JP Morgan: "Clear Potential for KOSPI Gains"

"Concerns Over Increased Losses Depending on Market Conditions"

Recently, as the KOSPI index surpassed the 4,100 mark for the first time in history and the domestic stock market enters a boom period, there has been a rapid increase in interest in financial investment among the younger generation. However, some point out that a growing number of people are rushing into investments driven by FOMO (Fear Of Missing Out) without sufficient information.

JP Morgan: "KOSPI Could Reach 6,000 in a Bull Market"

On the 31st of last month, the KOSPI index rebounded after a decline at the start and is once again challenging to reach a new high. Various indices and exchange rates are displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. 2025.10.31 Photo by Dongju Yoon

On the 31st of last month, the KOSPI index rebounded after a decline at the start and is once again challenging to reach a new high. Various indices and exchange rates are displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. 2025.10.31 Photo by Dongju Yoon

As the domestic stock market continues to hit record highs, global investment bank JP Morgan has presented an optimistic outlook that the KOSPI index could rise to 6,000 points.

On the 28th of last month (local time), JP Morgan released a report titled "KOSPI 5000 on the Cards," stating, "There is clear potential for further gains in the Korean stock market," and added, "In a bull market scenario, the KOSPI could even reach 6,000." The report analyzed that the issue of the domestic stock discount related to government policy has not yet been reflected in stock prices, and if this is resolved, it could further boost the market.

Some have argued that the KOSPI's rise of over 70% since the beginning of the year is excessive. Nevertheless, JP Morgan stated, "Korea remains our top OverWeight (OW) market in Asia," and recommended, "Even if the Korean stock market appears to be moving quickly and prices seem to have risen excessively, we advise buying on short-term corrections."

Millennials & Gen Z Increasing Their Investment Asset Allocation

Amid this optimistic outlook, the investment craze among the younger generation is intensifying. Realizing that it is difficult to build wealth through earned income alone, young people are entering the investment market in pursuit of higher returns than previous generations, and are boldly investing in highly volatile assets such as virtual assets.

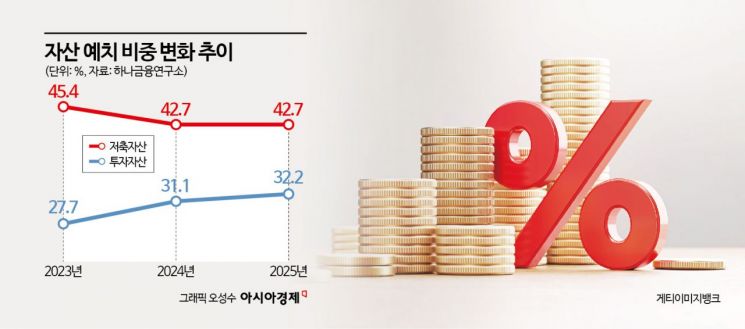

This trend is also evident in the statistics. According to the "2026 Korea Financial Consumer Trends" report released by Hana Institute of Finance at the end of last month, the proportion of investment assets has rapidly increased over the past three years. The proportion of savings assets fell from 45.4% in 2023 to 42.7% in both 2024 and 2025, while the proportion of investment assets steadily rose from 27.7% in 2023 to 31.1% in 2024 and 32.2% in 2025. The institute analyzed, "As investment spreads to Millennials & Gen Z, it is becoming mainstream."

Additionally, the proportion of Millennials & Gen Z among those with assets of at least 100 million won rose from 19.8% in 2022 to 33.6% last year. In other words, one out of every three people with assets exceeding 100 million won now belongs to Millennials & Gen Z.

Concerns Over 'Debt-Fueled Investments'... Margin Loans Reach 25 Trillion Won

However, as investment fever grows, so do concerns about market overheating. There are increasing worries that people, anxious about falling behind others, are engaging in excessive investments, leading to a resurgence of so-called "debt-fueled investments" (borrowing to invest).

In fact, the balance of margin loans-money individuals borrow to invest-reached a record high of 25.0968 trillion won as of the 29th of last month. Margin loans, which involve borrowing short-term funds from securities firms to buy stocks, tend to become more active when expectations for a bull market rise. In other words, as the domestic stock market continues its boom and the consensus grows that it has entered a major bull market, a large number of individual investors are flocking to the Korean stock market.

On online communities, posts expressing concerns about stock investments are increasing. One user, who identified as a freelancer in their 40s, wrote, "I just work hard, put my money in savings, and live off the interest, but people around me say that only saving is foolish. Even though I have a house and a car without investing in stocks, I'm wondering if I should at least start with ETFs."

In response, the Korea Financial Investment Association and the Korea Exchange have urged special caution regarding the surge in debt-fueled investments. The two organizations issued a joint press release on the 17th of last month, stating, "Leverage investments such as margin loans can maximize returns during a bull market, but if the market moves contrary to expectations, losses can rapidly expand. Therefore, it is crucial to refrain from excessive leverage trading that exceeds one's repayment capacity." They added, "Recently, external factors such as the US-China conflict and the possibility of short-term corrections due to the continued rise of the stock market have increased market volatility. In such times, investors should be even more cautious when using margin loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)