Scott Besant, U.S. Treasury Secretary, Interview with the Financial Times

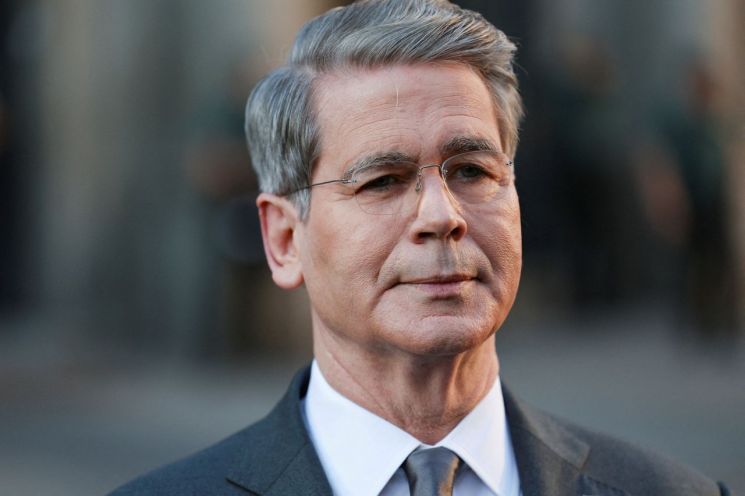

Scott Besant, U.S. Treasury Secretary, held a press conference in Madrid, Spain, on the 15th of last month (local time). Photo by Reuters Yonhap News

Scott Besant, U.S. Treasury Secretary, held a press conference in Madrid, Spain, on the 15th of last month (local time). Photo by Reuters Yonhap News

Scott Besant, U.S. Treasury Secretary, on the 13th (local time), criticized China for damaging global supply chains and threatening the world economy through comprehensive export sanctions on rare earth elements and critical minerals.

Secretary Besant told the Financial Times (FT) that these sanctions come just three weeks before a meeting between U.S. President Donald Trump and Chinese President Xi Jinping, adding, "This reflects problems within the Chinese economy itself." He continued, "This is a signal of how weak the Chinese economy is," and added, "They are trying to drag everyone else down with them."

Secretary Besant also remarked, "Perhaps there is a Leninist business model that believes harming your customers is a good thing," but he pointed out, "However, as the world's largest supplier, if they attempt to slow down the global economy, they will be the ones who suffer the most."

He further stated, "They are in the midst of a recession and stagnation, and are trying to get out of it through exports," adding, "The problem is that such actions are actually worsening their international standing."

Previously, after halting imports of U.S. soybeans, China announced on the 9th that it would strengthen export controls on rare earth alloys. On the 14th, China announced it would impose a "special port service fee" of 400 yuan (approximately 80,000 won) per net ton on U.S.-related vessels.

In response, President Trump announced retaliatory measures, stating that starting November 1, an additional 100% tariff would be imposed on imports from China. The United States also began imposing a port entry fee of $50 (about 70,000 won) per net ton on Chinese vessels, with plans to gradually increase this to $140 per ton by 2028.

An individual familiar with U.S.-China relations told the FT that the U.S. has already prepared a draft of countermeasures should the two sides fail to reach an agreement. He stated, "This issue will be addressed first at the G7 finance ministers' meeting during the World Bank and International Monetary Fund (IMF) meetings in Washington this week."

Two other sources revealed that the United States is considering making export licensing mandatory for companies exporting software to China. This is expected to have a dramatic impact across Chinese industries.

Meanwhile, it had been highly anticipated that the U.S. and Chinese leaders would hold a summit during the Asia-Pacific Economic Cooperation (APEC) meeting in Gyeongju, South Korea, at the end of October. However, with both sides recently escalating tough trade pressure against each other, uncertainty has increased.

Nevertheless, the South China Morning Post (SCMP) reported that due to the unprecedentedly tough response from Chinese authorities, the U.S. offensive has somewhat subsided, creating public sentiment in favor of a summit between President Donald Trump and President Xi Jinping.

Wu Xinbo, director of the Center for American Studies at Fudan University in Shanghai, analyzed, "If the next round of U.S.-China trade negotiations proceeds smoothly, there is a high possibility that a summit between President Xi and President Trump will take place." He added, "Given Beijing's recent pressure tactics against the U.S., the Trump administration has become more aware that the cards China holds can inflict real damage on the U.S., making a more pragmatic approach increasingly likely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.