The Market Eyes November After Assuming an October Freeze

"The Key Is the Effectiveness of Additional Measures"

Heightened Housing Market Sensitivity Ahead of Local Elections

"A Rate Cut in the First Half of Next Year Will Not Be Easy"

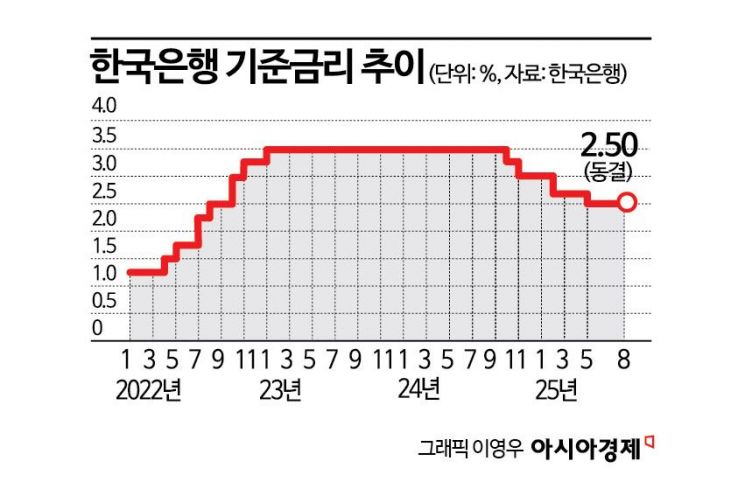

As volatility in the housing market has persisted even after the Chuseok holiday, the market, which had already factored in a rate freeze for October, is now turning its attention to November. For a rate cut to take place at the end of next month, when the final Monetary Policy Board meeting of the year will be held, experts say the effectiveness of this week’s housing market stabilization measures must be confirmed within the remaining month and a half.

Market assumes October rate freeze, eyes November... "Key is effectiveness of additional measures"

According to the financial investment industry on the 15th, the market is operating on the assumption of an October rate freeze and is now watching the next developments. The focus has shifted to whether there will be a rate cut in November and the final rate level within the rate-cutting cycle that may extend into next year.

Morgan Stanley has projected that the Bank of Korea will pause rate cuts in October (with one dissenting vote), but will resume them in November. This outlook is based on the recent renewed increase in Seoul housing prices, as well as the fact that even Shin Sung-hwan, a Monetary Policy Board member known as a representative dove (favoring monetary easing), has recently taken a more cautious stance. On September 25, Shin emphasized in his message as the presiding member for the financial stability review that “expectations for rising housing prices in the Seoul metropolitan area remain, so it is necessary to respond through close policy coordination with the government.”

Kathleen Oh, Chief Economist at Morgan Stanley, stated, “The Bank of Korea is likely to wait another month to observe the effects of real estate market measures,” but added, “The rate-cutting cycle has not been halted, only delayed. If the growth of household debt slows and the new housing market policies prove effective, a rate cut will be implemented in November.”

Korea Investment & Securities predicted that a unanimous rate freeze would be decided this month. Choi Jiuk, a researcher at Korea Investment & Securities, said, “If the weekly increase in Seoul apartment prices could be kept below 0.1%, a rate cut in October would have been possible, but the situation is unfolding differently.” He pointed out, “After the June 27 measures, prices in the Han River belt areas-Songpa, Mapo, Seongdong, and Gwangjin districts-had slowed, but from the third week of September, they began to rebound, and the overall increase in apartment prices in Seoul and the metropolitan area is now accelerating.”

Uncertainty in the foreign exchange market is also a factor that could delay a rate cut by the Bank of Korea. Choi noted, “With recent increases in exchange rate volatility and the rise of the won-dollar exchange rate being mentioned in the statement under the finance and foreign exchange market section, it is expected to be newly included as a consideration for future monetary policy.” He also predicted, “The number of forward guidance members (those signaling a rate cut within three months) will decrease slightly from five in August to three to five in October.”

Lee Chang-yong, Governor of the Bank of Korea, is holding a press briefing after the monetary policy direction decision meeting at the Bank of Korea in Jung-gu, Seoul on August 28. Photo by Yonhap News

Lee Chang-yong, Governor of the Bank of Korea, is holding a press briefing after the monetary policy direction decision meeting at the Bank of Korea in Jung-gu, Seoul on August 28. Photo by Yonhap News

Heightened housing market sensitivity ahead of local elections... "A rate cut in the first half of next year will be difficult"

The key issue is how the market responds to the government’s additional real estate measures this week. If the market remains overheated despite these additional measures, experts believe not only will the final rate for this year remain at the current 2.50% per annum, but it will also be difficult to guarantee a rate cut next year. Lee Changyong, Governor of the Bank of Korea, previously stated that the rate-cutting cycle could continue into the first half of next year, but emphasized that rate cuts should not stoke expectations in the real estate market.

In this context, Economist Oh predicted that further rate cuts next year would be difficult after a cut in November. She said, "The outlook for additional rate cuts next year is uncertain,” adding, "With sensitivity to the housing market heightened ahead of local elections, it will also be heavily influenced by general environmental uncertainties.”

Researcher Choi predicted that the 2.50% rate would be maintained until the first half of next year, with a 0.25 percentage point cut coming in July. He explained, "Given the low demand pressure and Governor Lee’s comments about maintaining the rate-cutting cycle, an additional cut is still expected, but in terms of financial stability, the timing is likely to be pushed to July next year.” The forecast is that a rate cut will be implemented after conditions for a cut are established in the second or third quarter of next year, considering financial stability, growth, and inflation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)