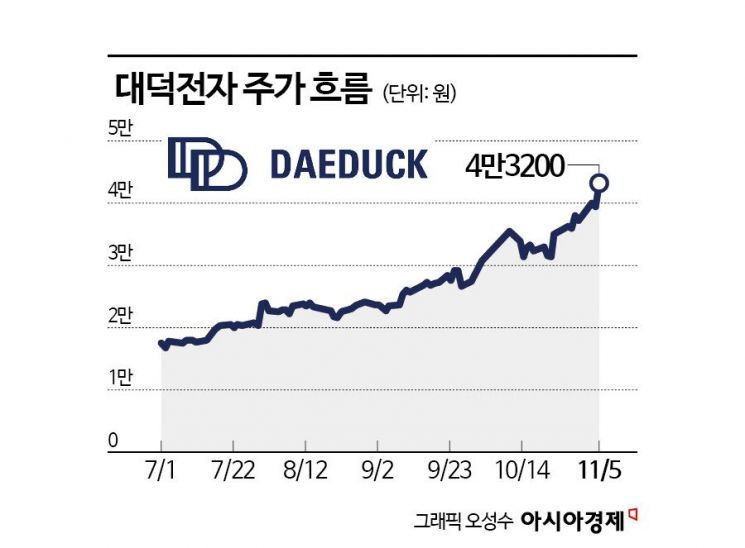

According to the financial investment industry on November 6, Daeduck Electronics' stock price has risen by 178.7% since the beginning of this year. Its market capitalization has grown to 2.135 trillion won. Despite the "Black Wednesday" when the KOSPI fell by nearly 3%, the company's stock continued its upward trend. During the previous day’s trading session, the price reached as high as 45,350 won, setting a new record high.

Daeduck Electronics supplies advanced PCBs to a range of industries, including semiconductors and telecommunications equipment. Its main products are high-layer PCBs (MLB) for non-memory and memory semiconductor packages, as well as for artificial intelligence (AI) servers, network, and inspection equipment.

In the third quarter of this year, the company posted sales of 286.2 billion won and an operating profit of 24.4 billion won. Compared to the same period last year, these figures increased by 23% and 165%, respectively. Kim Minkyeong, a researcher at Hana Securities, explained, "Even after accounting for approximately 4 billion won in one-off costs, the results far exceeded previous estimates," adding, "The utilization rate is rising faster than expected."

By segment, sales of memory package substrates increased by about 30 billion won compared to the previous quarter. This was due to increased demand for DRAM substrates used in data centers, as well as higher sales of chip-scale package (CSP) substrates.

Sales of logic package substrates rose by about 5 billion won quarter-on-quarter. Profitability improved as losses from flip-chip ball grid array (FC BGA) narrowed. The end of depreciation on large-scale investments and the conversion of production facilities compatible with other products to memory substrate production reduced fixed costs.

As network client orders recovered and sales for accelerators increased, MLB sales grew by about 5 billion won compared to the previous quarter.

Ko Euyeong, a researcher at iM Securities, estimated, "By segment, the utilization rates are 88% for memory substrates, 100% for MLB, and in the high 50% range for FC-BGA," and analyzed, "Daeduck Electronics is considering line realignment to respond to the surging demand for memory substrates."

The trend of improving performance is expected to continue into next year. Park Kangho, a researcher at Daishin Securities, analyzed, "The company has added new clients and is also increasing supply to existing customers," adding, "With higher sales and improved profitability next year, the overall operating margin is expected to reach 9.5%, up 5.2 percentage points from the previous year."

Daishin Securities estimated that Daeduck Electronics will achieve sales of 1.1987 trillion won and operating profit of 113.6 billion won next year. These figures represent increases of 15% and 154%, respectively, compared to this year's estimates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.