Seaweed Industry Set to Hit Record Export Highs This Year

Major Manufacturers Like Kwangcheon Seaweed and Sungkyung Seaweed Up for Sale

Difficult to Secure Margins in a Fixed-Cost Sector

The Korean seaweed industry, a leading representative of K-food enjoyed by people around the world, has found itself in a dilemma amid an unprecedented boom. Although exports have reached record highs, major manufacturers are being put up for sale one after another. This is due to the structural limitations that prevent export growth from directly translating into improved profitability, compounded by the rapidly increasing burdens of investment and certification.

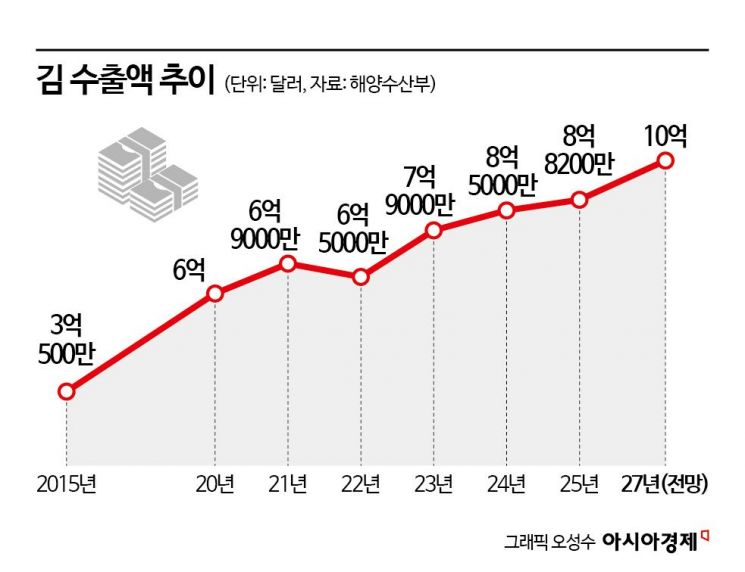

According to the Ministry of Oceans and Fisheries on November 2, seaweed exports from January to September this year reached $882 million (approximately 1.25 trillion won), a 14% increase compared to the same period last year. By the end of the year, exports are expected to surpass last year’s record of $850 million, setting a new all-time high.

Korea’s unique seasoned seaweed, flavored with salt and other ingredients, is gaining popularity in the United States as a snack to accompany alcoholic beverages, rapidly increasing local consumption. Riding the K-food wave, demand for Korean seaweed is also expanding in various Asian countries. As a result, seaweed exports, which stood at $300 million in 2014, have nearly tripled over the past decade. Korean seaweed now accounts for more than 70% of the global market share, firmly establishing itself as a global food product.

However, in the mergers and acquisitions (M&A) market, rumors of seaweed manufacturers being sold continue to surface. Kwangcheon Seaweed, the industry leader, selected Samil PwC as its lead manager in June and began the process of selling its management rights. Kwangcheon Seaweed, which operates production bases both domestically and overseas, has been the subject of ongoing sale rumors since last year. The mid-sized brand Sungkyung Seaweed recently signed a memorandum of understanding (MOU) with Samchully Group and has started due diligence. In 2017, Sungkyung Seaweed was valued at 150 billion won and was sold once to Affirma Capital (then SC PE).

The seaweed industry is a typical fixed-cost sector, with raw materials, equipment, logistics, and exchange rates all intricately intertwined. Even as exports increase, the costs of cultivating and harvesting seaweed, as well as those for cooking oil, packaging materials, and energy, all rise together, making it difficult to secure margins. Additionally, the aging population in fishing villages is making it increasingly hard to secure labor, which presents another structural constraint.

Expanding overseas distribution networks cannot be addressed by simply increasing production. This is because a comprehensive response system for local logistics, marketing, certification, and quarantine is required. In this process, major companies must invest significant capital in expanding automated facilities, securing overseas warehouses, and renewing quality certifications.

Large companies are rapidly building direct sales structures targeting overseas consumers by leveraging their capital and distribution networks, but small and medium-sized manufacturers are still limited to the OEM (original equipment manufacturing) model. An industry insider commented, "As the export market grows, costs for inspection, packaging improvements, and certification renewals increase, but small businesses find it difficult to bear these expenses. Ultimately, joining a conglomerate or bringing in outside capital is becoming the survival strategy."

The surge in export volume and higher company valuations have led founders and investors to view this as the 'last chance to sell at a good price.' This is why there is a clear trend of seeking to recoup capital before export growth slows or global competition intensifies.

Another industry source explained, "Seaweed is clearly a growth item, but since most companies are family-run, it is not easy to raise capital. As the market has grown, there is a natural trend toward accepting outside capital to fuel further growth."

He added, "The seaweed industry has now become a global distribution network battle, much like the instant noodle sector. The current wave of sales is both proof of the industry’s expansion and a signal of structural transformation. The sector is expected to be reorganized around large companies with capital and strong brands."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.