SK Hynix Q3 Earnings

Data Center Server Replacement Cycle

Mobile Demand Also Rising: Compound Boom

NAND Prices Up for Nine Consecutive Months

"Positive Trend May Continue Until 2028"

SK Hynix achieved its highest-ever quarterly performance, surpassing 10 trillion won in operating profit for the first time in its history. This record-breaking achievement is seen as the result of a 'compound boom,' where multiple favorable factors converged simultaneously. High Bandwidth Memory (HBM) has become the core of artificial intelligence (AI) memory, now representing a significant portion of SK Hynix's revenue. At the same time, demand for general-purpose memory such as DRAM and NAND flash has rebounded amid rising prices, which analysts say further boosted the company's results.

Kyung Hee-kwon, a research fellow at the Korea Institute for Industrial Economics & Trade, stated, "With the revival of the mobile segment, the center of the semiconductor market, and astronomical investments in data centers, memory prices have risen significantly. The replacement cycle for servers in devices such as mobiles, PCs, and cloud platforms has also coincided, leading to increased demand."

According to industry sources, the memory market has entered a 'supercycle' as the replacement of mobile devices and PCs, as well as data center servers, all occurred simultaneously this year. While companies focused on HBM production, their capacity for traditional DRAM decreased and supply was limited. As a result, demand has outpaced supply, causing prices to rise rapidly, according to industry explanations.

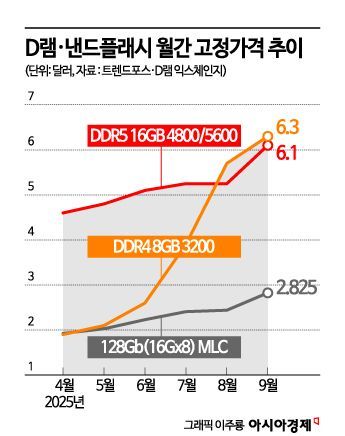

According to DRAMeXchange, last month the average contract price for PC DRAM (DDR4 8Gb) rose 10.5% from the previous month to $6.30, surpassing $6 for the first time since January 2019. The price of NAND flash (128Gb) also climbed 10.6% to $3.79, marking the ninth consecutive month of increases.

As major global companies ramp up data center construction, demand for memory tailored to 'inference AI' has recently surged. Products with low power consumption and cost are preferred, including High Bandwidth Memory (HBM) used in graphics processing units, graphics DRAM, low-power DRAM for mobile devices, and server DRAM. NAND flash and solid-state drives (SSD), which are well-suited for handling large volumes of data, are also considered core components for data center operations.

Since late last year, SK Hynix has been rolling out new products and expanding its memory lineup to capitalize on these trends. The company stated, "With the expansion of AI infrastructure investment, overall memory demand has surged. Sales of high-value-added products such as HBM 3E (12-layer) and DDR5 have increased, and shipments of DDR5 modules with capacities of 128GB or more more than doubled compared to the previous quarter." In the NAND sector, "the proportion of enterprise SSDs for AI servers has also expanded," the company added.

The market is now focused on how long SK Hynix can sustain these strong results. The continuation of the memory boom and the company's strategic responses are expected to determine the future trajectory of its performance.

Securities analysts and industry insiders believe that the positive momentum in the memory sector could last as briefly as the first quarter of next year or as long as 2028. Since the AI infrastructure market, now centered on data centers, is still in its early stages, demand for AI memory is expected to continue growing steadily for the next three years.

Nvidia CEO Jensen Huang predicted that global corporate investment in AI infrastructure will reach $1 trillion (about 1,370 trillion won) by 2028. As large-scale memory semiconductors are essential for building AI infrastructure, industry observers expect that memory manufacturers like SK Hynix will secure new growth opportunities over the medium to long term.

During its conference call that day, SK Hynix stated, "Given the rapid expansion of HBM demand, it will be difficult for supply to catch up in the short term," forecasting that the supply shortage will continue until 2027. The company added, "HBM products have been consistently sold out since 2023, and (HBM4) prices are currently at levels that maintain profitability."

SK Hynix appears to be advancing step by step in line with market trends. While continuing to focus on its core HBM business, the company is also eyeing NAND flash as a new growth engine and is working to expand its business in that area. Development and mass production of sixth-generation (HBM4) and seventh-generation (HBM4E) HBM are proceeding smoothly. The Cheongju M15X fab (factory), which aims for completion within the year, began bringing in equipment on October 27 after opening its cleanroom for the first time, signaling imminent expansion of production capacity.

However, there is a sense of urgency in the industry that preparations for the future must continue even amid the current boom. Major clients such as Nvidia are diversifying their HBM suppliers and creating a price-competitive environment, making it increasingly important for SK Hynix to seek new growth drivers. In this context, the High Bandwidth Flash (HBF) that SK Hynix unveiled at the '2025 Open Compute Project (OCP)' held in San Jose, California from October 13 to 16 drew attention. HBF is a technology that applies the multi-layered HBM structure of DRAM to NAND flash, enabling AI in data centers to process large volumes of data more quickly. SK Hynix is considering using its HBF-based 'AIN-Bandwidth (AIN-B)' solution alongside HBM. Research fellow Kyung commented, "Recently, the driving force of semiconductor demand has shifted completely from customized (consumer) to enterprise applications. Enterprise NAND products are also gaining traction in the market," predicting that SK Hynix's push into the NAND sector will continue.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.