Top 10 Didim Funds Record 16.5% Average Annual Return

The Korea Financial Investment Association stated on October 20 that the Didim Fund, which was jointly launched by 25 asset management companies on September 25 last year, has expanded investment options for pension investors over the past year through a variety of asset allocation strategies.

The Didim Fund is a product designed to support long-term pension investments by the public and lower entry barriers to the capital market by utilizing asset allocation strategies similar to those used by pension funds. To make complex asset allocation investments more accessible to the general public, 25 asset management companies each launched a flagship product that consolidates their respective asset allocation expertise.

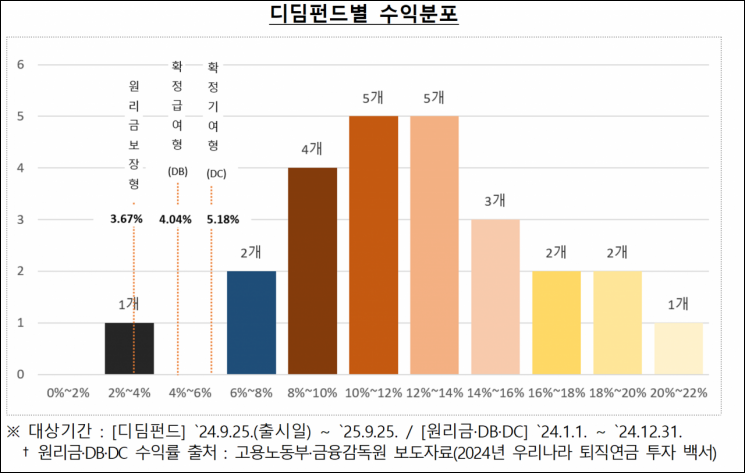

During the first year since the launch of the Didim Fund, the average return of the top 10 funds was 16.5%, while the overall average return was 12.5%. Over the same period, the KOSPI index fell by 8.8% before rebounding by 31.9%. The S&P 500, a leading US index, fluctuated within a range of -2.9% to 15.8%. While these major indices showed high volatility, the Didim Fund maintained relatively low volatility and delivered stable returns. This performance is attributed to the risk diversification effect, which is a key advantage of asset allocation.

The fund size (initial principal) has grown to 227.2 billion won. Additional capital inflows are expected toward the end of the year due to increased demand for tax deductions. In terms of capital sources, while the fund initially focused on individual DC and IRP accounts, corporate funds are now being actively invested. Approximately 28 billion won has been invested this year. The asset allocation structure and performance of the Didim Fund are seen as well-suited to the asset management needs of corporations.

As of this year, the sales share by sector is led by securities companies at 77%, followed by banks at 15%, insurance companies at 6%, and others at 2%. Compared to last year, the share of banks (from 7% to 15%) and insurance companies (from 3% to 6%) has increased, indicating a diversification of sales channels.

In May of this year, the Didim Fund was included as a default option for the first time, and as its track record builds, additional inclusion is expected, especially for high-performing funds. As a result, both investment accessibility and sales volume are anticipated to increase.

The Didim Fund limits stock allocation to 50%, allowing for full investment through retirement pension accounts. Subscribers can allocate all or part of their reserves according to their investment preferences. Aggressive investors may also consider supplementing their asset allocation by investing the remaining 30%-outside the 70% limit for performance-based products-into the Didim Fund.

Lee Hwantae, Head of the Industrial Market Division at the Korea Financial Investment Association, stated, "It is significant that we have provided asset allocation-based pension investment options based on the achievements of the past year." He added, "Going forward, we will further expand the base of asset allocation pension investments among the public through support for default option inclusion, diversification of sales channels, and active promotion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)