Insurance Claims Without Paperwork via Silson24 App or Website

Check Participating Medical Institutions Through Naver Map, Kakao Map, and More

Financial Authorities Offer Incentives to Medical Institutions Participating in Silson24

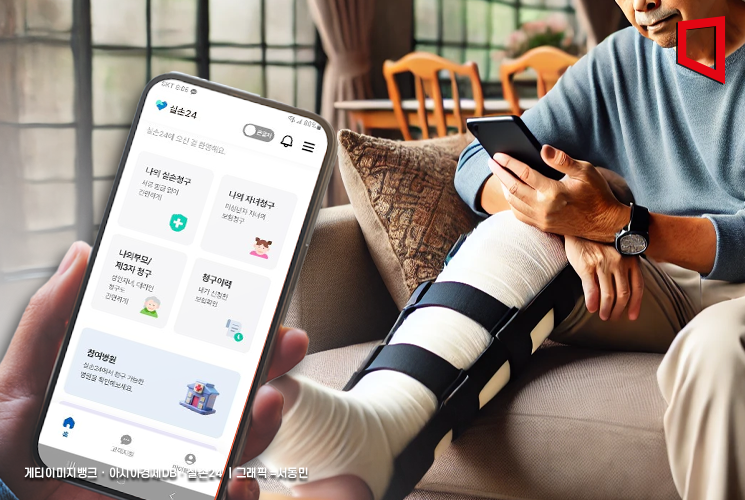

Starting on October 25, the digitalization of indemnity health insurance claims will be expanded beyond large hospitals and public health centers to include clinics and pharmacies. Through the Silson24 application (app) or website, users can now easily file indemnity insurance claims without visiting hospital counters or obtaining physical documents.

The Financial Services Commission announced on October 23 that it will implement the second phase of the digitalization of indemnity insurance claims from October 25. The first phase, launched on October 25 last year, was initially applied to medical institutions with 30 or more beds. With the second phase, the scope will be expanded to include clinics and pharmacies.

However, the Silson24 service is not yet available at all medical institutions nationwide. As of October 21, 10,920 medical institutions, including hospitals, clinics, and pharmacies, have been linked with Silson24, representing a linkage completion rate of 10.4%. The linkage rate for hospitals and public health centers in phase one is 54.8% (4,290 institutions), while the linkage rate for clinics and pharmacies in phase two is 6.9% (6,630 institutions). Before the full implementation of phase two, the financial authorities allowed clinics and pharmacies wishing to participate in Silson24 to join in advance. As the second phase becomes fully operational, the number of medical institutions participating in Silson24 is expected to increase further. After the Silson Digital System Operation Committee meeting on September 5, medical associations such as the Korean Pharmaceutical Association (12,000 pharmacies) and the Association of Korean Medicine (3,200 Korean medicine clinics) also announced their intention to participate in Silson24.

Anyone with an indemnity insurance policy can easily use the digitalization service by downloading the Silson24 app or accessing the website. Through Silson24, users can electronically transmit invoices, receipts, detailed statements of medical expenses, and prescriptions to their insurance companies.

To check whether a nearby medical institution participates in the Silson24 service, simply search for 'Silson24' on Naver Map or Kakao Map. You can also check using the 'Find Participating Hospitals' feature within the Silson24 service. If the medical institution you used is not yet linked with Silson24, you can request linkage through the 'Request Participation' feature.

Even digitally marginalized groups who are not familiar with using apps or websites can access the service. By utilizing the 'Third-Party Claim' feature, a third party, such as a child, can complete the insurance claim process on behalf of elderly parents. The 'My Child Claim' feature allows legal guardians to file insurance claims for minor children. Family relationships can be verified through linkage with the Ministry of the Interior and Safety's public MyData service, and users can easily connect to a dedicated call center for guidance on how to use the service.

The financial authorities plan to make the digital claims service easily accessible through popular online platforms such as Naver and Toss, which are widely used by the public. After system development, the Silson24 service will be available through these platform apps as early as November. Without installing the Silson24 app, users will be able to complete the entire process, from checking their insurance company to filing claims, within the platform. Consumers will also receive separate point cashback for claims filed through the platform. In the future, the service will be improved to allow a one-stop process from hospital reservation to insurance claim by linking with unique services provided by the platforms, such as hospital reservations.

The financial authorities are also considering various incentives to encourage more medical institutions to participate in the digitalization of indemnity claims. Medical institutions participating in Silson24 will receive benefits such as reduced credit guarantee fund fees and discounts on general insurance premiums. Indicating linkage with Silson24 on detailed pages of medical institutions on Naver Map or the Emergency Medical Portal is also expected to help improve the provision of medical services.

Plans are in place to strengthen collaboration with the Ministry of Health and Welfare as well. In the future, whether a medical institution is linked with Silson24 will be actively considered during the 'medical quality evaluation' of general hospitals. The Emergency Medical Portal will display the Silson24 linkage status of each medical institution to expand information for consumers and enhance their ability to choose medical institutions.

An official from the Financial Services Commission stated, "We will actively promote participation in Silson24 and ensure that activation measures are implemented without delay," adding, "We will also continue to monitor and address any inconveniences consumers encounter when using Silson24 to further improve user convenience."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)