Top 1% Average Picking Rate Reaches 7%

Calculating Benefit Rate Compared to Annual Fees

BankSalad, a company specializing in MyData services, released the card usage data of the top 1% of customers for its "Card Benefits Received This Month" feature on October 24.

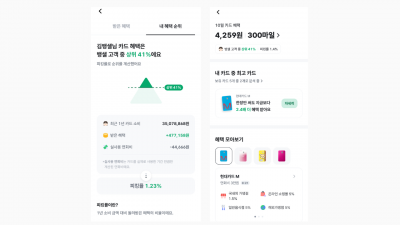

BankSalad's "Card Benefits Received This Month" screen where you can check your card picking rate and ranking. BankSalad

BankSalad's "Card Benefits Received This Month" screen where you can check your card picking rate and ranking. BankSalad

As of last month, the highest card picking rate (benefit rate relative to spending) among BankSalad customers was 7.85%. This customer enjoyed an average monthly discount benefit worth 217,726 won and held four cards. It was analyzed that this customer combined cards with high picking rates for use.

The average picking rate for the top 1% of customers was 5%. On average, they held five cards and utilized about 56,000 won in monthly benefits. They tended to use mainly discount or point accumulation cards. The average age of the top 1% customer group was 37.1 years old, and the proportion of male customers was higher than that of female customers.

"Card Benefits Received This Month" is a service that analyzes users' credit and debit cards to identify which card provides the most benefits, shows monthly benefit status, and displays the user's benefit ranking.

The card benefits service, first launched by BankSalad in the industry in June, analyzes benefit data and picking rates for each card held, providing an overview of individual benefit management. In particular, by applying the MyData 2.0 infrastructure, the company has improved data retrieval speed and stability.

The monthly benefits feature calculates and displays the card benefits received each month down to a single won. For airline mileage cards, it calculates and displays the miles earned for the month down to a single mile.

The "My Benefit Ranking" function allows users to compare their benefits with other users and see what percentage they fall into. It also automatically calculates the picking rate by comparing card benefits to the annual fees paid over the past year. This enables users to check their performance at a glance without complex Excel calculations.

For customers who use multiple cards, the service calculates whether their current combination is optimal and suggests ways to reduce the number of cards held. It also automatically detects spending related to specific events, predicts future spending, and recommends the card that will provide the maximum benefit.

A BankSalad representative said, "We designed the service to allow customers to see if they are receiving optimal benefits by leveraging BankSalad's MyData technology and card analysis capabilities," adding, "We will continue to enhance our card services so that customers can enjoy the greatest possible benefits in the most rational way."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.