Samsung Asset Management has become the first company in the domestic exchange-traded fund (ETF) industry to surpass 100 trillion won in net assets.

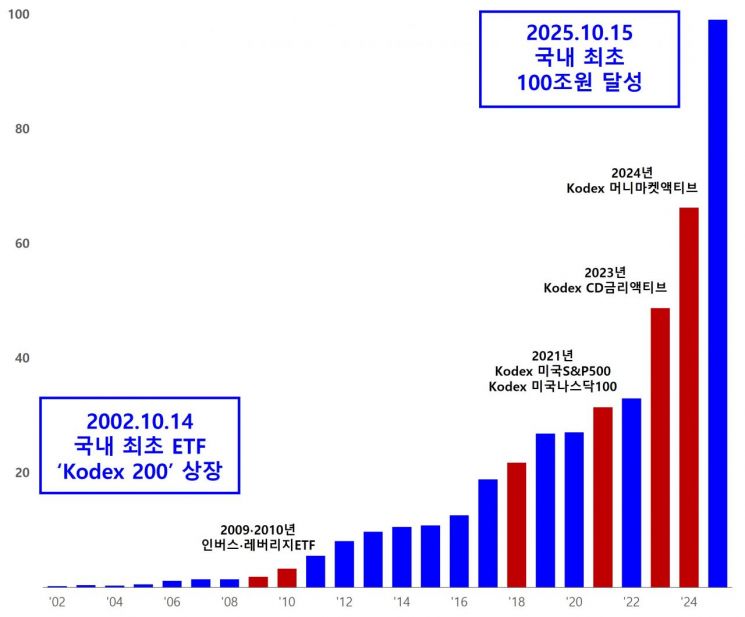

On October 16, Samsung Asset Management announced that the total net assets of its KODEX ETFs reached 100.5071 trillion won. This milestone comes 23 years after the launch of KODEX 200, South Korea’s first ETF, on October 14, 2002.

Net assets increased by 51.7% in just over nine months, rising from 66.2508 trillion won at the end of last year. After surpassing 90 trillion won in net assets on September 11, the figure grew by more than 10 trillion won in just over a month. This rapid growth was driven by the balanced expansion of various products, encompassing a wide range of assets and themes, rather than being concentrated in a specific product type.

Park Myungje, Head of the ETF Business Division at Samsung Asset Management, stated, "The fact that KODEX ETFs have achieved 100 trillion won in net assets for the first time in the domestic industry is thanks to the trust and support of our clients." He added, "Going forward, KODEX ETFs will become even more customer-oriented, and we will strive to protect financial consumers."

As the leading company in the domestic ETF industry, Samsung Asset Management has enabled investors to easily access a variety of assets, themes, and strategies through KODEX ETFs. The company has played a key role in helping clients grow their assets stably and in establishing a sound investment culture. Through the trust of its clients, Samsung Asset Management has maintained its top position in the industry for 23 years, culminating in the achievement of 100 trillion won in net assets.

Since listing KODEX 200, which tracks the KOSPI 200 Index, in 2002, Samsung Asset Management has been at the forefront of the domestic ETF market. In 2006, the net assets of KODEX ETFs surpassed 1 trillion won, and in the same year, the company launched Korea’s first thematic ETF (KODEX Semiconductor). In 2007, it introduced Korea’s first overseas investment ETF (KODEX China H), and in 2009, the first bond-type ETF (KODEX Treasury Bond 3-Year), thereby providing investors with a wide range of investment opportunities and expanding the ETF market base.

In 2009 and 2010, Samsung Asset Management became the first in Asia to list inverse and leveraged ETFs, establishing itself as a leading ETF manager not only in Korea but also across Asia.

In 2020, the company added equity-type active ETFs and domestic and international thematic ETFs. After surpassing 30 trillion won in net assets in 2021, it exceeded 40 trillion won in 2023. Last year, it became the first in the industry to surpass 60 trillion won in net assets and to manage more than 200 ETF products. This year, benefiting from the rapid growth of the ETF market, Samsung Asset Management became the first in the domestic ETF industry to reach 100 trillion won in ETF net assets (across 222 ETFs), opening a new chapter in the Korean ETF market.

To mark the start of the 'KODEX ETF 100 Trillion Won Era,' Samsung Asset Management will strengthen its commitment to 'customer-centric management' in response to client trust. The company emphasized its intention to develop products and services from the customer’s perspective and to make tangible contributions to clients’ asset growth. As a leading company in the asset management industry, Samsung Asset Management also pledged to take the initiative in protecting financial consumers, which has become increasingly important recently.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)