KOSPI Up About 60% Year-to-Date... Mounting Overheating Concerns

Most Say "Rise Driven by Industrial Restructuring and Earnings... Not a Bubble" vs. Some "AI Industry in Early Bubble Stage"

Bull Market Expected to Continue Into Next Year

The KOSPI continues its record-breaking rally. After surpassing the 3,500 mark for the first time ever at the beginning of this month, the KOSPI has continued its unstoppable upward momentum, crossing 3,600, 3,700, and even 3,800. As the KOSPI rises at such a rapid pace, concerns about a potential bubble are also mounting. However, experts agree that this situation is different from the dot-com bubble or the COVID-19 era, and they do not yet consider it a bubble. With improved corporate earnings and policy reforms, there are forecasts that the bullish market will continue into next year.

Is the KOSPI, Up About 60% Since the Start of the Year, a Bubble?

As the KOSPI repeatedly hits new all-time highs, there are growing voices expressing concerns about a bubble. Some point out that the current phenomenon, where buying surges simply because of anything related to artificial intelligence (AI), resembles the stock market during the dot-com bubble period (1999-2000). The KOSPI, which has risen nearly 60% since the beginning of the year, has already surpassed the 1998 growth rate (49.93%) and is rapidly closing in on the 1999 record (82.78%). Considering that the KOSPI plummeted by 50% in 2000, the year after the dot-com bubble burst, it is understandable that investors are cautious.

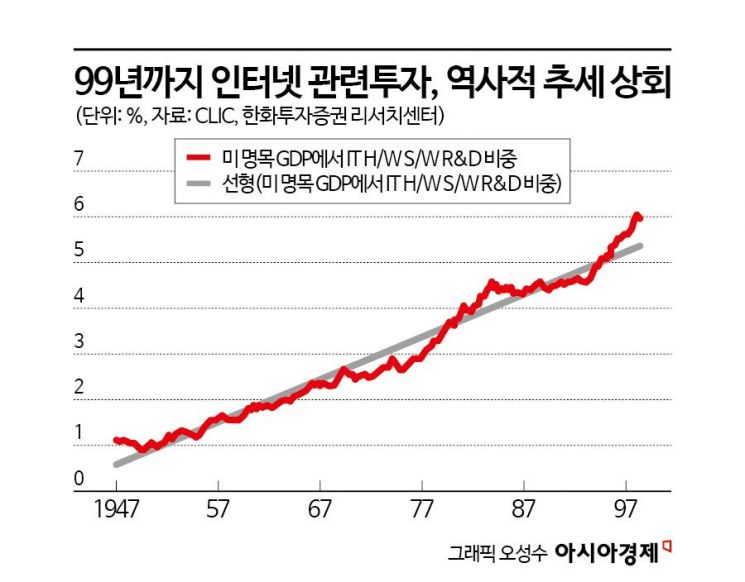

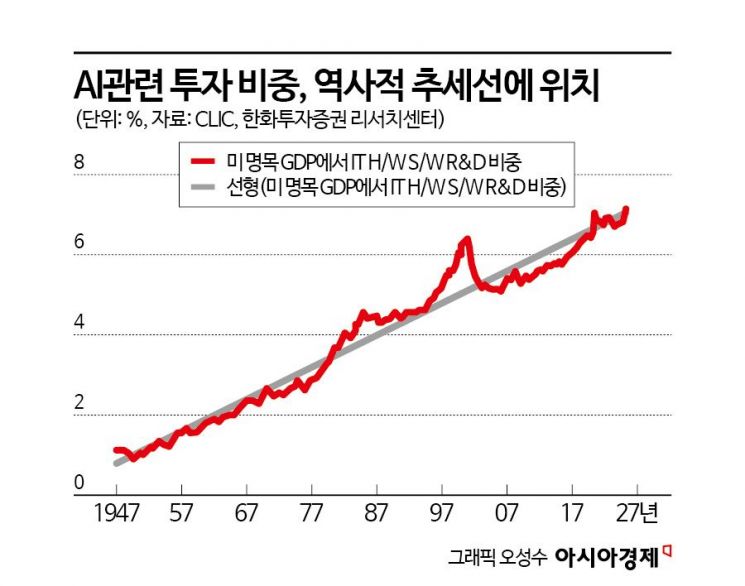

There are several factors fueling bubble concerns in the market. In the United States, where the AI bubble was discussed earlier than in Korea, the share of IT hardware, software, and research and development (R&D) in nominal GDP reached 7.16% in the second quarter of this year, surpassing the 6.25% recorded in the first quarter of 2000 at the peak of the dot-com bubble. As of October 10, the price-to-earnings ratio (PER) of the top 1,000 companies by market capitalization listed on the US stock market stood at 27.1 times, higher than the 26.2 times seen at the height of the bubble in late February 2000.

Market anxiety is also evident in quantitative indicators. The cyclically adjusted price-to-earnings ratio (CAPE), which compares the current price level to the average real (inflation-adjusted) earnings per share over the past 10 years, reached 40.21 as of October 21, marking the highest level since the dot-com bubble (44.19 in December 1999). This index, devised by Nobel laureate Robert Shiller of Yale University, indicates that the higher the value, the more overheated the market is compared to economic and corporate performance.

The so-called "Buffett Indicator" has also flashed a warning sign for overheating. This indicator, which divides the total market capitalization of a country's stock market by its nominal GDP, generally considers a ratio below 80% as undervalued, 80-100% as fair value, and over 100% as overvalued. At the peak of the dot-com bubble in 2000, the US Buffett Indicator soared to the 140% range; as of October 20 (local time), it surpassed 220%. In Korea, as of October 21, it reached an all-time high of 125%.

'Not a Bubble'... Rise Based on Industrial Restructuring and Earnings

Despite growing bubble concerns, stock market experts have assessed that the Korean stock market is not in a bubble. Yoon Changyong, head of the Research Center at Shinhan Investment & Securities, stated, "I do not see this as a bubble. Even if there is some short-term valuation pressure, the overall rise in stock prices is based on improved earnings and changes in industrial structure," and added, "Earnings improvement is clearly evident, and the overall market PER has not even reached 12 times, making it difficult to view the market as overheated. In particular, the upward revision of earnings estimates for key sectors such as semiconductors and secondary batteries indicates that the rise is based on fundamentals, distinguishing it from a simple liquidity-driven rally."

There are also opinions that the bubble is growing. Kim Dongwon, head of the Research Division at KB Securities, said, "I believe we are in a phase where the bubble is expanding," adding, "The S&P 500's valuation has reached its highest level since the dot-com bubble, the proportion of stocks in US household financial assets is at a record high, and the share of US stocks owned by foreigners is also at its highest since 1969."

Analysts note that the situations in the US and Korea are different. In the US, bubble concerns have been raised because excessively optimistic expectations about AI are reflected in technology stocks. However, for Korean semiconductor companies, the rise is based on actual downstream demand, making it difficult to view the market as a bubble. Lee Kyungmin, head of FICC Research at Daishin Securities, explained, "Although bubble concerns are being raised around US AI technology stocks, it is difficult to see the KOSPI and the semiconductor sector, which are driving the recent rally in the Korean market, as being in bubble territory." He continued, "The fundamental reason for AI bubble concerns in the US stock market is that investments by major AI-related companies may be excessive relative to potential demand, and that stock prices of technology and infrastructure companies leading the market to all-time highs are reflecting overly optimistic outlooks for the potential growth of the AI market. Currently, the S&P 500 technology sector's PER is 43 times, with a forward PER of 28 times, and Nvidia, which is leading the AI momentum, has a PER of 52 times and a forward PER of 28.3 times. These are stock prices that reflect somewhat high expectations, so there is a possibility that we are at the early stage of a bubble." He added, "In contrast, the stock prices of the semiconductor and infrastructure sectors driving the rise in the Korean market are based on the actual infrastructure investment targets of downstream companies, the government, and institutions, and are supported by realistic expectations for the AI service market. As evidence, actual infrastructure investments are being made, leading to supply shortages in semiconductors and electrical equipment, and rising prices in the DRAM market."

There are also views that, from a valuation perspective, it is difficult to see the market as a bubble. Yoo Jongwoo, head of the Research Division at Korea Investment & Securities, said, "From a valuation perspective, the market is more stable compared to the liquidity bubble in 2021," noting, "As of October 17, the KOSPI's 12-month forward PER is 11.3 times, whereas during the liquidity-driven rally following the COVID-19 outbreak in 2020, the KOSPI's 12-month forward PER rose as high as 14.6 times."

A Bull Market Different from Past Bubbles

Experts believe that the current market is different from the liquidity-driven rallies seen during the dot-com bubble or the COVID-19 era. Currently, the rally is supported by earnings, and there are no signs of risk typically seen in bubble phases, such as surges in theme stocks lacking fundamentals or excessive corporate investment.

Kim Yonggu, head of the Investment Strategy Team at Yuanta Securities, commented, "The S&P 500's 12-month forward PER is 23.0 times, close to the 24.5 times peak during the dot-com bubble in 2000, so it is clear that both domestic and global markets are in a situation where bubble debates could intensify based on stock prices and valuations." However, he added, "The current market leaders-AI and hyperscaler companies such as Microsoft, Meta, Amazon, Google, and Oracle-are all seeing continued increases in capital expenditures (Capex) and free cash flow. Unlike the dot-com bubble, there is no capital raising through stock issuance or borrowing. This means that the current AI supercycle is being driven by organic cash flow and profitability." He continued, "The AI data center Capex supercycle is likely to gain further momentum, especially when combined with government fiscal policies and preemptive monetary easing (interest rate cuts), and this will be reflected in further improvements in Korea's exports and corporate earnings through the semiconductor industry."

Lee Younggon, head of the Research Center at Toss Securities, stated, "The growth of the AI industry is accompanied by real investment and earnings support, unlike the dot-com bubble," and added, "Stock prices are not rising solely on expectations for future growth, but rather, a virtuous cycle is being created through actual profit generation and investment."

There is also analysis that this bull market is different from past bubbles because it is driven by changes in industrial structure. Yoon Changyong noted, "Whereas past bubbles were formed by expectations and liquidity, the current phase is characterized by growth driven by industrial restructuring and real investment expansion. The value chain is expanding from intermediate goods to finished goods and services, and global companies are clearly increasing capital expenditures and moving to secure technological standards. The existence of real growth momentum differentiates the current phase from the past." Cho Suhong, head of the Research Center at NH Investment & Securities, said, "This rally is not a forced rise due to liquidity, but rather, structural polarization is the fundamental driver of the market. Highly time-efficient and technology-intensive industries are generating excess returns, while traditional manufacturing and domestic industries are stagnating. In other words, this is a shift from a simple liquidity-driven rally to a productivity-driven rally."

The AI Industry: Early Stage of a Bubble...It Will Take Considerable Time to Burst

There are also predictions that the AI industry has entered the early stage of a bubble. Cho commented, "In terms of stock price growth rates, the AI industry is now entering the initial phase of a bubble, as AI-related stocks are responding more to news than to earnings, showing continuous increases without corrections." However, he also analyzed that, as related demand continues, it will take considerable time before the AI bubble bursts. Cho predicted, "As the shortage of AI hardware supply continues due to expanding AI demand, it will be quite some time before the AI bubble bursts."

Park Heechan, head of the Research Center at Mirae Asset Securities, stated, "Given that bubble theories regarding US AI investments are emerging, it will be especially important to monitor this trend next year."

The bullish phase of the stock market is expected to continue into next year. Yoo Jongwoo predicted, "The bull market will continue next year as well. Improvements in earnings and tax reforms will enhance the attractiveness of the stock market, accelerating the shift of funds from other assets to equities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.