Private Consumption Grows 1.3%, Highest in Three Years... Improved Sentiment and Consumption Coupon Effect

Domestic Demand Leads Growth... Construction Investment Improves from a Drag to a Neutral Role in Q3

"1% Growth Possible This Year, Achiev

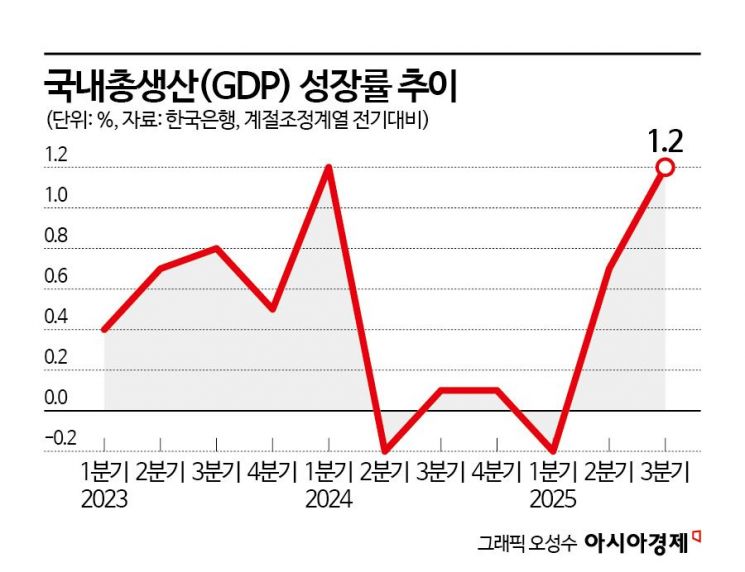

In the third quarter of this year (July to September), South Korea's economy recorded a surprising growth rate of 1.2%. This is the highest figure in six quarters since the first quarter of last year (1.2%), surpassing the Bank of Korea's forecast of 1.1% made in August. The strong growth in the third quarter was driven by a significant improvement in private consumption. The recovery in consumer sentiment, along with the government's expansive fiscal policy-including a total of 13 trillion won worth of consumer coupons for livelihood recovery-had a notable impact. The launch of new products such as smartphones and electric vehicles, as well as the wealth effect from rising stock prices, also played a role. Exports maintained a solid performance in the third quarter, following a strong increase in the second quarter, particularly in semiconductors and automobiles.

With the third-quarter economic growth rate exceeding expectations, attention has shifted to whether the country can achieve a 1% growth rate for the year. The Bank of Korea projected that if the fourth-quarter growth rate lands between -0.1% and 0.3%, achieving 1% annual growth is possible. This is attainable if the fourth quarter performs at the Bank of Korea's August forecast of 0.2% growth. The key factors will be the export trend of semiconductors and other goods, the sustainability of robust private consumption, and the extent of improvement in construction investment.

Private Consumption Growth Rate Hits Three-Year High... Decline in Construction Investment Narrows

On October 28, the Bank of Korea announced that the real gross domestic product (GDP) growth rate (preliminary estimate) for the third quarter increased by 1.2% compared to the previous quarter. To the second decimal place, it was 1.17%. This slightly exceeds the Bank of Korea's August forecast of 1.1% and matches the previous high of 1.2% in the first quarter of last year.

This is the first time in six quarters that the quarterly growth rate has reached the 1% range. After a surprise growth in the first quarter of last year, South Korea's economy contracted by 0.2% in the second quarter, followed by only 0.1% growth in both the third and fourth quarters. In particular, the first quarter of this year saw a return to negative growth, raising concerns about prolonged low growth. However, the economy rebounded by 0.7% in the second quarter, breaking the cycle of stagnation and raising hopes for recovery.

This growth was led by domestic demand, with private consumption showing a marked increase. The decline in construction investment, which had previously dragged down the growth rate, also slowed significantly, contributing to the improvement. Private consumption increased by 1.3% compared to the previous quarter, as spending on goods such as passenger cars and communication devices, as well as services like restaurants and healthcare, all rose. This matches the previous high in the third quarter of 2022 (1.3%). The effect of the first round of consumption coupons, distributed since July 21, also played a role. Lee Dongwon, Director General of Economic Statistics Department 2 at the Bank of Korea, stated, "Coupons were used for a variety of items, including restaurants, hospitals, opticians, and beauty salons, which clearly contributed to the increase in private consumption in the third quarter; however, it will take time to determine the exact effect. The impact of the second round of coupons, distributed from September 22, will be reflected in the fourth quarter."

Government consumption rose by 1.2%, mainly due to increased spending on goods and health insurance benefits. Construction investment decreased by 0.1% compared to the previous quarter, marking the sixth consecutive quarter of negative growth, but the rate of decline has gradually slowed since the fourth quarter of last year (-4.1%). Compared to the second quarter (-1.2%), the decrease has narrowed considerably. Facility investment rebounded by 2.4%, mainly due to increased investment in machinery such as semiconductor manufacturing equipment.

Exports continued to grow, led by a boom in semiconductors. In the third quarter, exports increased by 1.5% compared to the previous quarter, driven by semiconductors and automobiles. Although growth continued, the rate of increase was smaller than in the second quarter (4.5%) due to base effects. Imports grew by 1.3%, mainly in machinery, equipment, and automobiles.

Domestic Demand Leads Growth... Construction Investment Improves to a 'Growth-Neutral Role' in Q3

Looking at the contribution by expenditure category in the third quarter, the rebound in consumption is clear. The contribution of domestic demand to growth increased from 0.4 percentage points in the second quarter to 1.1 percentage points in the third quarter. Specifically, the contribution of consumption rose from 0.5 percentage points to 0.8 percentage points, with private consumption (0.6 percentage points) outpacing government consumption (0.2 percentage points). During the same period, the contribution of net exports (exports minus imports) fell from 0.3 percentage points to 0.1 percentage points.

By industry, the improvement in the service sector was notable. Service industries, led by wholesale and retail, accommodation and food services, and finance and insurance, increased by 1.3% compared to the previous quarter. Manufacturing grew by 1.2%, driven by transport equipment and computers, electronics, and optical devices, continuing the growth trend seen in the second quarter (2.5%). The electricity, gas, and water supply sector grew by 5.6%, mainly due to increased electricity production. Construction maintained the same level as the previous quarter, as civil engineering works increased but building construction decreased. Agriculture, forestry, and fisheries declined by 4.8% due to poor crop production.

In the third quarter, real gross domestic income (GDI) increased by 0.7% compared to the previous quarter, falling short of the GDP growth rate. Director Lee explained, "This is due to deteriorating terms of trade, as the prices of imported goods such as crude oil and natural gas rose, while the prices of export goods such as automobiles and chemical products fell."

1% Growth Possible This Year... Achievable Even with -0.1% to 0.3% Growth in Q4

With the third-quarter economic growth rate exceeding expectations, attention has focused on whether the country can achieve a 1% growth rate for the year. In August, the Bank of Korea forecast annual growth of 0.9% for this year and projected a fourth-quarter growth rate of 0.2%. Director Lee stated, "Based on simple calculations, if the fourth-quarter growth rate is between -0.1% and 0.3%, it is possible to achieve 1% annual growth. We need to monitor the export trend, especially in semiconductors, the sustainability of strong private consumption, and the degree of improvement in construction investment."

Both market analysts and academics increasingly predict that South Korea's economic growth rate will exceed 1.0% this year. Heo Moonjong, head of the research center at Woori Finance Management Research Institute, said, "Despite a slowdown in exports due to higher U.S. tariffs, domestic demand is clearly improving thanks to the recovery in consumption driven by expansive macroeconomic policies and the easing of sluggish construction investment. The growth rate for this year is expected to be around 1.0%."

Kang Sungjin, professor of economics at Korea University, also commented, "Considering the third-quarter growth rate, achieving growth in the 1% range this year is possible," adding, "The increase in domestic demand in the third quarter appears to be the result of livelihood recovery support funds. The pace of stock price increases also suggests the possibility of an interest rate cut effect." Professor Kang further stated, "Next year, prices are expected to stabilize and the semiconductor sector to improve, marking a recovery after hitting bottom this year. The remaining variables are the outcome of U.S. trade negotiations and the direction of stock prices. If the stock market declines, it could have a negative impact on the growth rate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)