Doosan Surpasses 1 Million Won, Joins the Ranks of Emperor Stocks

Number of Emperor Stocks Rises to Six from Zero at the Start of the Year

Record-Breaking Bull Market Drives Surge in Emperor Stocks

As the KOSPI continues its record-breaking rally, an increasing number of so-called "Emperor Stocks"-shares priced over 1 million won-are emerging. At the beginning of the year, there were none, but now the number has grown to six. If the stock market rally continues, more stocks are expected to join the ranks of Emperor Stocks.

According to the Korea Exchange on November 4, Doosan closed at 1,018,000 won the previous day, officially entering the Emperor Stock category. On that day, Doosan's share price rose by 7.27%. During intraday trading, it climbed as high as 1,025,000 won, setting a new all-time high.

Yang Ji-hwan, a researcher at Daishin Securities, analyzed, "Doosan is expected to directly benefit from the boom in artificial intelligence (AI) and the semiconductor industry through its own business operations. It will also indirectly benefit from the global expansion of the nuclear power business and the growth of the humanoid robot market through its subsidiaries, Doosan Enerbility and Doosan Robotics."

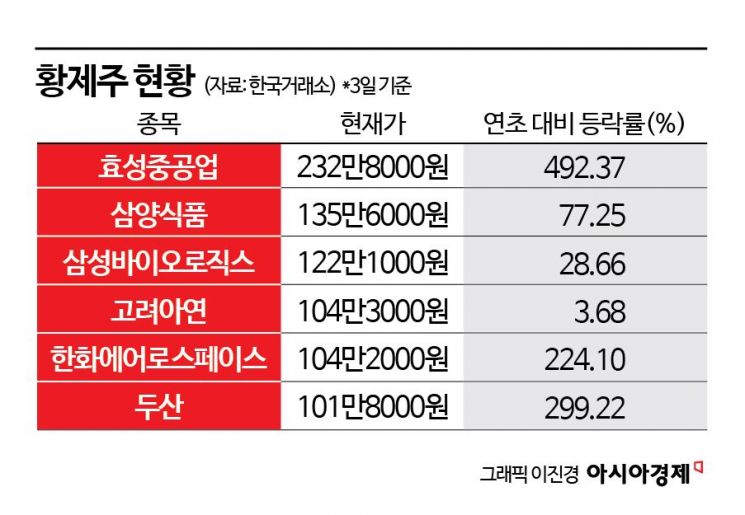

The number of Emperor Stocks, which was zero at the start of the year, has now increased to six. Doosan's share price has surged by 299.22% this year, while Hyosung Heavy Industries has soared by 492.37%. Hanwha Aerospace rose by 224.10%, and Samyang Foods by 77.25%. Samsung Biologics increased by 28.66%, and Korea Zinc rose by 3.68%.

In particular, Hyosung Heavy Industries, which recorded the largest increase, now has its target price raised to as high as 3 million won. On this day, securities firms raised their target prices for Hyosung Heavy Industries in response to its strong third-quarter results and expected future growth. NH Investment & Securities and Hana Securities raised their targets from 1.5 million won to 3 million won. Kyobo Securities raised its target from 2 million won to 2.6 million won, and IBK Investment & Securities increased its target from 1.5 million won to 2.6 million won. Samsung Securities raised its target from 1.45 million won to 2.66 million won, while Korea Investment & Securities increased its target from 1.8 million won to 2.8 million won. Jang Nam-hyun, a researcher at Korea Investment & Securities, stated, "We are raising our target price by 55.6% compared to the previous figure," explaining, "We changed the earnings per share (EPS) estimate used for the target price calculation from 2026 to 2027, and raised the 2027 EPS estimate by 35.4% compared to the previous estimate." He added, "The target price-earnings ratio (PER) was calculated using the 2027 average PER of global power equipment companies (ABB, Schneider Electric, Eaton, and Hitachi), whose average annual EPS growth rate for 2025-2027 is 13.8%. In comparison, Hyosung Heavy Industries is expected to achieve a 47.0% growth rate, securing the fastest earnings improvement among its global peers."

The most likely next candidate for Emperor Stock status is HD Hyundai Electric. HD Hyundai Electric closed at 949,000 won the previous day, up 9.08%. During intraday trading, it reached a new all-time high of 969,000 won. HD Hyundai Electric's share price has risen by 148.43% so far this year.

SK Hynix, which surpassed the 600,000 won mark for the first time ever the previous day, is also drawing attention as its target price has been raised to 1 million won, fueling expectations that it could become an Emperor Stock. SK Hynix closed at 620,000 won the previous day, up 10.91%, achieving the milestone of "600,000-nix." On this day, SK Securities raised its target price for SK Hynix from 480,000 won to 1 million won. Han Donghee, a researcher at SK Securities, explained, "We raised the 2026 operating profit forecast for SK Hynix by 35% and increased the target price accordingly." He continued, "The upward revision in performance outlook is because the beginning of the AI scale-out cycle is expected to drive strong demand across the entire memory sector, not only for high-bandwidth memory (HBM) but also for server DRAM and enterprise solid-state drives (eSSD). In addition, the limited supply capacity is expected to prolong the supply-side advantage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)