Wall Street's Leading Tesla Bull

"AI Semiconductor Rally Will Last Another 2-3 Years"

Marketing to U.S. Investors, Securing Talent, and Building the Startup Ecosystem Remain Key Challenges

Dan Ives, a leading Wall Street optimist and analyst at Wedbush Securities, gave a positive assessment of the K-Semiconductor-led KOSPI rally, but also pointed out three challenges that need to be addressed to enhance the investment appeal of Korean technology stocks. These are marketing to American investors, preventing talent outflow, and fostering entrepreneurship.

At the "Hana x Wedbush Global Insight: Next Wave" seminar held at the Hana Securities headquarters in Yeouido on the 27th, Ives stated, "Korean companies will play an increasingly significant role in the midst of the global artificial intelligence (AI) revolution." Renowned on Wall Street for his expertise in technology stock analysis and known for his accurate predictions, Ives is also a long-standing Tesla bull and a familiar figure among Korean individual investors investing in U.S. stocks.

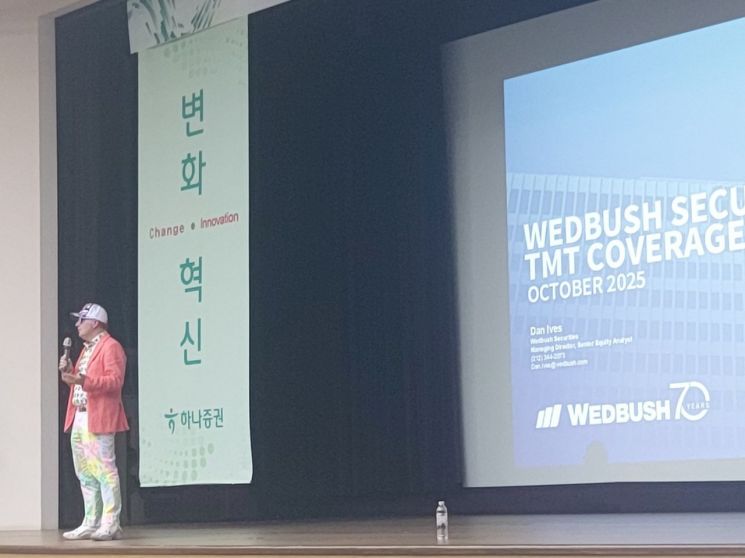

Dan Ives, Wedbush Securities analyst, is giving a lecture at the "Hana x Wedbush Global Insight: Next Wave" seminar held at the Hana Securities headquarters in Yeouido on the 27th. Photo by Kim Jinyoung

Dan Ives, Wedbush Securities analyst, is giving a lecture at the "Hana x Wedbush Global Insight: Next Wave" seminar held at the Hana Securities headquarters in Yeouido on the 27th. Photo by Kim Jinyoung

Ives remarked, "The Korean stock market seems to be rediscovered on a global scale, with the KOSPI's year-to-date growth rate approaching 70%." He continued, "After meeting with many executives from Korean companies such as SK, Samsung, and LG, I realized that the AI innovation happening in Korea is not limited to memory (semiconductor capabilities) alone." He added, "The number of companies demonstrating entrepreneurship is steadily increasing, and the government is also driving the AI revolution. The AI rally in Korea is just beginning."

Among domestic listed companies, the AI rally beneficiary he specifically mentioned was SK Hynix. Ives stated, "I love SK Hynix," and added, "At the current share price level, I see the potential for the stock to double." As the memory semiconductor supercycle (boom period) unfolds, SK Hynix, one of the two leading KOSPI semiconductor stocks, is considered to have secured a favorable position in the AI revolution. On this day, SK Hynix, along with Samsung Electronics, reached an all-time high, contributing to the KOSPI surpassing the 4,000 mark.

However, he also expressed some disappointment. He pointed out that SK Hynix and other prominent Korean companies are not making enough efforts to attract global investment capital. When an audience member noted that SK Hynix was not included in the recently launched "Dan Ives Wedbush AI Revolution (IVES)" ETF portfolio, Ives explained, "One reason why Korean listed companies are given relatively lower multiples compared to American companies is that they do not actively promote themselves," and argued, "When it comes to conveying a vision to investors, their competitor Micron may be a step ahead."

He said, "American technology companies are very proactive in communicating with investors and excel at painting a compelling story and market blueprint. In contrast, Korean companies are very conservative in this regard, and simply listing performance figures can be detrimental to stock prices. There is a need to shift to a more U.S.-centric approach in terms of marketing."

Dan Ives, a Wedbush Securities analyst regarded as an expert in analyzing technology stocks on Wall Street, is answering reporters' questions ahead of his lecture at a seminar held in February this year at the headquarters of Hana Securities in Yeouido, Seoul.

Dan Ives, a Wedbush Securities analyst regarded as an expert in analyzing technology stocks on Wall Street, is answering reporters' questions ahead of his lecture at a seminar held in February this year at the headquarters of Hana Securities in Yeouido, Seoul.

He also identified Korea's talent outflow and entrepreneurship as challenges. "Many outstanding Korean investors and technology experts I know currently reside in the United States," he said, predicting, "In the future, efforts to retain talent will be a key factor determining corporate success or failure." Believing that securing talent is linked to entrepreneurship through the startup ecosystem, he emphasized, "Given Korea's talent pool, I believe entrepreneurship already exists, but it should be further fostered through government-level startup programs, innovation, and support for startups."

He reaffirmed his previous view that the global stock market's AI boom will continue for the next two to three years. Ives commented, "If you imagine the AI party started at 9 p.m., it's now only 10:30 p.m. The party will continue until 4 a.m." He also noted, "So far, the AI bull market has been led by big tech, but secondary and tertiary ripple effects will soon emerge. The time is coming when cybersecurity companies like Palo Alto Networks, which have been outside the mainstream, will start to attract attention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)