Hanmi Pharmaceutical and Daewoong Pharmaceutical Expected to Grow in Both Sales and Operating Profit

Yuhan Corporation and GC Green Cross See Solid Sales but Declining Profitability

As the third-quarter earnings announcements for major domestic traditional pharmaceutical companies approach, it appears that their profitability will vary significantly by company. While some companies are expected to continue their growth trajectory thanks to strong performance from key subsidiaries and flagship products, others are likely to experience a temporary decline in profits due to factors such as the reversal of milestone (technology fee) effects and pressure from higher cost ratios.

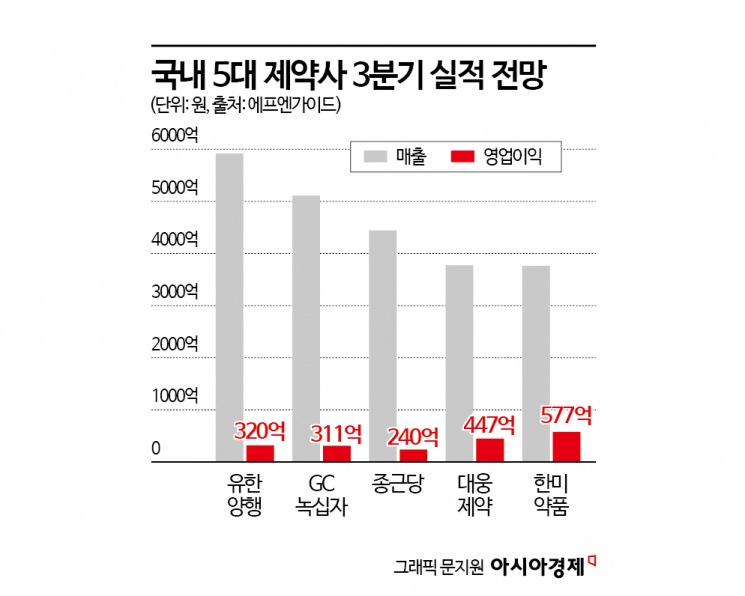

According to the third-quarter earnings consensus (average securities firm forecast) from financial information provider FnGuide as of October 21, sales for leading traditional pharmaceutical companies such as Yuhan Corporation, GC Green Cross, Hanmi Pharmaceutical, Daewoong Pharmaceutical, and Chong Kun Dang are generally expected to rise, but their operating profit margins are predicted to show mixed results.

Both Hanmi Pharmaceutical and Daewoong Pharmaceutical are expected to see growth in both sales and operating profit in the third quarter. The recovery of subsidiary performance and the growth of flagship products have driven these strong results. Hanmi Pharmaceutical's third-quarter sales consensus stands at 376.2 billion won, with operating profit at 57.7 billion won, representing year-on-year increases of 3.89% and 13.14%, respectively. The main driver of growth is the recovery of Beijing Hanmi Pharmaceutical's performance. After experiencing negative growth from the third quarter of last year, Beijing Hanmi Pharmaceutical is expected to post sales of 91.8 billion won and operating profit of 17 billion won in the third quarter of this year, up 8.9% and 13.3% year-on-year, respectively. In addition, the imminent announcement of clinical results for new drugs in the obesity and MASH (metabolic dysfunction-associated steatohepatitis) treatment pipeline is expected to positively impact the evaluation of Hanmi Pharmaceutical's research and development value.

Daewoong Pharmaceutical's third-quarter earnings consensus forecasts sales of 377.4 billion won, up 5.27%, and operating profit of 44.7 billion won, up 19.84%. Despite the reversal effect following record-high sales of its flagship botulinum toxin product Nabota in the second quarter, robust growth is expected to continue thanks to expanded exports to countries such as Brazil. The reversal effect refers to a phenomenon where, if the reference period's figures are very high, even a slight improvement in subsequent performance can appear as a decrease in actual results.

In particular, the prescription drug (ETC) division's liver function improvement product Ursodeoxycholic Acid (Ursosa) is benefiting from the growth of the obesity treatment market. With a recent surge in patients receiving GLP-1 (glucagon-like peptide-1) class obesity treatments, prescriptions for Ursosa are reportedly increasing as a preventive option for gallstones resulting from rapid weight loss.

On the other hand, Yuhan Corporation and GC Green Cross are expected to see their profitability stall due to the reversal of milestone effects and pressure from higher cost ratios, respectively. Yuhan Corporation is projected to post third-quarter sales of 591.6 billion won and operating profit of 32 billion won, down 1.2% and 32.77% year-on-year, respectively. This is attributed to the absence of milestone payments from Johnson & Johnson, the partner for Yuhan's lung cancer drug Leclaza (ingredient: lazertinib), resulting in a reversal effect. Yuhan Corporation received a milestone payment for Leclaza's FDA approval in the United States in the third quarter of last year, and for approval in Japan in the second quarter of this year, which led to high profits. However, since there are no such one-off milestone payments in the third quarter, operating profit is expected to temporarily decrease.

GC Green Cross's third-quarter sales consensus is 510.8 billion won, up 9.87% year-on-year. However, operating profit during the same period is expected to fall 21.46% to 31.1 billion won. The main reason for the decline in profitability is pressure from rising cost ratios. As sales estimates for key profit-improving products such as influenza vaccines and Hunterase have slightly decreased, the proportion of low-margin product sales is expected to rise, resulting in an overall increase in the cost ratio. In addition, proactive investments aimed at improving profits are expected to increase non-operating expenses in the third quarter.

Chong Kun Dang has also seen sales growth, but continues to face profitability challenges. According to Eugene Investment & Securities, Chong Kun Dang's third-quarter sales are expected to reach 444 billion won, up about 7.5% year-on-year, but operating profit is projected to decrease by 7.7% to 24 billion won during the same period.

Jung Yuntaek, head of the Pharmaceutical Industry Strategy Research Institute, stated, "Concerns remain about U.S. tariffs on pharmaceuticals, but global demand for pharmaceuticals continues to grow steadily due to worldwide aging trends. The significant quarterly fluctuations in performance due to milestone receipts from technology exports are not so much an issue for individual companies, but rather a characteristic of the pharmaceutical and biotech industry as a whole."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.