KB Securities and JP Morgan Forecast KOSPI 5000 Next Year

"First Long-Term Uptrend in 40 Years Since the 'Three Lows Boom'"

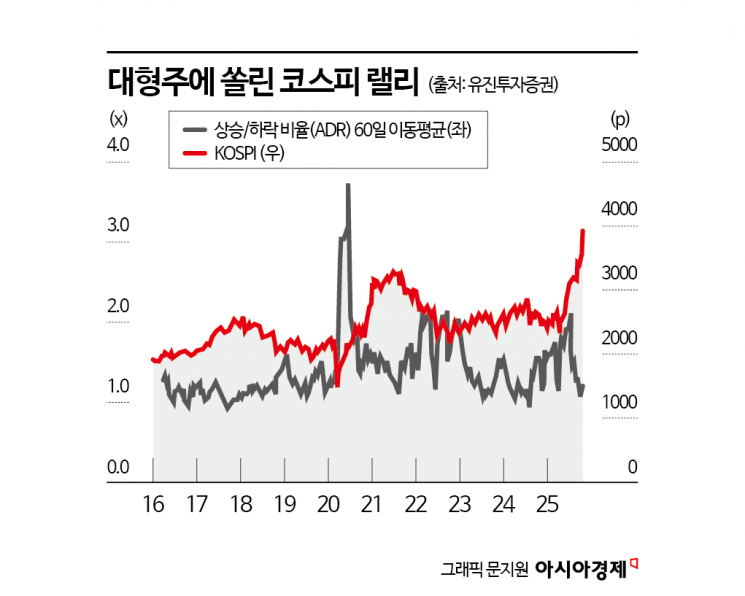

Concerns Over Concentration in Large-Cap Stocks

The figure of 'KOSPI 5000,' once thought of as a distant prospect, has begun to appear in securities firms' annual outlook targets for 2026. Amid this historic stock market boom, there is a growing perception that achieving the 'Ocheonpi' (KOSPI 5000) promised by the Lee Jaemyung administration is no longer just political rhetoric, but an attainable goal.

According to the Korea Exchange on October 30, the KOSPI closed at 4,081 the previous day, up 1.7%, setting another all-time high. SK Hynix, which posted a record quarterly operating profit of over 1 trillion won in the third quarter of this year, saw its market capitalization surpass 400 trillion won, while Samsung Electronics, now firmly above the 100,000 won mark, is on the verge of reaching a market capitalization of 600 trillion won.

'Three Lows Boom' Rally to Return?

Amid this record-breaking rally, analysts in the securities industry suggest that the Korean stock market has entered a period of structural transformation. KB Securities stated, "This bull market is not just a simple economic rebound, but likely the beginning of a long-term upward phase not seen since the 'Three Lows Boom' (low dollar, low oil prices, low interest rates) 40 years ago. This rally is characterized not only by improved corporate earnings, but also by changes in global asset allocation and shifts in global liquidity."

Korea's stock market has experienced two major bull runs in the past (1986-1989 and 2003-2007), but KB Securities explains that the rare combination of a low dollar and low oil prices is reappearing for the first time in about 40 years, creating a market pattern and macro environment similar to the late 1980s 'Three Lows Boom.' The KOSPI target index for 2026 was set at 5,000.

Global investment bank JP Morgan also set its 12-month KOSPI target at 5,000, the same as KB Securities, and projected that in a bullish scenario, it could reach as high as 6,000. JP Morgan commented, "Although the Korean stock market has moved rapidly and prices may appear overheated, we recommend buying on short-term corrections," highlighting memory semiconductors, financials, holding companies, defense, shipbuilding, and power equipment as preferred sectors.

DS Investment & Securities set its KOSPI band for 2026 at 4,200-4,500. The firm assessed, "The current KOSPI level, considering both inflation and exchange rates, is still below the 2021 peak, and factors such as broad money (M2) liquidity growth, the Federal Reserve's interest rate cut cycle, and the shipbuilding supercycle are all favorable for the market." In addition, Korea Investment & Securities set next year's KOSPI target at 4,600, Heungkuk Securities projected a range of 3,500-4,600, and Kiwoom Securities suggested a range of 3,500-4,500.

Is the Concentration on Large-cap Stocks a Problem?

However, there are concerns that the recent KOSPI rally has relied heavily on the momentum of a handful of large-cap stocks, including Samsung Electronics and SK Hynix. In fact, while the KOSPI soared 70% this year up to the previous day, the KOSDAQ rose only 33%, about half as much. During the same period, large-cap stocks within the KOSPI jumped over 76%, whereas small-cap stocks gained only 19%. Notably, as the combined market capitalization of the KOSPI and KOSDAQ increased by 1,459 trillion won this year, the semiconductor sector alone accounted for an increase of 552 trillion won, representing 37.8% of the total.

Kang Songcheol, a researcher at Eugene Investment & Securities, stated, "The KOSPI's ADR (advance-decline ratio) rose until July and August, but since September, as the index surged mainly due to large-cap semiconductor stocks, the ADR has plummeted again. If the index continues to rise while the ADR remains below 1, the burden of concentration on a few stocks could intensify. A rebound in the ADR seems necessary for a stable uptrend."

Lee Euntaek, a researcher at KB Securities, commented, "Even when the dot-com bubble burst in the past, the Nasdaq 100, with its high valuation, nearly doubled while other indices were falling, and only then peaked. As uncertainty grows, investors tend to focus their funds even more on stocks with high future growth potential and visible current earnings. The concentration on existing leading stocks is likely to become even more pronounced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)