HD Hyundai Electric and LS ELECTRIC Hit Record Highs

Strong Third-Quarter Results Drive Stock Rally

Power Equipment Industry Enters Long-Term Growth Cycle

Earnings Growth Expected to Continue Next Year

Power equipment stocks are showing strong performance, buoyed by solid third-quarter results this year. In the securities industry, there is a growing view that the boom in the power equipment sector is not temporary but rather part of a long-term growth cycle, leading to expectations that robust earnings and strong stock price trends will continue.

According to the Korea Exchange on October 24, HD Hyundai Electric closed at 746,000 won, up 60,000 won (8.75%) from the previous session. During the day, the stock climbed to 753,000 won, hitting an all-time high. LS ELECTRIC surged 14.87%, also reaching a new record high of 369,000 won during trading.

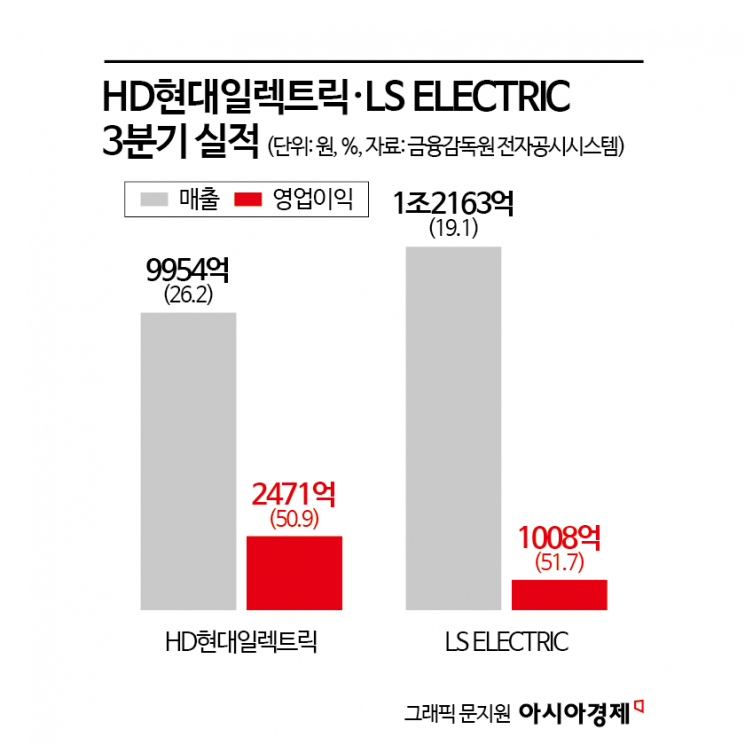

It is believed that the strong third-quarter results have influenced stock prices. On the previous day, HD Hyundai Electric announced that its third-quarter revenue and operating profit reached 995.4 billion won and 247.1 billion won, respectively. These figures represent increases of 26.2% and 50.9% year-on-year. According to financial information provider FnGuide, the consensus for HD Hyundai Electric's third-quarter operating profit was 231 billion won. The operating margin stood at 24.8%, continuing its upward trend from 20.4% in the fourth quarter of last year, 21.5% in the first quarter of this year, and 23.1% in the second quarter.

Sales of power equipment increased by 87.7% compared to the same period last year, driven by higher transformer sales in major overseas markets and increased sales of high-voltage circuit breakers in the domestic market. In particular, sales in the European market rose by 76.1% as backlogged orders were converted into revenue. Third-quarter orders amounted to 1.212 billion dollars, a 71.4% increase year-on-year.

LS ELECTRIC released its third-quarter results on October 22. Revenue rose 19.1% year-on-year to 1.2163 trillion won, and operating profit increased 51.7% to 100.8 billion won. As of the end of the third quarter, the order backlog stood at 4.1 trillion won, up 200 billion won from the previous quarter, while the order backlog for ultra-high-voltage transformers reached 1.9 trillion won, supported by new orders from the United States.

Although LS ELECTRIC's third-quarter results fell short of market expectations, securities firms have raised their target prices in anticipation of earnings growth next year. Korea Investment & Securities raised its target price for LS ELECTRIC by 11.4% to 390,000 won. SK Securities increased its target from 220,000 won to 420,000 won, and NH Investment & Securities raised its target from 360,000 won to 410,000 won. KB Securities also raised its target by 7.9% to 410,000 won. Jang Namhyun, a researcher at Korea Investment & Securities, commented, "LS ELECTRIC's third-quarter operating profit was 10% lower than market expectations due to the impact of tariffs. However, profitability centered on the power sector remains strong. Excluding the impact of tariffs, the operating margin is estimated at 10.3%, marking a quarterly record." He added, "The customer base in the U.S. market continues to expand, and negotiations to pass on tariffs are progressing smoothly. As a result, operating profit in 2026 and 2027 is expected to grow by 35.2% and 19.1%, respectively, compared to the previous year."

There are projections that the boom in the power equipment industry is not temporary. Son Hyunjung, a researcher at Yuanta Securities, stated, "The power equipment industry has entered a long-term growth cycle rather than a temporary boom. Korean power equipment companies are direct beneficiaries of the global power grid investment cycle, based on exports of high value-added products. The expansion of exports to the United States and the rising proportion of high-priced transformers will serve as key drivers for stock prices in 2026."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.