$350 Billion Investment Agreement with the U.S.

Potential Contraction of Domestic Investment Amid Rising Overseas Expansion

Chain Reactions: Facility Relocations and Job Losses

Severe Impact on Primary and Secondary SME Partners

"Urgent Need to Ease the Three Major Policies, Including the Yellow Envelope Act"

As expectations rise that investments in the United States will surge following the conclusion of the Korea-U.S. tariff negotiations, concerns are spreading throughout related industries that domestic investment could shrink as a side effect. In particular, analysts warn that if large corporations accelerate the relocation of their facilities overseas, many domestic small and medium-sized partner companies could lose significant business, resulting in a major shock. Experts emphasize that the government must actively step in to revamp the domestic investment environment and minimize the impact of capital outflows.

According to industry sources on November 4, following the conclusion of the U.S. tariff agreement at the Korea-U.S. summit during the 2025 Asia-Pacific Economic Cooperation (APEC) summit, small and medium-sized enterprises are increasingly alarmed about the potential contraction of domestic investment.

Kim Yongbeom, Chief Presidential Policy Secretary, previously explained, "Investments are made according to the progress of business projects, so the impact on our foreign exchange market will remain within manageable limits and can be minimized." However, this has not dispelled concerns that the domestic investment market will contract significantly starting next year, when investments in the United States are expected to ramp up.

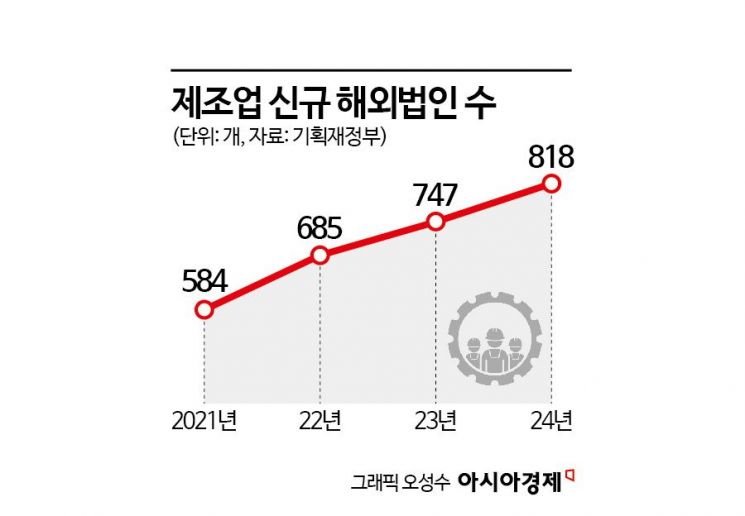

According to the government, the number of overseas investment corporations in the domestic manufacturing sector increased from 584 in 2021 to 813 last year, and in the first half of this year alone, the number reached 589, on track to set a new annual record. Analysts warn that if the pace of overseas relocation accelerates due to declining domestic investment capacity, not only will a large number of domestic jobs disappear, but local economies that rely on manufacturing as a base could also be destabilized. Heo Jeong, Professor of Economics at Sogang University, explained, "Annual investments in the United States are expected to double starting next year. As corporate funds flow overseas, the capacity for domestic investment will decline."

The situation is even more challenging for small and medium-sized enterprises that depend on large corporations as their main clients. As major companies in industries such as automobiles and steel move their production bases overseas, small and medium-sized businesses risk losing clients that account for more than half of their sales, and will likely bear the full brunt of the resulting downturn in regional economies.

The small and medium-sized business sector believes that, in addition to deregulation efforts to attract foreign companies to Korea, it is urgent to resolve industry difficulties arising from the three major policies: the Yellow Envelope Act, the Serious Accidents Punishment Act, and the 52-hour workweek system. Currently, the Korea Federation of SMEs has formed a task force with related organizations such as the Korea Employers Federation to deliver industry opinions on working hours and labor laws to the Ministry of Employment and Labor.

An official from the small and medium-sized business sector stated, "It is essential to foster the perception that Korea is as business-friendly as any foreign country in order to minimize the fallout from the contraction of domestic investment. The most urgent task is to ensure that industry opinions are reflected in the implementation of the three major government policies-the Yellow Envelope Act, the Serious Accidents Punishment Act, and the 52-hour workweek system-and we plan to actively voice our concerns to this end."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)