Agreement on Most-Favored-Nation Status for Pharmaceuticals at Korea-U.S. Summit

Optimism Spreads Among CDMO and Biosimilar Leaders

Industry Closely Watching Ripple Effects of Tariff Imposition

With the conclusion of the Korea-US customs negotiations, the domestic pharmaceutical and biotech industries are collectively expressing relief. The risk of extremely high tariffs, ranging from 100% to 200%, as previously warned by the Donald Trump administration, has been eliminated, and much of the uncertainty surrounding the establishment of local manufacturing facilities in the United States has also been resolved.

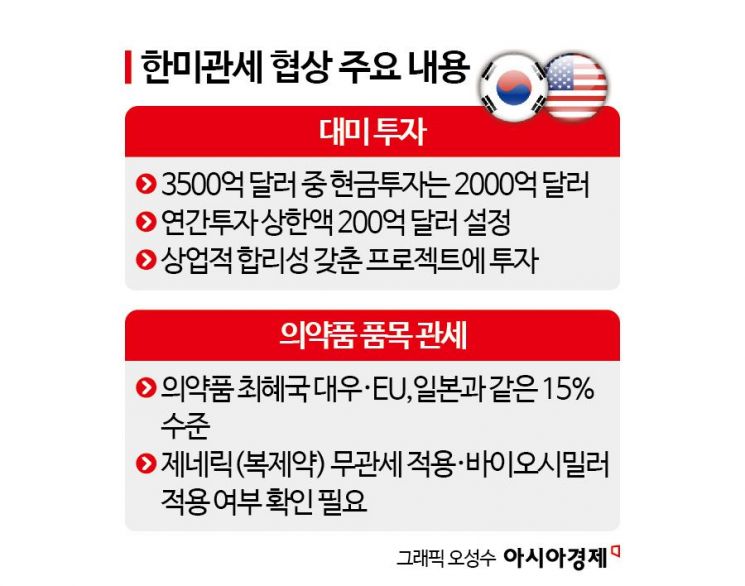

According to the Office of the President on October 30, pharmaceutical products among Korean exports to the United States will be subject to Most-Favored-Nation (MFN) tariff rates. In addition, generic drugs will be exempt from tariffs. The MFN tariff rate for pharmaceuticals is set at 15%, the same level as the European Union and Japan.

Previously, President Trump had declared, "We will impose a 100% tariff on pharmaceutical products from companies that do not build factories in the United States," and even mentioned the possibility of tariffs as high as 200%, which heightened industry concerns. If such extremely high tariffs had been implemented, the prices of Korean pharmaceuticals would have more than doubled, forcing companies to reconsider their business operations in the US. Biosimilar companies, whose main strength lies in price competitiveness, would have been particularly hard hit.

The industry interprets the agreement as more than just the removal of a tariff risk. Most domestic pharmaceutical and biotech companies mass-produce drug substances (DS) in Korea and export them to the US and Europe, where only packaging and distribution are handled locally. The significance of this agreement lies in the fact that the human and material resources concentrated in bio clusters such as Songdo, Incheon, remain intact. With the pressure to relocate production bases to the US eased, companies can now respond in the short term using their existing contract manufacturing (CMO) and parallel production capabilities already established locally.

The Korea Pharmaceutical and Bio-Pharma Manufacturers Association issued an official statement welcoming the agreement. Lee Hyunwoo, Head of the Global Industry Division, said, "Securing MFN status similar to the EU and Japan itself provides stability," and added, "Although it is necessary to confirm whether CDMO raw materials and biosimilars are included among the tariff-exempt items, this will likely have a positive effect on expanding into the US market." However, it has not yet been determined whether biosimilars will be classified as generics and thus be exempt from tariffs, or whether they will be subject to separate consideration. The association plans to continue monitoring until detailed guidelines for each item are released.

Some have also pointed out the need to monitor the cascading changes in the industry resulting from tariff imposition. Lee Seungkyu, Vice Chairman of the Korea Biotechnology Industry Organization, stated, "The most significant aspect of this measure is that it has quickly resolved market uncertainty," but also noted, "Ultimately, US tariff policy is linked to the investment direction of big pharma. If global pharmaceutical giants expand their manufacturing facilities in the US, the pressure to pass on costs could affect latecomer countries, including Korea. While short-term risks have been resolved, in the long term, this marks the beginning of a full-scale restructuring of supply chain strategies."

He also commented, "In a structure where both local bases and research and development (R&D) must be managed, policies that support industrial competitiveness are needed, rather than mere protective measures," and added, "It is time for the government to shift its policy framework from 'post-support' to designing an 'industrial competitive structure.'"

Meanwhile, some domestic companies have already secured production bases in the US in preparation. SK Biopharmaceuticals is operating a factory in Puerto Rico, a US territory, while Celltrion has acquired the Eli Lilly plant in New Jersey to establish a production infrastructure. Lotte Biologics is also working to expand its presence in the US market based on its production facility in Syracuse.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.