Nongshim Plunges 25% From Peak After K-Pop Demon Hunters Boost

"At the Start of an Overseas Momentum Expansion Cycle" ? Optimistic Outlook

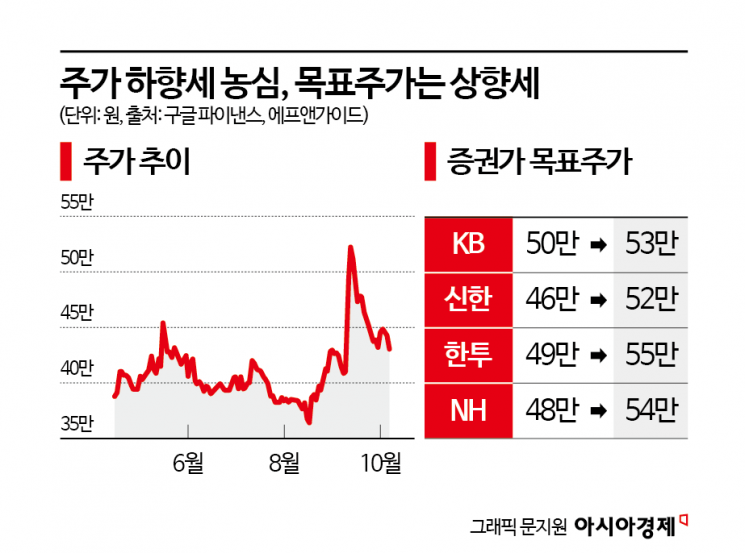

While Nongshim's stock price, which had previously surged thanks to the "K-Pop Demon Hunters" (K-Pop Demon Hunters) collaboration, is now sharply declining, securities firms are raising their target prices, drawing attention to the underlying reasons.

According to the Korea Exchange on October 15, Nongshim closed at 429,000 won the previous day, down 3.05%. After news broke last month of a product collaboration with the globally popular animation K-Pop Demon Hunters, Nongshim hit a 52-week high of 579,000 won on September 12, but the stock price has since been on a steady decline. As of the closing price, the stock has plunged 25% from its previous peak.

Investors are increasingly concerned as Nongshim, once dubbed the "second Myeonvidia" (ramyeon + Nvidia), has given up all its gains without any particular negative news. This is especially notable given that the KOSPI continues to hit record highs and K-Pop Demon Hunters has surpassed 300 million cumulative views, setting a new all-time record for Netflix viewership. Despite this positive environment, Nongshim's stock has failed to ride the momentum, leaving shareholders feeling relatively deprived.

No clear buying force has emerged to support the stock. Individual investors, who bought 147 billion won worth of Nongshim shares last month, have turned to net selling this month. Foreign investors, who sold 78.1 billion won last month, have continued their selling trend with an additional 2.8 billion won in net sales this month. Trading volume, which exceeded 1.18 million shares on September 12, has plummeted by about 96% to around 45,000 shares as of October 13, while the short selling ratio has soared to 9.94%.

However, optimism prevails among securities analysts, who forecast a rebound in Nongshim's stock price. After a sluggish first half, Nongshim is expected to enter a full-fledged recovery in the second half of the year, driven by increased overseas sales. Since the start of this month, four securities firms-KB Securities, Shinhan Investment, Korea Investment & Securities, and NH Investment & Securities-have all raised their target prices for Nongshim.

Cho Sanghoon, a researcher at Shinhan Investment, noted, "Starting in October, Nongshim is expanding its brand lineup by securing main shelf placements at Walmart in the United States (a fivefold increase compared to before) and by adding new production lines at its second plant. The establishment of a European sales subsidiary in March this year is also expected to open up new markets." He raised the target price from 460,000 won to 520,000 won.

Nongshim's consolidated sales for the third quarter of this year are estimated at 872.3 billion won (up 2.6% year-on-year), with operating profit at 46.5 billion won (up 23.5%), slightly exceeding market expectations. This is attributed to robust growth in snack sales due to improved domestic consumer sentiment and the impact of price hikes for key products in the United States. Additionally, the 50 billion won worth of K-Pop Demon Hunters marketing collaboration products, to be sold through the first quarter of next year, are expected to boost Nongshim's fourth-quarter results.

There are also expectations that Nongshim's localization strategy is beginning to bear fruit. Kang Eunji, a researcher at Korea Investment & Securities, commented, "To lower entry barriers for new consumers, Nongshim first launched Tom Yum Kung-flavored Shin Ramyeon, and in the fourth quarter of last year, released Shin Ramyeon Tumba, marking the start of its localization strategy. Now is the time to focus on the performance improvement momentum that will be driven by the K-Pop Demon Hunters collaboration and the localization strategy." She raised her target price from 490,000 won to 550,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)