Real Estate Task Force to Be Launched Soon

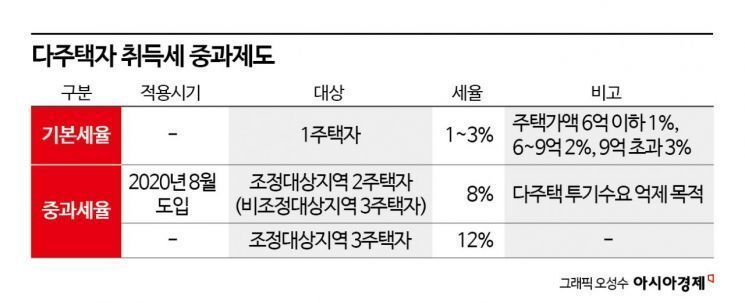

As the government moves to ease real estate transaction taxes, it is set to begin in-depth discussions on relaxing the heavy acquisition tax imposed on owners of multiple homes. Currently, when a person without a home purchases a single property, the basic acquisition tax rate of 1-3% applies, but the rates rise to 8% for a second home and 12% for three or more homes. The government will soon launch an inter-ministerial task force to adjust the tax burden at each stage of real estate transactions-including acquisition, holding, and transfer-and will begin formal discussions on the matter.

On October 30, the Ministry of Economy and Finance, the Ministry of the Interior and Safety, and the Ministry of Land, Infrastructure and Transport announced that they would form a task force aimed at stabilizing housing prices and begin discussions on strengthening real estate holding taxes (comprehensive real estate tax and property tax) and easing transaction taxes. A government official explained, "Easing the heavy acquisition tax will also be included in the discussions." Recently, the focus of discussions on easing transaction taxes has been on capital gains tax. However, within government circles, there is a consensus that, since the core of transaction taxes lies in the acquisition tax paid when purchasing real estate, it is crucial to discuss ways to reduce the acquisition tax burden on owners of multiple homes.

Currently, Korea's acquisition tax is applied very strictly to owners of multiple homes. For a single-home owner, the basic tax rate of 1-3% applies when acquiring a property worth up to 600 million won, and 3% for properties exceeding 900 million won. For owners of multiple homes, if the property is located in a regulated area, the acquisition tax rate is 8% for a second home and 12% for a third home. This system of imposing higher taxes on owners of multiple homes was introduced in 2020 during the Moon Jae-in administration to curb speculative demand. The aim was to discourage speculative home purchases by raising the maximum acquisition tax rate for owners of multiple homes. However, there have been ongoing concerns that excessively high transaction taxes have led to a persistent shortage of properties for sale. Even those who wish to sell a home with a high holding tax burden and buy another property are reluctant to do so because of the significant transaction tax burden.

The Yoon Suk-yeol administration attempted to ease the heavy acquisition tax on owners of multiple homes by amending the Local Tax Act in 2022, but the effort failed due to disagreements between the ruling and opposition parties. At the time, the government and ruling party proposed applying the basic tax rate (1-3%) to second homes, reducing the rate for third homes from 8-12% to 4-6%, and lowering the rate for four or more homes and corporations from 12% to 6%. A similar structure is likely to be reconsidered in the upcoming discussions. In May of this year, the government relaxed the criteria for excluding properties in local areas from the heavy acquisition tax, raising the threshold from 100 million won to 200 million won. However, the higher tax rates remain in effect in major areas such as Seoul and the metropolitan region.

However, easing the acquisition tax is expected to lead to a reduction in local government revenues, which is likely to provoke significant opposition from local governments. This is because changes to the requirements for heavy acquisition tax have a major impact on local tax revenues. Acquisition tax is the largest single item among local tax revenues and is fully allocated to metropolitan governments, with a portion distributed to basic local governments. According to the Korea Local Tax Institute, as of 2022, local taxes collected amounted to 118.5707 trillion won, with acquisition tax accounting for 23% of the total. As a result, the government is expected to comprehensively review the interests of both local and national taxes for each tax item as it adjusts acquisition, comprehensive real estate, property, and capital gains taxes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.