Korea Asset Management Corporation (KAMCO) has selected four management companies to oversee the sixth sub-fund (blind fund) of the Corporate Restructuring Fund, valued at 1 trillion won, aimed at supporting companies affected by customs duties.

According to KAMCO on October 24, the selected management companies are Melon Partners-Union Asset Management, EverBest Partners-Woori Venture Partners, KB Securities-NH Investment & Securities, and SKS Credit.

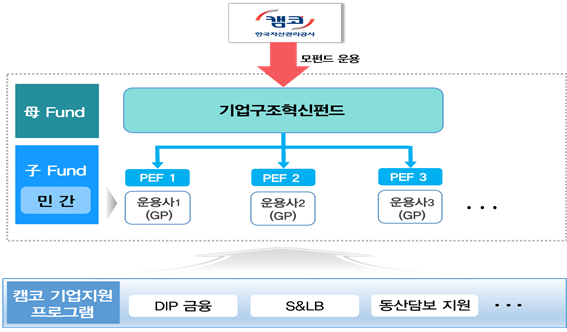

KAMCO plans to invest a total of 500 billion won raised from government funds, Korea Development Bank, Export-Import Bank of Korea, and Industrial Bank of Korea into the blind fund established by these management companies. In addition, the management companies will raise private capital, bringing the total investment to over 1 trillion won, which will be invested in key industries and companies undergoing restructuring.

This sixth Corporate Restructuring Fund will focus on providing intensive support to six major export-oriented industries that are vulnerable to customs-related damages: petrochemicals, steel, semiconductors, displays, secondary batteries, and automobiles.

Lee Jongguk, Executive Director of Corporate Support at KAMCO, stated, "KAMCO will utilize the sixth Corporate Restructuring Fund to fully support the renewed growth of export-based key industries," adding, "Going forward, KAMCO will continue to support the smooth restructuring and competitiveness enhancement of Korean companies through active cooperation with the capital market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.