Third Real Estate Policy Under Lee Administration: 10·15 Regulations

As Mortgage Loans Are Blocked, Unsecured Loans Rise

Increase in Overdraft Accounts and Loans Secured by Savings or Installment Deposits

As the third household debt measure under the Lee Jaemyung administration, the “10·15 Measures” have continued to impose strict regulations, making it increasingly difficult to obtain mortgage loans from banks. As a result, a “balloon effect” has emerged, with demand shifting to unsecured loans. With mortgage loans restricted, borrowers are turning to overdraft accounts and loans secured by savings or installment deposits. Although unsecured loans had been on the decline, data shows that they began to rise again in October.

According to the financial sector on November 3, as of October 27, the total balance of household loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 766.0389 trillion won. This represents an increase of 1.944 trillion won compared to September, surpassing the previous month’s (August) increase of 1.1964 trillion won. If this trend continues, the increase in household loans for the month of October is expected to exceed 2 trillion won by the 31st. Previously, the increase in household loans at the five major banks peaked at 6.7536 trillion won in June, then declined to 4.1386 trillion won in July, 3.9251 trillion won in August, and 1.1964 trillion won in September, before rebounding in October.

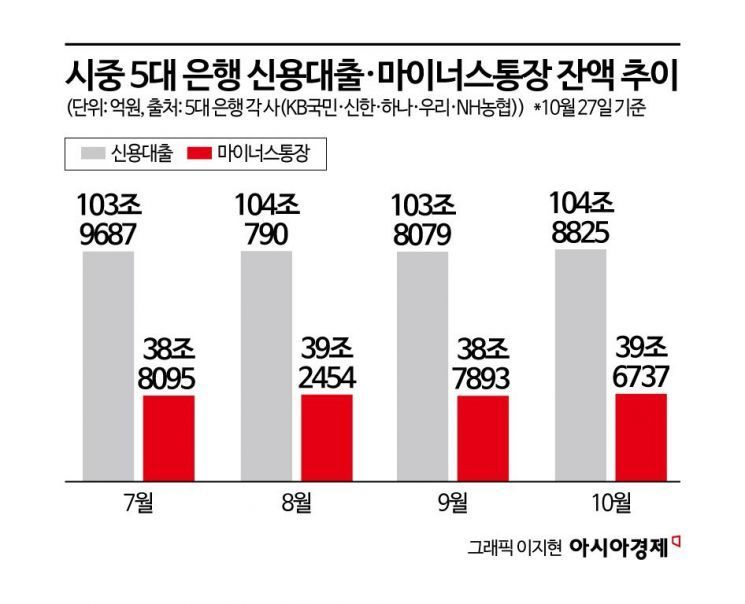

The main driver of the increase in household loans in October was unsecured loans. As of October 27, unsecured loans at the five major commercial banks totaled 104.8825 trillion won, an increase of 1.0746 trillion won compared to the end of September. This is the largest monthly increase since June, when the first household debt measure under the Lee Jaemyung administration, the “6·27 Measures,” led to a surge of 1.0876 trillion won. This contrasts with the three consecutive months of decline in unsecured loans from July to September.

An official at a major commercial bank analyzed, “Due to the 10·15 real estate measures, mortgage loan limits have been significantly reduced, and the booming stock market has also contributed to the marked increase in unsecured loans.”

Another bank official said, “Although it has become more difficult to obtain unsecured loans, as they are now limited to within one’s annual income, borrowers who had previously increased their overdraft limits were able to avoid the new regulations, resulting in increased demand for overdraft accounts. In addition, as the window for other loans has narrowed, loans secured by savings or installment deposits-which are not subject to the Debt Service Ratio (DSR) regulation-have seen a rise in inquiries from borrowers.”

In fact, as of October 27, the balance of overdraft accounts at the five major banks stood at 39.6737 trillion won, reversing the slight decline observed at the end of the previous month. Loans secured by savings or installment deposits at the five major banks totaled 6.236 trillion won as of October 27. These loans, which were in the 5 trillion won range at the beginning of the year, have steadily increased and have remained above 6 trillion won since June. Loans secured by savings or installment deposits allow borrowers to obtain funds using their deposit or subscription account balances as collateral, regardless of existing loans. For banks, these products are attractive because of the solid collateral, and for borrowers, they offer lower interest rates than unsecured loans, making them a popular source of emergency funds.

In the non-bank sector, policy loans against insurance policies are also not subject to DSR regulations, but most experts believe that the balloon effect on insurance loans will be limited. This is because, despite the government’s strong regulation of household loans-including mortgages-insurance companies have proactively reduced policy loan limits. While policy loans can be executed immediately without a separate review, their relatively high interest rates, ranging from 3% to 8% per year, make them less attractive to borrowers. The loan limit is also set at 50% to 95% of the policy’s surrender value.

There are also concerns that the balloon effect may spill over into secondary financial institutions, such as mutual finance companies. Household loans at these institutions increased by 600 billion won in August, but then declined by 900 billion won in September.

A financial sector official said, “In the case of secondary financial institutions, the DSR limit is 10 percentage points higher than at banks, so even though interest rates are higher, borrowers in urgent need of funds may shift to these institutions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.