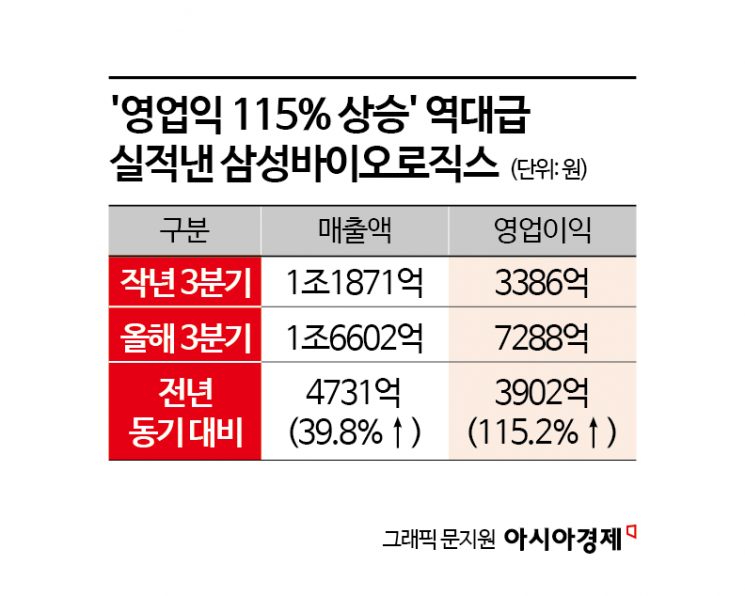

Sales Reach 1.66 Trillion Won, Operating Profit at 728.8 Billion Won

Driven by Full Operation of Plants 1?4 and Favorable Exchange Rates

Samsung Biologics has achieved its highest-ever quarterly performance since its founding. This was driven by the full operation of its Songdo Plants 1 to 4, expanded sales of biosimilar products, and favorable exchange rates.

On October 28, Samsung Biologics announced through a public disclosure that its consolidated sales for the third quarter of this year reached 1.6602 trillion won, with operating profit at 728.8 billion won. Compared to the same period last year, sales increased by 473.1 billion won, or 39.8%, and operating profit rose by 390.2 billion won, or 115.2%.

On a separate basis, Samsung Biologics also recorded its highest-ever quarterly sales, thanks to increased contributions from the full operation of Plants 1 to 4. Third-quarter separate sales reached 1.2575 trillion won, and operating profit was 633.4 billion won, marking year-on-year increases of 190.4 billion won and 188.9 billion won, respectively. Plant 5 is currently undergoing technology transfer for new orders and is ramping up production in a stable manner.

Samsung Bioepis posted third-quarter sales of 441.0 billion won and operating profit of 129.0 billion won. Driven by the launch of new products in the U.S. and the expansion of biosimilar product sales in the global market, sales increased by 110.7 billion won and operating profit by 61.1 billion won compared to the same period last year.

Samsung Biologics expects to achieve its annual sales growth guidance of 25-30%, which was raised during the second quarter earnings announcement, for both consolidated and separate results.

As of the end of the third quarter of this year, Samsung Biologics reported consolidated assets of 18.3373 trillion won, equity of 12.1794 trillion won, and liabilities of 6.1579 trillion won. The company maintains a stable financial position, with a debt ratio of 50.6% and a borrowing ratio of 9.9%.

Samsung Biologics continues to show strong order growth based on its customer-centric management. As of this year, the cumulative order amount disclosed reached 5.2435 trillion won, nearly matching last year's annual order amount of 5.4035 trillion won within just ten months. The contract development (CDO) business also secured eight new contracts in the third quarter, including deals with global pharmaceutical companies. Since its founding, cumulative orders have reached 105 for CMO and 154 for CDO, with the total cumulative order value surpassing 20 billion dollars (approximately 28.772 trillion won).

Samsung Biologics currently counts 17 of the global top 20 pharmaceutical companies as clients. Recently, it signed contracts with four of Japan's top 10 pharmaceutical and biotech companies and is in final negotiations with one more. The company is also strengthening its order activities targeting the global top 40 pharmaceutical companies.

The company is accelerating efforts to secure a significant lead in production capacity. In April, Plant 5, with a capacity of 180,000 liters, began operations after automation and digitalization upgrades, bringing the total production capacity to 784,000 liters. By 2032, Samsung Biologics plans to build three additional plants at its second bio campus, increasing total production capacity to 1,324,000 liters.

Investments to expand the portfolio are also ongoing. To enter the clinical research organization (CRO) field, the company launched the "Samsung Organoids" service. Samsung Biologics is also accelerating the acquisition of advanced bio technologies such as antibody-drug conjugates (ADC), multi-specific antibodies, and adeno-associated virus (AAV) to diversify product modalities.

Samsung Bioepis continues to show solid growth in performance by steadily expanding biosimilar product sales in the global market, based on thorough supply chain management and close collaboration with partners.

In particular, the biosimilar (SB17) of the autoimmune disease treatment "Stelara," launched in the U.S. market in the first half of this year, has secured two private label contracts with major private insurance companies, distributing the drug under their own brands. With product supply starting in the third quarter, market entry is accelerating.

In July, Samsung Bioepis signed a U.S. partnership agreement with Harrow for the ophthalmic disease treatments Lucentis biosimilar (SB11) and Eylea biosimilar (SB15). This new agreement follows the expiration of Biogen's licensing agreement, and the company plans to continue selling ophthalmic disease treatments in the U.S. through Harrow after completing the license transfer process within the year.

In Korea, Samsung Bioepis launched the osteoporosis treatments Prolia/Xgeva biosimilar (SB16) in July and August, respectively, increasing its total number of commercialized products in the domestic market to 11 and expanding its product portfolio to cover a wider range of disease areas.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.