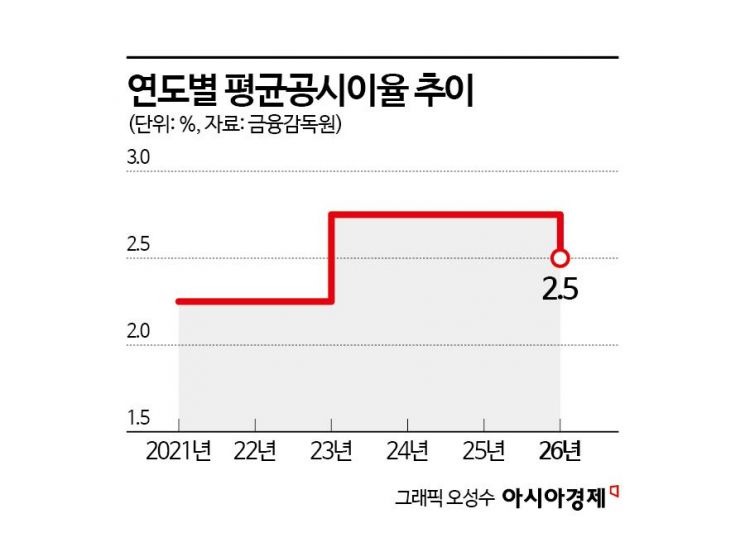

Insurers’ Average Declared Interest Rate to Drop to 2.5% Next Year for the First Time in Two Years

Expected Interest Rates Likely to Fall as Well, Leading to Higher Premiums

Beware of Mis-selling and Unfair Replacement Contracts

"Sign up before insurance premiums go up."

Marketing tactics exploiting the fear of missing out are rampant in the insurance sales field. This is because the average declared interest rate, which will be applied starting next year, is set to decrease for the first time in two years, raising the likelihood that insurance premiums will rise by about 5-10% next year.

According to the financial sector on October 14, the Financial Supervisory Service recently announced that the average declared interest rate for next year will be 2.5%. After maintaining a rate of 2.75% for two years from 2024 to this year, it is now set to decrease for the first time in two years. This marks the first time since 2020 that the average declared interest rate will be 2.5%. The ongoing trend of base interest rate cuts has contributed to this change.

The average declared interest rate is an index calculated as the weighted average of each insurer’s declared interest rate, based on premium reserves at the end of each month. The financial authorities calculate the figures for the previous 12 months as of the end of September each year and announce them around October. Insurance companies use this as a basis for calculating their business plans and assumed interest rates for the following year. It essentially serves as a kind of "base rate" reference when insurers plan their annual operations.

Generally, when the average declared interest rate falls, the assumed interest rate also decreases. The assumed interest rate is the return that an insurance company expects to earn by investing the premiums collected from customers. As the assumed interest rate drops, insurance companies link this to higher premiums to offset negative margins. As a result, new policyholders next year are likely to pay higher premiums than existing policyholders. Industry estimates suggest that a 0.25 percentage point drop in the assumed interest rate could lead to a 5-10% increase in premiums.

Life insurers, who mainly manage assets through long-term bonds, tend to feel interest rate changes more slowly, but the impact is greater than for non-life insurers. This is because a lower assumed interest rate significantly changes maturity refunds or surrender values. The higher the proportion of savings-type or refund-type products a life insurer offers, the greater the impact.

Non-life insurers, who sell products such as auto insurance, indemnity health insurance, and driver insurance, manage more short-term assets and are more sensitive to market interest rates. However, they are more affected by the loss ratio and risk rate of each product than by macro-level changes in the average declared interest rate. Recently, the loss ratios for auto and indemnity health insurance have deteriorated rapidly, making it likely that premiums for non-life insurance products will rise faster than those for life insurance products. An insurance planner explained, "If you are planning to remodel your family's insurance, it is advantageous to do so within this year," adding, "Especially if you want to re-enroll in indemnity health insurance, you should act quickly."

If last-minute marketing becomes overheated, insurance customers should be cautious, as it can lead to issues such as mis-selling or improper replacement contracts (switching insurance policies). Customers may suffer losses if they sign up for insurance based solely on a simple estimated premium comparison provided by a planner. According to the Financial Supervisory Service, the amount detected for improper replacement contracts at the four major life insurers (Samsung, Hanwha, Kyobo, Shinhan) and the five major non-life insurers (Samsung, DB, Meritz, Hyundai, KB) reached approximately 3.2 billion won last year, surpassing half the total amount (5.9 billion won) detected over the past five years (2020-2024). The prevalence of last-minute marketing was influenced by the revision of the experience mortality table in April last year, the first change in five years, which was expected to raise premiums by about 10% compared to previous levels.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)