Government's Tightening of Household Lending to Curb Housing Prices

Disrupts Mortgage Loan Business for KakaoBank and K Bank

Asset Quality Concerns for Loans to Small and Medium-Sized Business Owners

Turning to Secured Loans for Sole Proprietors

The government has once again tightened household loans with the October 15 real estate measures, leading internet banks to face increasing concerns. Due to the ongoing regulatory tightening, it has become more difficult for these banks to aggressively promote their previously strong mortgage loan products, and as a result, third-quarter earnings are also expected to slow down.

Household Loan Tightening Leads to Sluggish Performance

According to financial information provider FnGuide on October 20, KakaoBank's net profit for the third quarter is projected to be 121.1 billion won, a 2.5% decrease compared to the same period last year. KakaoBank had previously recorded steady quarterly growth, including a 5.1% year-on-year increase in net profit to 126.3 billion won in the second quarter of this year.

KB Securities noted that KakaoBank has not been able to sufficiently offset the decline in net interest income caused by a drop in net interest margin (NIM) with an increase in non-interest income, and that the loan-to-deposit ratio is expected to continue to decline, presenting this analysis. DB Securities also forecasted a 7.3% year-on-year decrease in net profit, projecting 115.2 billion won for the third quarter.

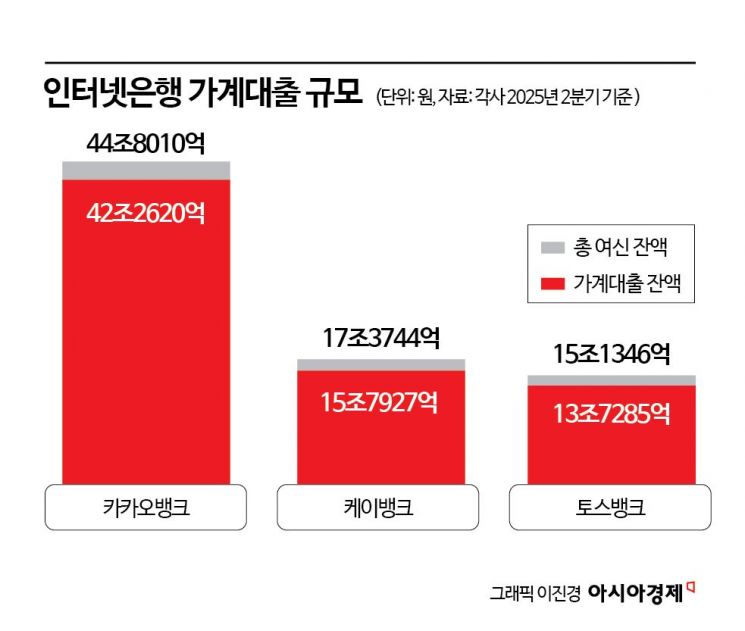

For internet banks, household loans account for over 90% of their total loan portfolios. As of the second quarter, KakaoBank's outstanding household loans stood at 42.262 trillion won, making up 94% of its total loans. K Bank is in a similar situation, with household loans amounting to 15.7927 trillion won, about 91% of its total loans. Toss Bank, which has yet to launch mortgage loans, also reported household loan balances of 13.7285 trillion won, accounting for approximately 91% of its total loans.

Because of this, continued government regulation will inevitably disrupt the business operations of internet banks. In the June 27 measures, the government capped mortgage loans at 600 million won and halved the annual household loan growth target, imposing comprehensive restrictions on household lending. Under the latest October 15 real estate measures, the previous 600 million won mortgage loan cap was further reduced: for homes valued at over 1.5 billion won up to 2.5 billion won, the cap is now 400 million won, and for homes over 2.5 billion won, the cap is 200 million won.

In fact, a representative from one internet bank stated, "We are generating revenue from non-interest segments, but it is not enough to offset the decline in household loan income," adding, "Since we cannot increase loans in proportion to deposit growth, we are compensating through returns from investing in stable assets and commissions from introducing investment products."

Turning to Relatively Safe Secured Loans for Sole Proprietors

With the government's continued tightening of household loans, internet banks are seeking new opportunities through business loans. However, due to the non-face-to-face nature of internet banks, it is not easy for them to grow business loans compared to traditional banks. Furthermore, as their customer base consists mainly of small and medium-sized business owners, maintaining asset quality remains a challenge. As a result, they have recently turned to secured loans for sole proprietors as a new avenue.

KakaoBank plans to launch secured loans for sole proprietors in the fourth quarter to expand its market. This product provides funding using real estate collateral owned by sole proprietors with a business registration certificate. The entire process, from application to post-management, is conducted non-face-to-face. Loans secured by real estate are generally classified as "safe loans." However, loans to small businesses or sole proprietors can directly impact a bank's asset quality, as delinquency rates tend to rise during economic downturns.

K Bank is also aggressively expanding its loans to sole proprietors. The number of sole proprietor customers increased from 1 million at the end of 2023 to 2 million last month, doubling in size. K Bank is already operating its "Boss Real Estate Secured Loan" product, which features one of the industry's lowest interest rates (annual 3.2%) and emphasizes non-face-to-face convenience as a competitive advantage, continuing its aggressive marketing strategy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.