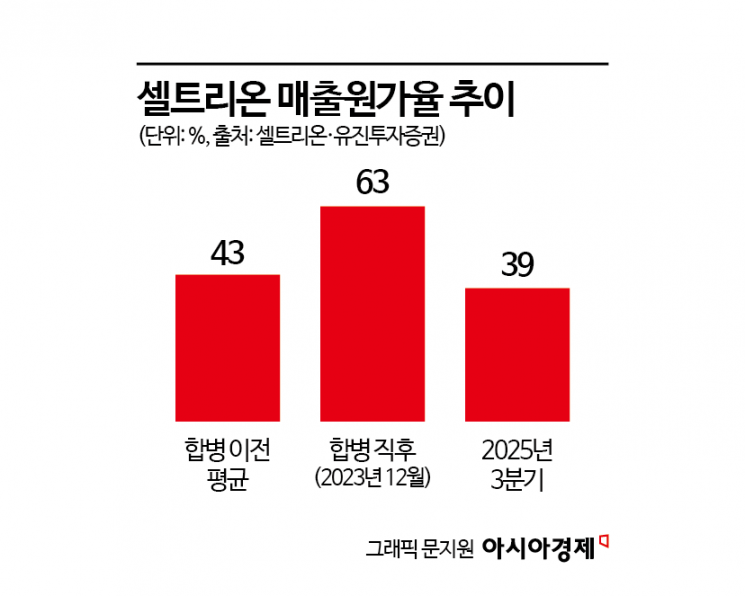

COGS Ratio Drops to 39% in Q3, Down 4 Percentage Points from Pre-Merger Levels

Lower COGS Ratio Drives Profitability Improvement and Plans for Additional Shareholder Returns

According to industry sources on October 22, Celltrion posted a COGS ratio of 39% in the third quarter of this year, down 9 percentage points from the same period last year. This figure is significantly lower than the average COGS ratio of 43% recorded from 2017, when the company moved to the KOSPI, up until the merger.

After the merger in 2023, Celltrion struggled with a high COGS ratio, mainly because Celltrion Healthcare’s average pre-merger COGS ratio was as high as 76%. However, as time passed after the merger, a significant portion of the high-cost inventory held by Celltrion Healthcare was depleted, resolving much of the issue.

The changes in these figures clearly illustrate this trend. At the end of 2023, when the merger took place, the COGS ratio stood at around 63%. By the second quarter of this year, it had dropped to about 43%. In the following third quarter, it fell by an additional 4 percentage points, successfully entering the 30% range. Celltrion plans to continuously lower its COGS ratio through improved production yield, expanded production at the third plant, and the completion of amortization for existing product development costs, aiming to bring the annual average COGS ratio down to the 20% range by 2027.

This improvement in cost structure is expected to lead to an increase in operating profit. Celltrion anticipates its COGS ratio in the fourth quarter will remain in the low 30% range, and expects its operating margin to approach the mid-40% range. The company intends to leverage this trend to enhance profitability and expand its market share. A low COGS ratio is one of the most significant competitive advantages in the biosimilar market.

With improved profitability and secured cash flow, further shareholder returns are also expected. At a meeting held last month, Celltrion Chairman Seo Jungjin stated regarding the cash flow generated from resolving high-cost inventory, "About one-third will be returned to shareholders, another third will be used for product development, and the remaining third will be retained or invested in facilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)