- Regulatory Areas Are "Prime Locations" with Unceasing Housing Demand

- Redevelopment Projects Losing Momentum, Strengthening the "Supply Cliff"... Scarcity of New Builds Highlighted

While the government is rolling out a series of strong regulatory measures to stabilize the housing market, the market is instead witnessing a surge in contrarian investment strategies that view these regulations as an opportunity to "separate the wheat from the chaff."

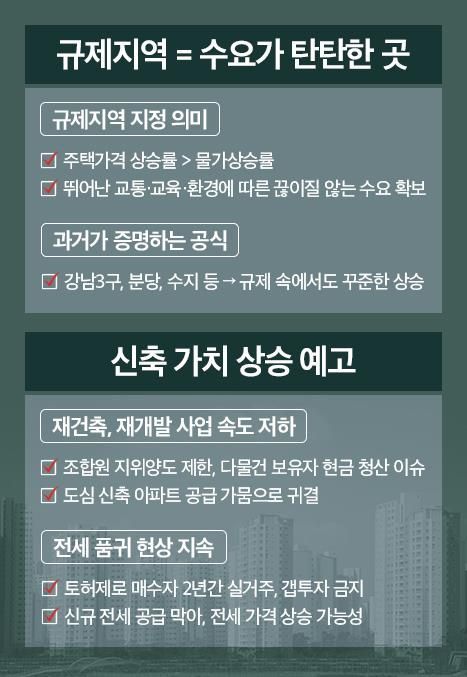

Experts say that the greater the market uncertainty, the more pronounced the trend will be toward concentrating on "one solid property" in a proven location. They analyze that the regulatory map is paradoxically becoming the "map of promising investments."

■ Regulation as a Guarantee... "Not Just Any Area Is Designated"

The government has clear criteria for designating certain areas as speculative overheated districts. These are areas where the rate of housing price increases is significantly higher than the inflation rate. This serves as evidence that the area is a "core location" with excellent residential conditions and consistently high housing demand.

A real estate expert stated, "The government's regulations are merely measures to curb short-term speculative demand and do not undermine the fundamental value of a region."

In fact, major areas such as Gangnam and Pangyo have consistently increased in value despite strict regulations, proving this principle over time. Other key areas in the Seoul metropolitan region-such as Bundang in Seongnam, Suji in Yongin, and Gwacheon-have shown similar trends, reinforcing the market perception that "regulation is a certification of value."

■ The Reality of a 'Supply Cliff'... New Apartment Prices Expected to Rise Further

The market's main concern is a mid-to-long-term drought in new housing supply. This is because the core of urban housing supply-reconstruction and redevelopment projects-now faces the risk of effectively coming to a halt due to the latest regulations.

For example, conflicts within associations are expected to intensify due to restrictions on the transfer of association member status and cash settlements for multi-property owners, leading to more cases of project cancellations or delays. This is especially anticipated to impact the supply of new apartments in Seoul and Bundang.

■ Supply Shrinks and Jeonse Prices Set to Surge, New Construction Sales Seen as the Best Option

There is also a high likelihood of a sharp rise in jeonse (long-term lease) prices. With the designation of land transaction approval zones, buyers are now required to live in the property for two years, and "gap investment" (buying with a tenant in place) is prohibited, effectively blocking new jeonse supply.

According to Jiptos, a real estate brokerage, after the June 27 measures, the number of new jeonse contracts in Seoul has dropped by more than 30% year-on-year, worsening the shortage of available properties.

■ New Brand Apartment Supply in Suji District Raises Expectations

Amid these trends, new apartment projects in Suji District, Yongin, are attracting increasing interest. As the area has been designated a speculative overheated district, market attention has intensified. The district is recognized as a traditional residential preference area, thanks to its excellent access to Pangyo and Gangnam via the Shinbundang Line, prestigious school districts, and robust amenities.

In fact, after the announcement of the regulations, GS Engineering & Construction's upcoming "Sujizai Edition," developed by Weebon, has seen a rise in inquiry calls. A local real estate official said, "With a severe supply drought in Bundang and Suji now all but certain, concrete consultations from genuine buyers who believe 'this may be the last chance' have actually increased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.