KOSDAQ Recovers the 920 Mark on Strong Foreign Buying

Foreign Investors Net Buyers in KOSDAQ for Five Consecutive Days

Attention on Whether KOSDAQ Can Narrow the Gap with KOSPI

While the KOSPI continues its record-breaking rally, drawing attention for its historic highs, the KOSDAQ, which had previously lagged behind, has shown a noticeable change since the beginning of this month. In particular, foreign investors have recently shifted from the main board to the KOSDAQ market, which is expected to further boost the KOSDAQ's upward momentum.

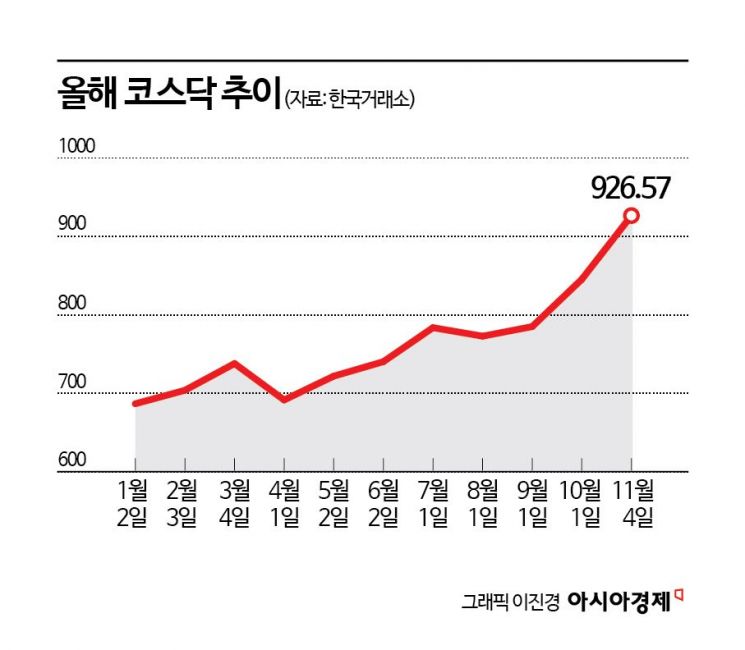

According to the Korea Exchange on November 5, the KOSDAQ closed at 926.57, up 1.31% from the previous day. This contrasts with the KOSPI, which fell by more than 2%. It is the first time since September 2023 that the KOSDAQ has finished above the 920 mark based on closing prices.

Although the KOSPI has sustained a record-breaking rally since the beginning of the year, the KOSDAQ has underperformed in comparison. While the KOSPI has risen by 71.78% year-to-date, the KOSDAQ has gained 36.62% during the same period.

As a result, the gap between the KOSPI and KOSDAQ has widened to an all-time high. On November 3, when the KOSPI surpassed the 4,200 mark for the first time, the relative strength-the ratio of the KOSPI to the KOSDAQ index-reached 4.62 times, breaking the previous record. The prior record was 4.49 times, set on June 14, 2011.

Kim Dooun, a researcher at Hana Securities, said, "The relative strength between the KOSPI and KOSDAQ expanded to 4.6 times at the end of last month, reaching a historic high," adding, "Since 2000, the average relative strength of the KOSPI compared to the KOSDAQ has been 2.8 times."

Jo Joongi, a researcher at SK Securities, commented, "While large-cap stocks have performed similarly or slightly better than the overall market index, small- and mid-cap stocks are in a dire situation." He pointed out, "Last week, the ratio of advancing to declining stocks (ADR) for both the KOSPI and KOSDAQ rose to 89% and 78%, respectively, indicating a slight easing of concentration, but the market is still closer to a bottom than a ceiling." An ADR below 100 means there are more declining stocks than advancing stocks.

Recently, a shift in foreign buying patterns appears to be providing the KOSDAQ with an opportunity to break out of its relative slump. Foreign investors, who had been driving the KOSPI rally, have recently turned net sellers in the main board. Over the past two days, they have recorded consecutive net selling, and during the past week, there was only one day of net buying. Notably, on the previous day, they net sold 2.2345 trillion won in the main board, dragging down the KOSPI. In contrast, they have been net buyers in the KOSDAQ for five consecutive days.

The stock most heavily purchased by foreign investors this month has been Alteogen, the leading KOSDAQ stock. Foreign investors have net bought 221.3 billion won worth of Alteogen shares so far this month. Conversely, they have sold the most shares of SK Hynix and Samsung Electronics. With four consecutive days of foreign buying, Alteogen has seen a sharp rise for four straight sessions, with its share price surpassing 500,000 won. On the previous day, it hit a new all-time high of 563,000 won during trading hours.

If the rally in biotech stocks, led by Alteogen, continues, it could help the KOSDAQ recover from its relative underperformance. Lee Jaewon, a researcher at Shinhan Investment Corp., analyzed, "Yesterday, the lack of large semiconductor inflows and absence of technology transfer (L/O) events contributed to the KOSDAQ's relative weakness, but as biotech stocks showed strength, the gap has narrowed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)