Analysis of Top Net-Purchased Stocks in October

Samsung Electronics, Net Sold by Individuals for 6 Trillion Won, Surges 24% This Month

Losses for Investors in Leveraged Inverse and Gold Spot ETFs

The KOSPI has surpassed the 4,000-point mark for the first time in history, but individual investors' accounts have not yielded the returns they had hoped for. The stocks that individuals carefully selected and purchased have not delivered high returns, and a significant number of individuals have also bet on a market decline. Compared to foreign and institutional investors who focused their investments on secondary batteries and semiconductor sectors, individuals have underperformed.

According to the financial investment industry on October 31, individuals recorded a net sell-off of 6.704 trillion won in the Korea Exchange this month. During the same period, foreign investors and institutional investors recorded net purchases of 4.028 trillion won and 2.482 trillion won, respectively.

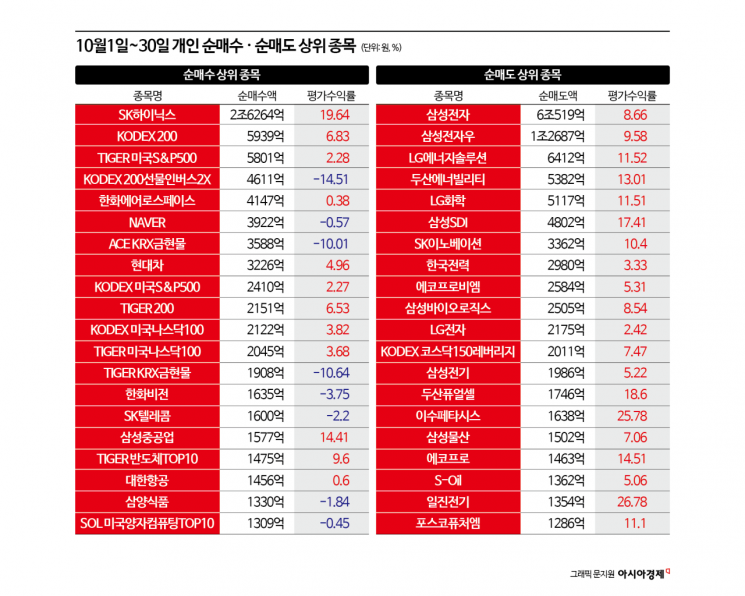

Individuals posted net sales of 6.052 trillion won and 1.269 trillion won in Samsung Electronics and Samsung Electronics preferred shares, respectively. Doosan Enerbility, LG Energy Solution, and LG Chem also ranked among the top net-sold stocks. This month, Samsung Electronics rose by 24%, surpassing 100,000 won. Both Doosan Enerbility and LG Energy Solution climbed by more than 40%.

All the stocks in which individuals reduced their holdings have risen, while the majority of the stocks they carefully selected for their portfolios have shown sluggish price movements. From the 1st of this month up to the previous day, individuals heavily purchased SK Hynix, Hanwha Aerospace, Naver, Hyundai Motor, and Hanwha Vision. The net purchase amount for SK Hynix reached 2.626 trillion won. The average purchase price per share was 474,777 won, with an evaluated return of 19.6% based on the previous day's closing price.

Except for SK Hynix, the other top 10 net-purchased stocks by individuals underperformed compared to the market return. While the KOSPI rose by 19.3% this month, the evaluated return for individuals' investments in Hanwha Aerospace was only 0.4%.

Individuals also bought a significant amount of Exchange Traded Funds (ETFs), mainly including KODEX 200, TIGER US S&P500, KODEX 200 Futures Inverse 2X, and ACE KRX Gold Spot.

Except for those who invested in the KODEX 200 ETF, which tracks the KOSPI200 index and recorded a return of around 6.8%, most ETF investors are facing losses. Individuals net purchased more than 461 billion won of the KODEX 200 Futures Inverse 2X ETF, which inversely tracks the index, over the past month. The evaluated loss rate stands at -14.5%. Investors in the ACE KRX Gold Spot ETF are also experiencing double-digit losses due to the recent correction in gold prices.

Foreign and institutional investors, who absorbed the sell-off by individuals, have seen all their top net-purchased stocks remain in profit. Foreign investors net purchased 5.192 trillion won and 1.141 trillion won of Samsung Electronics and Samsung Electronics preferred shares, respectively, over the past month, recording returns of 8-9%. Foreign investors also bought around 400 billion won each of LG Chem and Doosan Enerbility shares.

Institutions purchased SK Hynix, Samsung Electronics, and LG Energy Solution, achieving relatively the highest returns.

An official from the financial investment industry explained, "As a few leading stocks have driven the rise in the KOSPI, investors who did not invest in the semiconductor sector are feeling relatively left out. Quite a few investors who bet on an inverse strategy during the sharp rally have also suffered losses," he added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.