Risks from household debt have largely disappeared due to the 10·15 measures

Even if housing prices are not contained within a month or two, policy consistency must be maintained

Tariff agreements will help lower the exchange rate... "Seohak Ants" will provide a limit

"Economic uncertainties exist on both the upside and downside"

Semiconductor boom leads to upward revision of current account outlook

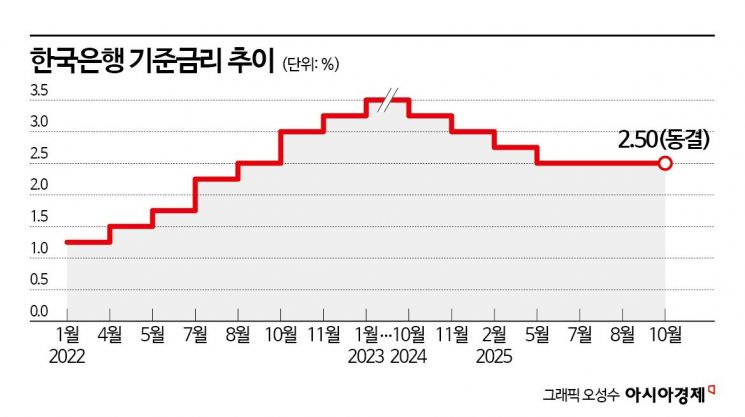

Lee Changyong, Governor of the Bank of Korea, described the market's retreating expectations for the speed and scale of base rate cuts as a "reasonable judgment." Recently, more market participants have voiced the opinion that additional rate cuts may be delayed from the first half to the second half of next year.

At a press conference following the Monetary Policy Committee meeting to decide the direction of monetary policy on the 23rd, Governor Lee stated, "The fact that the number of committee members open to a rate cut within the next three months has decreased from five in August to four this time reflects a greater focus on financial stability." He added, "While the overall direction remains toward rate cuts, it seems correct to say that both the timing and scale of cuts have been adjusted."

Regarding the possibility of a rate cut at the final Monetary Policy Committee meeting of the year, he said it was difficult to give a definitive answer due to numerous variables in November. "The most immediate issue to watch is the outcome of our country’s tariff negotiations, as well as the tariff negotiations between the United States and China," he said, noting that "(the US-China negotiations) will have a global impact." He assessed that if US-China tensions flare up again, it could affect the currently positive semiconductor cycle.

Lee Chang-yong, Governor of the Bank of Korea, is attending the Monetary Policy Committee meeting to decide the monetary policy direction at the Bank of Korea in Jung-gu, Seoul, on the morning of the 23rd, tapping the gavel. Bank of Korea

Lee Chang-yong, Governor of the Bank of Korea, is attending the Monetary Policy Committee meeting to decide the monetary policy direction at the Bank of Korea in Jung-gu, Seoul, on the morning of the 23rd, tapping the gavel. Bank of Korea

"Risks from household debt have largely disappeared due to the 10·15 measures... Even if the situation is not controlled within a month or two, policy consistency must be maintained"

On this day, the Monetary Policy Committee of the Bank of Korea kept the base rate at 2.50% per annum. The committee judged that with inflation remaining stable and growth improving, led by consumption and exports, it was necessary to further examine the impact of real estate measures on the housing market and household debt, as well as financial stability factors such as exchange rate volatility. There was one dissenting opinion (Shin Seonghwan, who advocated a 0.25 percentage point cut).

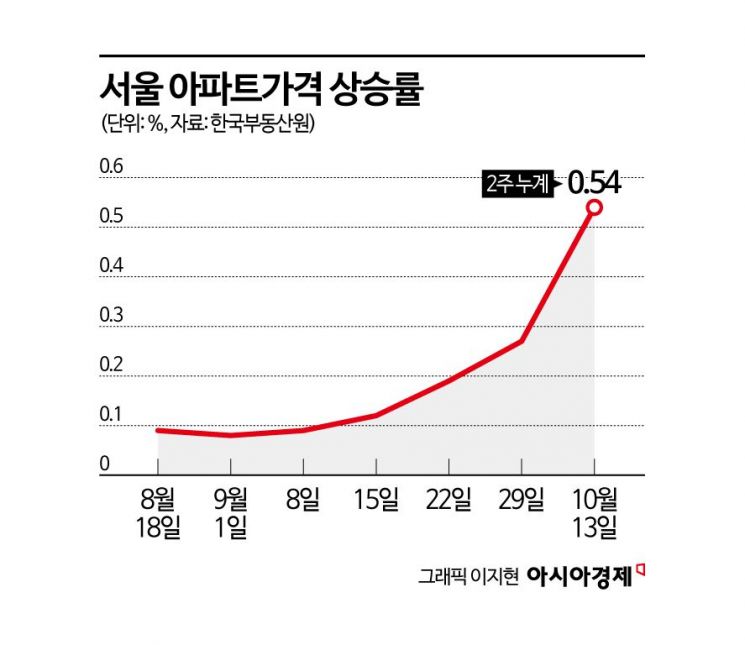

With signs of overheating re-emerging in the greater Seoul housing market and the government announcing additional real estate measures in response, the committee explained that it was also necessary from a monetary policy perspective to avoid fueling expectations of further housing price increases. Governor Lee stated, "The 10·15 measures seem to have significantly reduced the risks related to household debt this time," and added, "Some say that only a drop in real estate prices constitutes stabilization, but I do not see it that way. Stabilization should be assessed in terms of a steady and moderated trend, taking into account the pace of economic growth."

Governor Lee said, "I do not know how real estate prices will move going forward. Transaction volumes have dropped significantly, and the upward trend does not appear likely to reverse quickly, but since new policies have been announced, we need to monitor developments." He emphasized, "Even if the situation is not controlled within a month or two, policy direction should be maintained, additional supply measures should be announced, and population inflows into the Seoul metropolitan area should be minimized through other policies. All these policies must be implemented consistently."

Housing prices are too high... No need to worry about a stock bubble, but the AI sector may see a correction

Regarding the recent "everything rally," where not only real estate but also major asset prices are rising simultaneously, Governor Lee commented, "Given our country’s income level and other factors, real estate prices in Seoul and the metropolitan area are too high to maintain social stability." He added that, while overall stock prices are at average levels globally and not a cause for concern about a bubble, the artificial intelligence (AI) sector is subject to bubble concerns both in Korea and worldwide, and thus may be due for a correction.

Addressing the view that rate cuts have only a limited impact on growth, he explained, "On average, a 1.00 percentage point (100 basis points) rate cut is estimated to raise the growth rate by 0.24%." He continued, "It is still too soon to statistically determine whether the impact has been smaller in this cycle, but there is speculation that the effect may be working more to boost asset prices rather than stimulate the real economy."

Commenting on the scenario he described as the "bad case" in July-where tariffs rise and real estate remains uncontained-he said, "I warned that we should watch to see if conflicts between growth and financial stability intensify not only in tariffs but also in trade and real estate issues, and the situation has actually worsened since then." He added, "Things could deteriorate further, but we will need to see how various issues develop at the upcoming APEC summit to make a judgment."

"25% of the exchange rate increase is due to a stronger dollar, 75% is due to tariff and US investment uncertainties, etc."

Governor Lee also noted that, given the significant increase in exchange rate volatility in a short period, it is important to be mindful of its impact on financial stability. He stated, "Since the last policy meeting on August 28, the exchange rate has risen by about 35 won over roughly a month. Of this, about one-quarter is due to a stronger US dollar, while three-quarters are attributable to factors such as the weakening of the yuan due to US-China tensions, the weakening of the yen as Japan’s new prime minister pursues expansionary policies similar to Abenomics, our own tariff issues, and the uncertainty surrounding the procurement of 350 billion dollars. Domestic factors account for a significant portion."

He continued, "Looking at recent movements in the dollar index, uncertainty over our country’s tariff negotiations is exerting upward pressure on the exchange rate. If tariff negotiations are concluded, it will help bring the exchange rate down. In particular, since we are currently paying a 25% tariff, moving toward a 15% tariff would be a positive development." He added, "By examining the details of how we will secure and invest the 350 billion dollars, we can better understand the foreign exchange market impact. These two factors are likely to interact."

However, he explained that the recent increase in overseas securities investment by domestic investors-commonly referred to as "Seohak Ants"-will likely limit any decline in the exchange rate. Governor Lee stated, "So far this year, the scale of overseas securities investment by domestic investors appears to be about four times that of foreign investment in domestic securities. This suggests that a significant number of our private companies are also investing abroad."

The economy faces both upside and downside uncertainties... Semiconductor boom leads to upward revision of current account outlook

The domestic economy continued to improve, supported by a recovery in consumption and robust export growth. Although construction investment remained sluggish, private consumption rebounded due to improved economic sentiment and government policies to stimulate domestic demand. Despite a decline in exports to the United States, overall exports continued to increase more than expected, driven by the strong performance of the semiconductor sector.

The Monetary Policy Committee stated in its resolution, "Domestic demand is maintaining a recovery led by consumption, and exports are expected to remain strong for the time being, mainly due to the semiconductor boom. However, the impact of US tariffs is expected to gradually increase." The committee added, "Growth rates for this year and next are likely to be broadly in line with the August projections (0.9% and 1.6%, respectively)." However, they noted that both upside and downside uncertainties have increased regarding US-Korea and US-China trade negotiations, the semiconductor cycle, and the pace of domestic demand improvement.

In its "Economic Situation Assessment" released on this day, the Bank of Korea projected that the current account surplus for this year and next will exceed the previous forecasts of 110 billion dollars for this year and 85 billion dollars for next year. The goods account is expected to post a large surplus in both years, despite the impact of US tariffs, thanks to the strong semiconductor market. The service account deficit is also expected to narrow, mainly due to a significant increase in foreign tourist arrivals, especially in the travel sector.

In the short term, the results of the US-Korea and US-China trade negotiations, which are expected to become clearer around the Asia-Pacific Economic Cooperation (APEC) summit, will be the most important factor in determining the future growth trajectory. The results of the Federal Reserve’s October Federal Open Market Committee (FOMC) meeting, as well as the pace and duration of the semiconductor boom, should also be closely monitored to reassess the growth outlook for next year and beyond.

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting to decide the direction of monetary policy at the Bank of Korea in Jung-gu, Seoul, on the morning of the 23rd. Bank of Korea

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting to decide the direction of monetary policy at the Bank of Korea in Jung-gu, Seoul, on the morning of the 23rd. Bank of Korea

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.