Bank of Korea 2023 Corporate Management Analysis

Sales up 3.7%, Operating Profit Margin Improves to 4.6%

Semiconductors Soar, but SME Profitability Declines

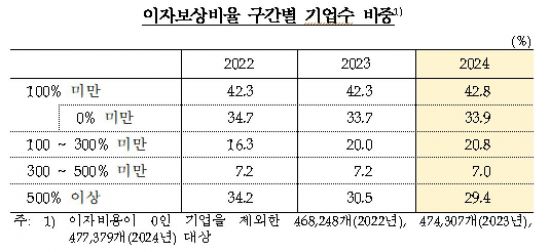

Proportion of Companies with Interest Coverage Ratio Below 100% Rises to 42.8%

Last year, while the overall growth and profitability indicators of domestic companies improved, the polarization of profitability between large corporations and small and medium-sized enterprises (SMEs) further intensified. Thanks to the strong performance of the semiconductor sector, large corporations showed a clear improvement in their results, whereas SMEs saw their operating profit margins deteriorate. The proportion of companies that found it difficult to cover interest expenses with their operating profits also reached a record high.

According to the "2024 Annual Corporate Management Analysis Results" released by the Bank of Korea on the 29th, the sales growth rate of non-financial for-profit corporations (961,336 companies) that filed corporate tax returns with the National Tax Service last year was 3.7%, turning positive compared to the previous year (-1.5%).

By industry, both manufacturing (-2.3%→4.6%) and non-manufacturing (-0.9%→2.0%) sectors saw increases. The electronics, video, and telecommunications equipment sector showed the largest rise in sales growth (-14.5%→19.6%). The Bank of Korea explained that increased demand for semiconductors related to artificial intelligence (AI) led to higher export prices and volumes, boosting sales for related companies. The transportation and warehousing sector (-9.0%→11.6%) also saw increased sales due to a rise in the shipping freight index, while the wholesale and retail sector (-2.1%→2.9%) improved due to the base effect from the previous year's decline in duty-free sales and an easing of sluggish raw material transactions.

By company size, large corporations shifted from -4.3% to 3.4%, and SMEs increased from 2.8% to 4.1%. The total asset growth rate also rose from 6.3% to 7.0% year-on-year.

The operating profit margin (operating profit to sales), an indicator of corporate profitability, improved to 4.6% from 3.5% the previous year. This is the fourth time since 2016, 2017, and 2021 that both growth and profitability have improved.

By industry, both manufacturing (3.3%→5.1%) and non-manufacturing (3.7%→4.1%) sectors saw increases. The improvement in profitability was particularly notable in the electronics, video, and telecommunications equipment sector (-3.0%→8.3%). The electricity and gas sector (-11.1%→0.7%) also turned profitable, influenced by electricity rate hikes and falling energy prices.

However, by company size, large corporations saw their operating profit margin rise from 3.7% to 5.6%, while SMEs saw a decline from 3.2% to 3.0%. The pre-tax net profit margin for large corporations also rose from 3.8% to 4.3%, whereas for SMEs it fell slightly from 2.6% to 2.4%.

Moon Sangyun, head of the Corporate Statistics Team at the Economic Statistics Department 1 of the Bank of Korea, stated, "This improvement in growth and profitability was centered on the semiconductor sector by industry and on large corporations by company size. While there was overall improvement, a closer look reveals that the positive trend was concentrated in large corporations and the manufacturing sector, especially semiconductors." He added, "Semiconductors were not the only sector to perform well, but their share in Korea is very high, and there was also a base effect from the particularly poor performance of semiconductors in 2023."

As profitability indicators for large corporations and SMEs diverged, the proportion of companies unable to cover interest expenses with operating profits actually increased.

The interest coverage ratio rose from 191.1% to 244.1%, but the proportion of companies with a ratio below 100% increased from 42.3% to 42.8%. This is the highest level since related statistics began to be compiled in 2009. The proportion of companies whose interest coverage ratio did not exceed 0% due to operating losses also increased from 33.7% to 33.9%. During the same period, the proportion of sound companies with an interest coverage ratio over 500% decreased from 30.5% to 29.4%.

The interest coverage ratio indicates the extent to which a company can cover its financial costs with income generated from operations; the higher the ratio, the more leeway a company has to handle its costs. Moon explained, "Interest operating profits increased significantly, mainly among semiconductor companies and large corporations, but profitability was poor for SMEs and smaller, less sound companies. This is why, even though the overall interest coverage ratio rose, the proportion of companies with a ratio below 100% also increased."

In terms of stability, the debt ratio, which represents the ratio of liabilities (debt) to equity, fell from 120.8% to 119.9% over the past year. A higher debt ratio means that the stability of corporate management has worsened. By industry, both the manufacturing sector (75.9%→75.8%) and non-manufacturing sector (163.1%→162.6%) saw slight decreases in their debt ratios. By company size, large corporations saw a slight increase from 101% to 101.5%, while SMEs saw a decrease from 166.9% to 162.7%. The dependency on borrowings, which refers to the proportion of external funds such as foreign loans, bank loans, and corporate bonds among a company's debts, was 31%, a slight decrease from 31.4% a year earlier.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)