Disputes Over Insurance Benefit Calculation and Payment at Non-Life Insurers Continue to Rise Each Year

Need for System Improvements, Including Designation of Management Items for Non-Covered Indemnity Health Insurance

The number of complaints filed with the Financial Supervisory Service against non-life insurance companies, which mainly sell long-term insurance products such as indemnity health insurance, did not decrease in the first half of this year. Since 2020, the number has increased every year, and the growth rate in the first half of this year was even higher than last year. As most complaints are related to the calculation and payment of insurance claims, there are calls for the financial and health authorities to promptly establish countermeasures, such as designating management items for the fifth-generation non-reimbursed indemnity insurance.

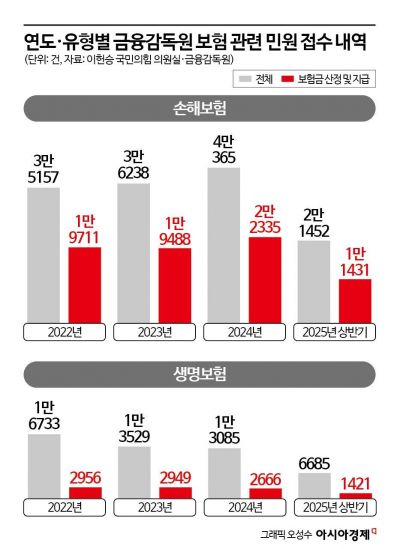

According to the data submitted by the Financial Supervisory Service to Assemblyman Lee Hunseung of the People Power Party, a member of the National Assembly’s Political Affairs Committee, the total number of complaints against non-life insurance companies was 32,124 in 2020, 32,200 in 2021, 35,157 in 2022, and 40,365 in 2023, showing a steady increase every year. In the first half of this year, the number reached 21,452, marking a sharper increase than last year. In contrast, the number of complaints against life insurance companies dropped sharply, from 21,170 in 2020, 18,401 in 2021, 16,733 in 2022, 13,529 in 2023, 13,085 last year, and 6,685 in the first half of this year. The trends in the two sectors diverged significantly.

The main reason for the difference in the increase and decrease of complaints between non-life and life insurance companies was disputes over the calculation and payment of insurance claims. Among the complaints against non-life insurers, those related to insurance claims steadily increased from 14,188 in 2020, 15,274 in 2021, 19,711 in 2022, 19,488 in 2023, 22,335 last year, and 11,431 in the first half of this year. The proportion of claim-related complaints among all complaints also rose from 44.2% in 2020 to 53.3% in the first half of this year.

On the other hand, claim-related complaints against life insurers decreased from 3,713 in 2020, 3,035 in 2021, 2,956 in 2022, 2,949 in 2023, 2,666 last year, and 1,421 in the first half of this year. The proportion of claim-related complaints among all complaints slightly increased from 17.5% in 2020 to 21.3% in the first half of this year.

The main reason for the sharp rise in insurance claim disputes at non-life insurers lies in the structural characteristics of their products. Insurance products are largely divided into "fixed benefit" types, which pay a predetermined amount, and "indemnity" types, which pay insurance claims in proportion to the actual loss incurred. Non-life insurers mainly sell long-term products, including indemnity insurance, and most of their products are designed to compensate for actual losses.

The insurance industry points to long-term insurance products, including indemnity insurance, as the main factor behind the surge in disputes over the past five years. In particular, there is growing concern about the problem of "non-reimbursed shopping." As the number of non-reimbursed items increases due to the relaxation of regulations on advanced regenerative medicine and new medical technologies, management and regulation of these items remain insufficient.

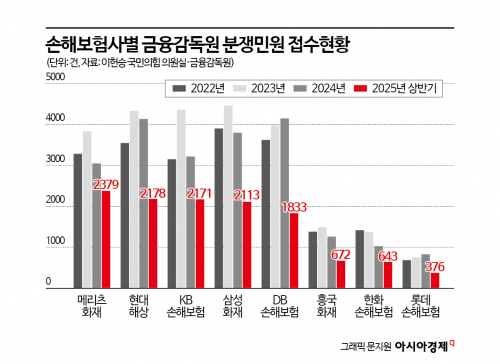

According to the status of dispute-related complaints received by each non-life insurer, submitted by the Financial Supervisory Service to Assemblyman Lee, the number of complaints at large companies that mainly sell long-term insurance products, including indemnity insurance, has increased significantly. Meritz Fire & Marine Insurance recorded 2,379 cases in the first half of this year and is expected to surpass last year’s total of 3,046. Hyundai Marine & Fire Insurance had 2,178 cases, KB Insurance had 2,171, and Samsung Fire & Marine Insurance had 2,113, all showing similar or slightly higher numbers compared to the previous year.

Due to issues related to organizational restructuring, the pace of executive appointments at the financial supervisory authorities has slowed, causing delays in the development of related regulations and systems. There is also a possibility that the launch of the "fifth-generation indemnity insurance" and the designation of management items, which the authorities had planned to introduce within this year, may be postponed to early next year. For example, the position of deputy governor of the Financial Supervisory Service, vacated by Kim Beomjun in July, has remained unfilled for three months.

A representative of the non-life insurance industry stated, "Automobile insurance is a mandatory policy that must be renewed every year, so the fluctuation in the number of claim disputes is not large. However, long-term insurance has shown a sharp annual increase in disputes as both the actual loss amounts and the number of contracts have risen. The financial authorities should actively establish related systems, such as designating management items for the fifth-generation indemnity insurance, to reduce disputes over insurance claim payments."

On the previous day at the National Assembly audit, Lee Chanjin, Governor of the Financial Supervisory Service, announced a strong response to non-reimbursed shopping and fraudulent insurance claims in indemnity insurance. In response to a question from Assemblyman Choo Kyungho of the People Power Party, he stated, "Indemnity insurance products contain a 'gray zone' where it is unclear whether an item is reimbursed or not, depending on the doctor’s judgment. This creates a structural problem that leads to consumer moral hazard. In consultation with the Financial Services Commission, we are pursuing insurance reform to convert the reimbursement system for the fifth-generation indemnity insurance to focus on essential and severe items."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)