Shipbuilding, Shipping, and Automotive Sectors Expect Improved Profitability

Petrochemical and Steel Industries Face Raw Material Cost Pressures

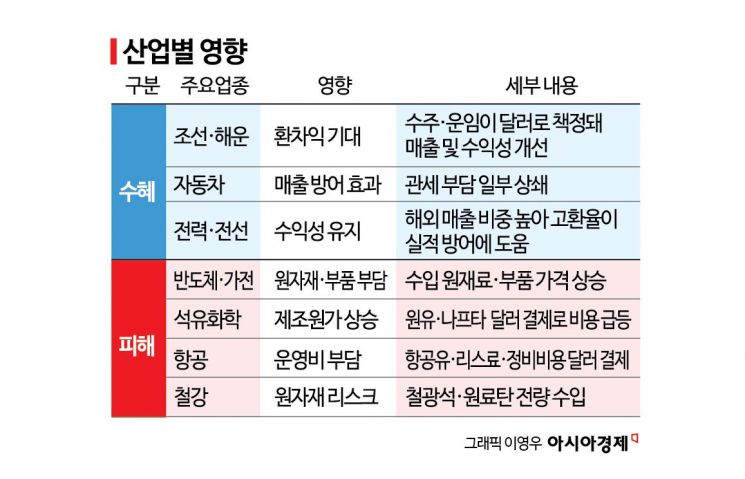

As the won-dollar exchange rate remains fixed in the 1,400 won range and becomes the 'new normal,' different industries are experiencing mixed fortunes. Industry insiders are increasingly concerned that, as seen during the 2008 financial crisis and the tightening period in 2022, the short-term export benefits could once again be offset by rising costs. Shipbuilding, shipping, and automotive sectors, which have a high proportion of dollar-denominated sales, can expect improved profitability. However, the semiconductor and home appliance sectors are facing greater burdens due to increased costs of imported components, while the petrochemical and steel industries are experiencing intensified cost pressures as most raw material payments are made in dollars.

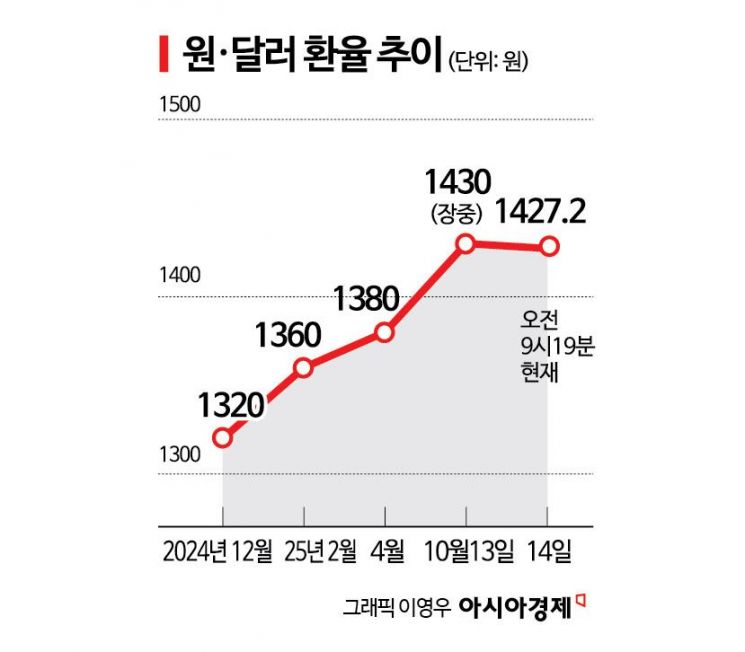

On October 14, at 9:19 a.m. in the Seoul foreign exchange market, the won-dollar exchange rate stood at 1,427.2 won, up 1.4 won from the previous trading day. Market forecasts suggest that the 1,400 to 1,450 won range will persist for the time being. In fact, major banks have recently raised their standard exchange rates for corporate foreign exchange transactions to around 1,430 won.

The impact of the high exchange rate is clearly divided across industries. While some sectors benefit from improved export competitiveness due to the rising exchange rate, many others are seeing their profitability deteriorate as the costs of procuring raw materials and components increase. In particular, differences in companies' foreign exchange hedging capabilities and the proportion of overseas production are widening the performance gap. According to an analysis by the Korea International Trade Association, when the won-dollar exchange rate rises by 10 won, the operating profit of export companies improves by an average of 0.5 to 1 percent, but industries with high import dependence see a decrease of 1 to 1.5 percent. In previous periods of high exchange rates, export sectors saw short-term improvements in performance, only for profits to reverse due to rising raw material prices and the limited ability to pass on costs. There are concerns that a similar pattern could repeat this time as well.

Export-oriented industries are once again welcoming the rise in the exchange rate, at least initially. In particular, both shipbuilding and shipping sectors, where orders and freight rates are set in dollars, are expected to see improved profitability as the exchange rate rises. A shipping industry insider said, "Although some operating costs are paid in foreign currency, exchange gains offset these expenses," adding, "There is a clear increase in sales during periods of dollar strength." The power and wire industries are also expected to benefit from the high exchange rate. A power industry representative explained, "For companies with a high proportion of overseas sales, a stronger exchange rate can help defend their performance."

The automotive industry is also expected to benefit directly from the high exchange rate, especially among automakers with a large share of overseas sales. According to Hyundai Motor Company's semiannual report, if the dollar-won exchange rate rises by 5 percent, pre-tax profit increases by 134.8 billion won. The current exchange rate in the 1,430 won range is about 6.1 percent higher than at the end of June, which means profits could increase by approximately 160 billion won based on a simple calculation. Hyundai Motor Company also recorded more than 600 billion won in exchange rate gains in the first quarter, when the average exchange rate was 1,453 won. Lim Eunyoung, a team leader at Samsung Securities, said, "When the exchange rate changes by 1 percent, the operating profit of Hyundai Motor Company and Kia fluctuates by 3.3 percent and 3.4 percent, respectively," adding, "If the current exchange rate is maintained, 30 percent of the tariff impact can be offset by the exchange rate."

The situation is different for the home appliance and semiconductor industries. They are highly sensitive to the sharp rise in the exchange rate. A home appliance industry insider said, "While it may seem that a higher exchange rate directly improves export competitiveness, the costs of importing raw materials and components also rise, which can increase the burden," adding, "Unlike in the past, overseas production bases have diversified, so prolonged uncertainty, including exchange rate fluctuations, is not helpful."

The semiconductor industry is particularly concerned about a prolonged period of high exchange rates. Since major equipment and raw materials are paid for in dollars, a rising exchange rate directly leads to increased costs. An industry insider said, "We have a system for stockpiling raw materials, so the short-term impact may be minimal, but if the high exchange rate persists, the burden of investment and procurement costs could grow," adding, "We are closely monitoring the situation until concrete measures are announced."

The petrochemical and airline industries are expected to be hit hard by the surge in the exchange rate. This is because most of their key raw materials, such as crude oil, naphtha, and jet fuel, are imported in dollars, so a higher exchange rate immediately translates into higher costs. A petrochemical company official said, "When naphtha prices rise, it is immediately reflected in manufacturing costs, but it is difficult to raise product delivery prices right away, making it hard to defend profitability." An airline industry insider also said, "Most costs, including jet fuel, lease payments, and maintenance expenses, are paid in dollars, so the higher the exchange rate, the greater the burden."

The steel industry is also under significant pressure from the rising exchange rate. Since most key raw materials, such as iron ore and coking coal, are imported from overseas, mainly Australia, a higher exchange rate increases purchasing costs. In particular, large steel mills such as POSCO and Hyundai Steel face greater exchange rate risks due to their scale of purchases. An industry insider said, "Although we are conducting pilot production of domestically sourced coking coal, it has not yet reached commercialization, so virtually all raw materials are still paid for in dollars," adding, "Even a 10-won increase in the exchange rate results in billions of won in additional cost burden."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.