Plan to Raise 19.5 Billion Won Through Rights Offering

200 Billion Won CB Issued Last Year, Early Redemption Period Begins Next May

Current Share Price at 1,300 Won, Below Conversion Price of 2,640 Won

Yuil Enertech, a secondary battery manufacturing equipment company, has initiated a rights offering to secure funds for repaying the convertible bonds (CB) issued in May last year. The company's stock price has dropped significantly since the CB issuance, now trading below the conversion price. The Yuil Enertech board has determined that CB investors are likely to exercise their early redemption rights instead of converting, and has proactively set up a plan to secure repayment funds.

According to the Financial Supervisory Service's electronic disclosure system on October 15, Yuil Enertech will issue 18.8 million new shares to raise 19.5 billion won. The planned issue price for the new shares is 1,039 won, with 0.551 new shares allocated for each existing share held.

Of the funds raised, Yuil Enertech will use 15 billion won to repay debt. Previously, on May 16 last year, the company issued CBs worth 20 billion won. At the time of issuance, the conversion price was set at 3,771 won, but was later lowered to 2,640 won due to the declining stock price. Although investors have been able to exercise their conversion rights since May 17 this year, no one has opted to convert into common shares as the stock price remains below the conversion price. The funds raised through the CB issuance were used to pay for raw materials and to repay debt.

Yuil Enertech is preparing a repayment plan, considering that early redemption rights can be exercised starting from May 17 next year. The company has sold its factory in Osan, Gyeonggi Province, for 5.2 billion won. To secure the remaining approximately 15 billion won, it is pursuing a rights offering.

If there are unsubscribed shares after the rights offering to existing shareholders, the company will recruit investors through a public offering. If there are still remaining shares after the public offering, LS Securities, BNK Investment & Securities, and Hanyang Securities will underwrite them. The more shares underwritten by the syndicate, the more the total fundraising amount may be reduced by the forfeited share fee.

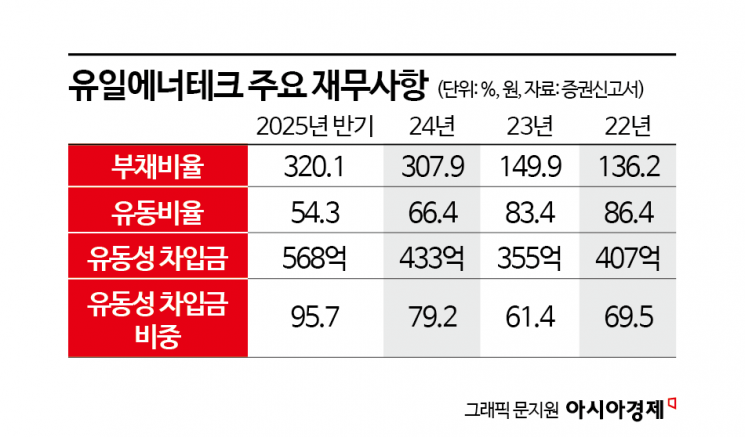

Existing shareholders who are allocated new shares are expected to consider not only the difference between the current share price and the issue price, but also whether the company’s profitability is improving when deciding whether to participate in the offering. As of the first half of this year, Yuil Enertech’s debt ratio stands at 320.1%. Total borrowings increased by approximately 4.6 billion won compared to the end of last year, reaching 59.4 billion won.

In the first half of this year, the company recorded sales of 26.2 billion won and an operating loss of 2.4 billion won. Operating losses have continued since 2022. As of the end of the first half, total equity had decreased to 36.5 billion won. The external auditor stated in the review report for the first half of this year that there is significant uncertainty regarding the company’s ability to continue as a going concern.

A representative from the lead manager for the rights offering stated, "Yuil Enertech has officially entered the hydrogen fuel cell equipment market as a new business." He added, "By supplying mass-production equipment for catalyst coating materials for power generation hydrogen fuel cells to Doosan Fuel Cell, the company has entered the hydrogen fuel cell market." He continued, "If the company receives follow-up orders, it is expected to mitigate the sales volatility based on secondary battery orders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)