K-Eyewear on the Rise

Blue Elephant's Sales Surge 30-Fold in Two Years

Operating Profit Soars 56-Fold... High-Margin Sunglasses

Domestic eyewear brand Blue Elephant is experiencing explosive growth and expanding its territory. Despite the global economic downturn, its affordable yet trendy glasses and sunglasses have captivated Millennials & Gen Z worldwide. Recently, the company has been aggressively opening stores in major domestic commercial districts popular among foreign tourists, as well as overseas markets, following the successful playbook of K-eyewear leader Gentle Monster.

Blue Elephant glasses became a hot topic after singer and actress Suzy wore them in her vlog video. Suzy YouTube

Blue Elephant glasses became a hot topic after singer and actress Suzy wore them in her vlog video. Suzy YouTube

According to industry sources on October 28, Blue Elephant plans to open a mega store, "Blue Elephant Space Seongsu," spanning 2,645 square meters (800 pyeong) on Yeonmujang-gil in Seongsu-dong, Seoul, around December. Blue Elephant is expanding its stores in key commercial districts with high Millennials & Gen Z foot traffic, such as Seongsu, Ikseon, Hannam, Sinyongsan, Hongdae, and Myeongdong, currently operating about 20 stores nationwide.

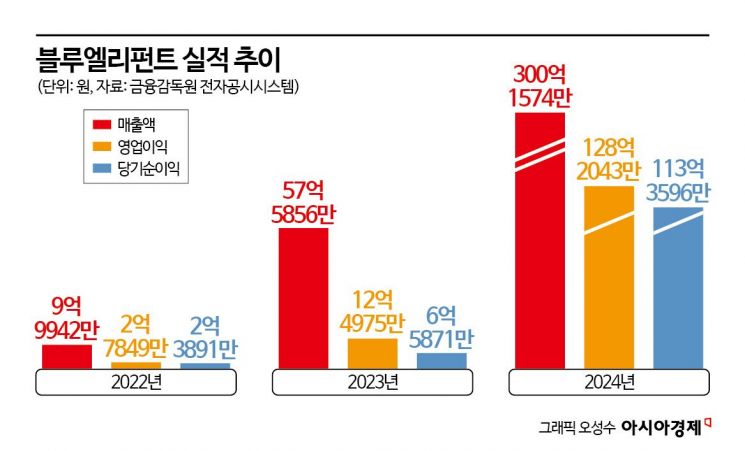

"The Second Gentle Monster" with 30-Fold Annual Revenue Growth in Two Years

Blue Elephant is a K-eyewear brand established in 2019. Its revenue soared from 900 million won in 2022 to 30 billion won last year, marking a 30-fold increase. During the same period, operating profit surged from about 200 million won to 11.3 billion won, a 56-fold jump. Despite offering reasonable prices around 50,000 won, the brand gained popularity among Millennials & Gen Z due to its trendy designs. Word spread on overseas social media and review platforms, dubbing it the "cost-effective Gentle Monster," which fueled its performance surge.

In fact, the company increased its advertising and promotional expenses from 100 million won in 2022 to 2.5 billion won last year, a 25-fold rise, targeting global consumers. As a result, it has established itself as a "must-visit destination for sunglasses shopping in Korea" among foreign tourists. Blue Elephant has leveraged this popularity to expand its offline stores.

This strategy closely mirrors Gentle Monster's growth trajectory. Launched in 2011, Gentle Monster broke away from the conventional, rigid image of optical shops by creating showrooms in the form of unique exhibition spaces and collaborating with global stars like Jennie of Blackpink, building brand awareness through social media. Especially during the COVID-19 pandemic, as the Korean Wave led by K-pop spread worldwide, Gentle Monster achieved rapid growth.

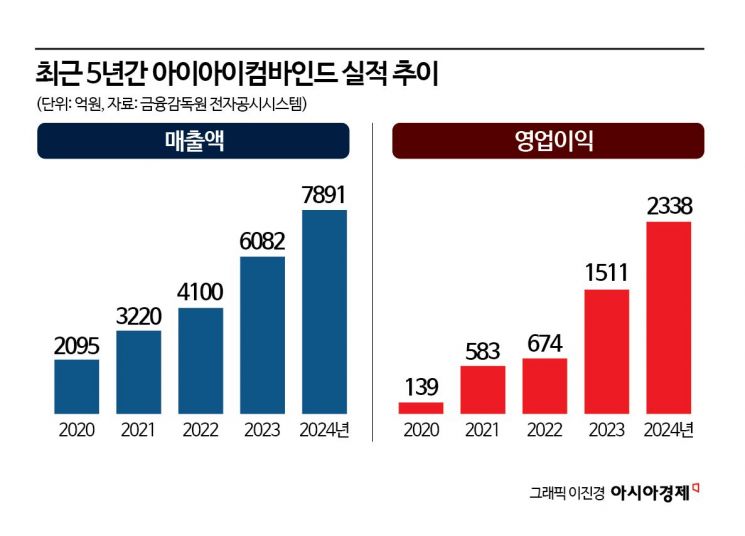

Last year, the operator of Gentle Monster, IICOMBINED, posted revenue of 789.1 billion won, nearly quadrupling in four years. During the same period, operating profit jumped from 13.9 billion won to 233.8 billion won, a nearly 17-fold increase. About 40% of total revenue comes from overseas, and in countries like Japan and the United States, the company has seen year-on-year growth rates of nearly four to six times. Gentle Monster is on the verge of joining the "1 trillion won revenue club" this year.

Eyewear Cost Ratio Below 20%... Over 40% Operating Margin, a High-Profit Business

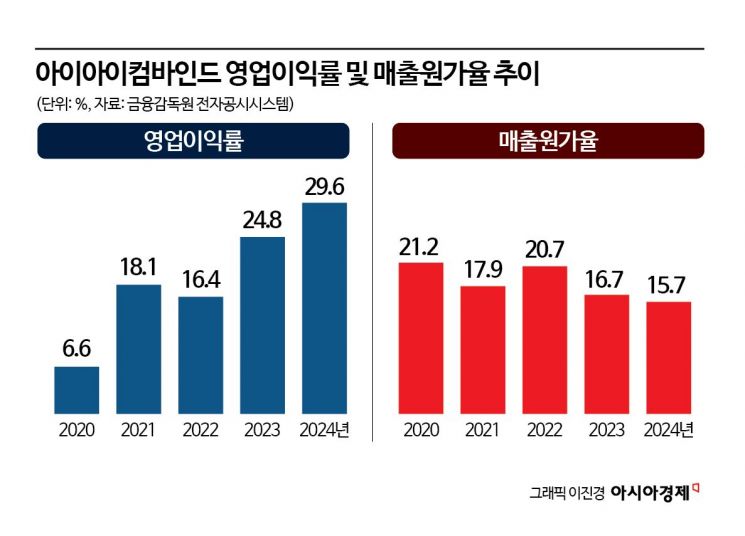

Eyewear is considered a "high-margin product category." With a lower cost ratio than apparel or footwear, it offers attractive profits. Blue Elephant's cost of goods sold ratio last year was 22.5%. In comparison, major fashion conglomerates handling luxury apparel brands have a cost ratio of about 40%, making Blue Elephant's figure roughly half. As a result, Blue Elephant's operating margin reached 42.7% last year.

The same applies to IICOMBINED (Gentle Monster). Last year, its cost of goods sold ratio was only 15.6%, and its operating margin during the same period was 29.6%. With strong performance, retained earnings have steadily accumulated. Blue Elephant's retained earnings increased about 8.5 times from around 1.5 billion won in 2023 to about 12.8 billion won last year.

Leveraging this investment capacity, Blue Elephant is targeting overseas markets. After opening a three-story flagship store in Harajuku, Japan last July, it plans to open its second Japanese store, the "Shinjuku Flagship Store," this month. In the first half of next year, the company plans to enter Los Angeles, USA, and in the second half, expand into Europe, aiming to broaden its global reach. This year, Blue Elephant aims to expand to 30 stores and achieve annual revenue of 100 billion won.

Industry leader Gentle Monster is also making significant strides in overseas markets. IICOMBINED is currently present in 14 countries, including the United States, China, Japan, Hong Kong, the United Kingdom, Australia, and Southeast Asia. In Japan, sales soared from 9 billion won in the first year of entry in 2023 to 55.6 billion won last year, a 6.17-fold increase in just one year. In the United States, sales jumped from 11.8 billion won in 2020 to 52.9 billion won last year, a 4.5-fold increase over four years.

As of last year, IICOMBINED's total tangible assets-including assets under construction, land, and buildings-reached 600 billion won, nearly doubling from 300 billion won a year earlier. This year, Gentle Monster completed its new headquarters in Seongsu-dong and acquired the Queen Mama Market building near Dosan Park, now operating it as Gentle Monster House.

An industry insider commented, "Eyewear is a high-margin category that the fashion industry is strategically focusing on. As domestic brands open flagship stores in Japan, the United States, and other markets, strengthening branding linked to K-culture, the growth potential of K-eyewear is highly anticipated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)